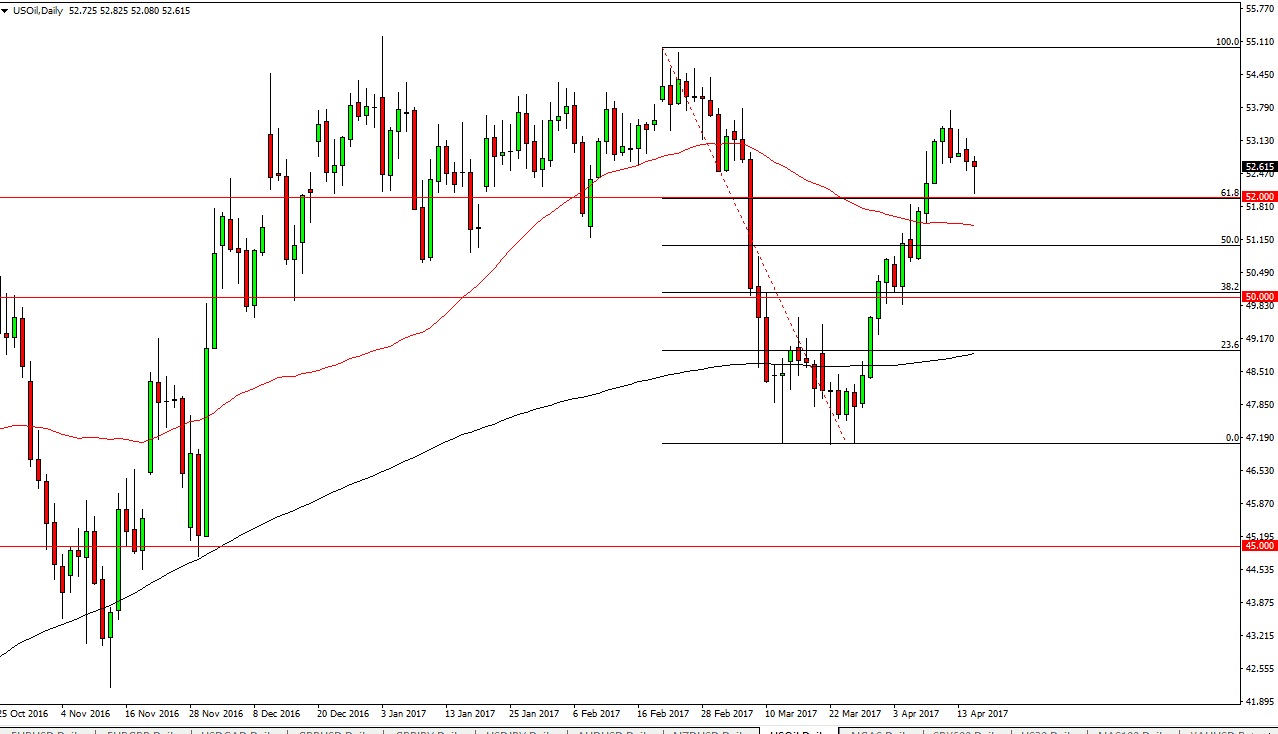

WTI Crude Oil

The WTI Crude Oil market initially fell on Tuesday but found the $52 level to be supportive enough to turn things around and form a hammer. That being the case, it’s likely that the market will continue to go higher, and if we can break above the top of the candle, the market could then reach to higher levels. We get the Crude Oil Inventories announcement coming out during the day, so having said that I believe that pullbacks could appear, but they should in the end of being buying opportunities. Because of this, the market should then reach towards the $55 level above, which has been resistance in the past. I believe that the market has already made up its mind that it wants to go higher.

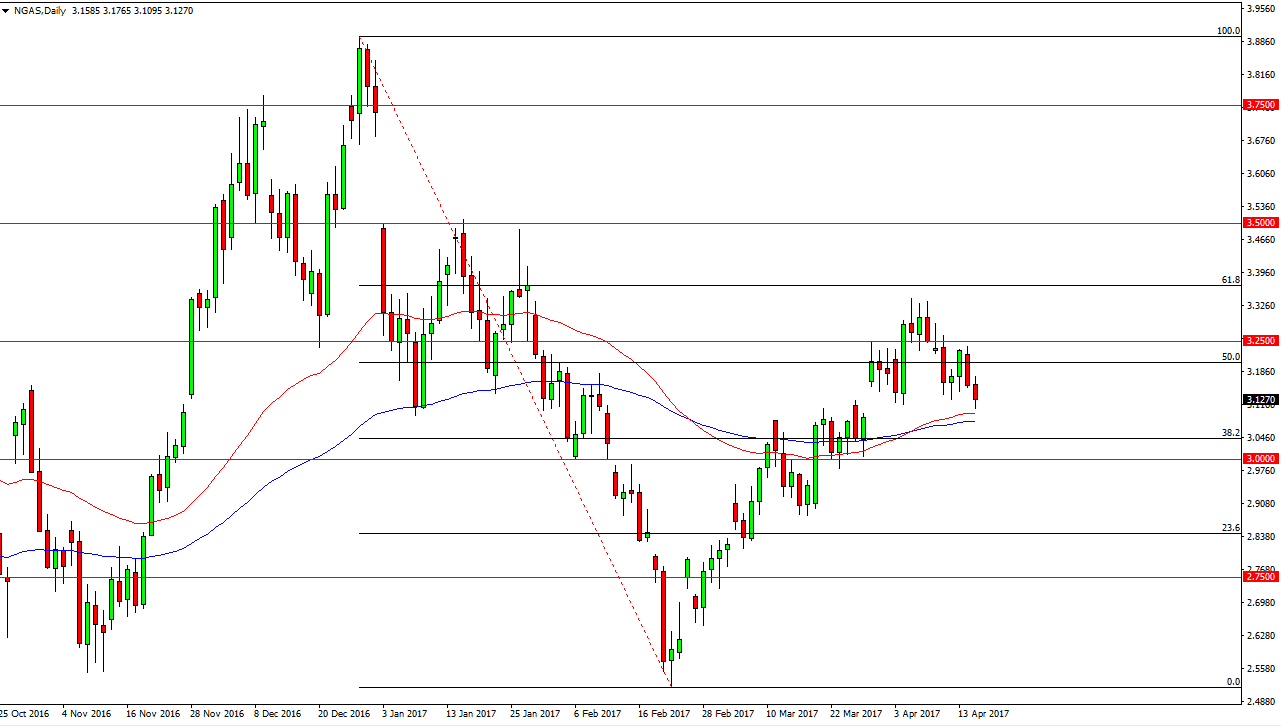

Natural Gas

Natural gas markets fell during the day but continue to find support near the $3.10 level. Because of this, I believe that the buyers are simply accumulating currently, and that the gap from the move a couple of weeks ago should continue to offer support. The 50-day exponential moving average breaking above the 100-day exponential moving average on the chart will have attracted a lot of longer-term buyers. On a break above the top of the candle for the session on Tuesday, I think that the market then goes to the $3.25 level above, and then eventually the $3.33 level above. I have no interest in shorting, least not until we break below the $3 level, which of course is something that doesn’t look very likely. Because of this, I think that short-term “buy on the dips” type of trade will continue to be a mainstay of what we see.

If we did break below the $3 level, I feel that this market would probably fall apart. However, that isn’t going to happen anytime soon from what I’m seeing on the chart.