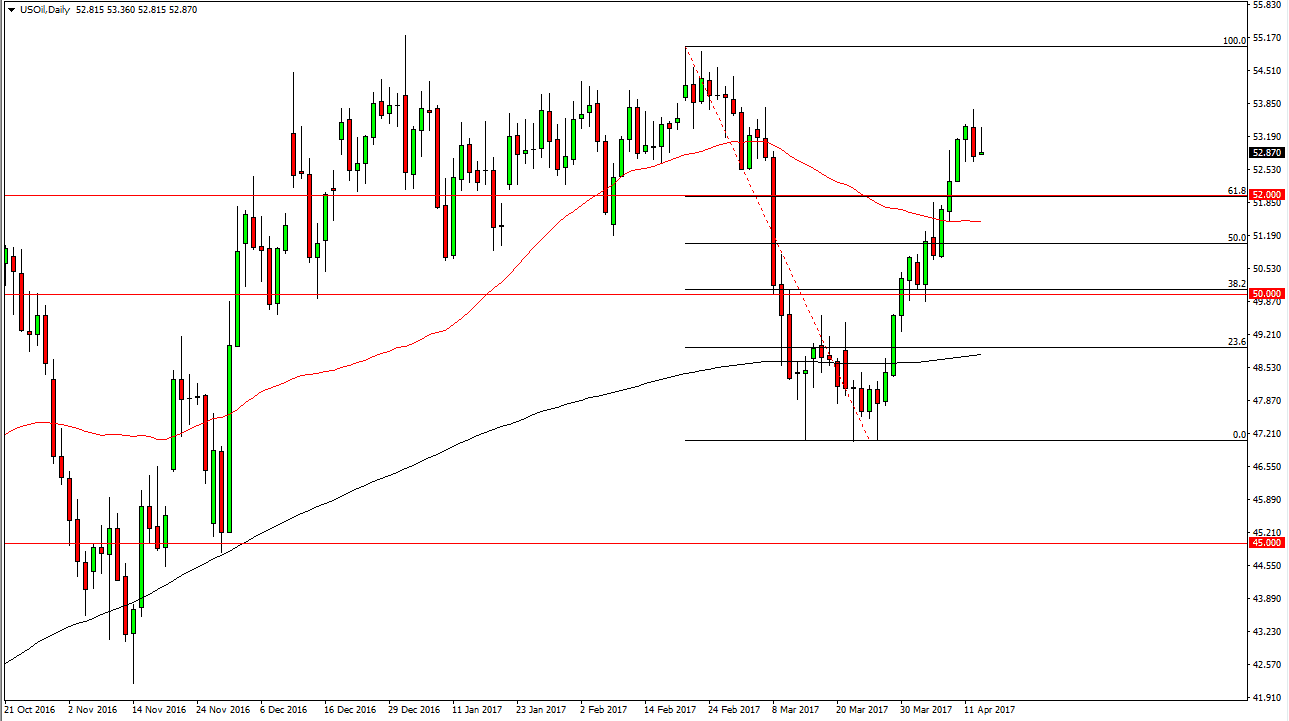

WTI Crude Oil

Friday was of course very thin as far as trading volume is concerned, and at the end of the day we essentially ended up where we started. Because of this, looks as if the crude oil market may pull back a little bit, and I believe that the West Texas Intermediate grade will go looking for support at the $52 level next. If we can get a bounce from there, I believe that the buyers will continue to jump into the market. Alternately, if we break down below there we could go as low as the $50 level. The oil markets certainly looked a bit overbought towards the end of the week, and I think that’s what we are starting to see, a market that needs to pull back to build up enough momentum to continue the move.

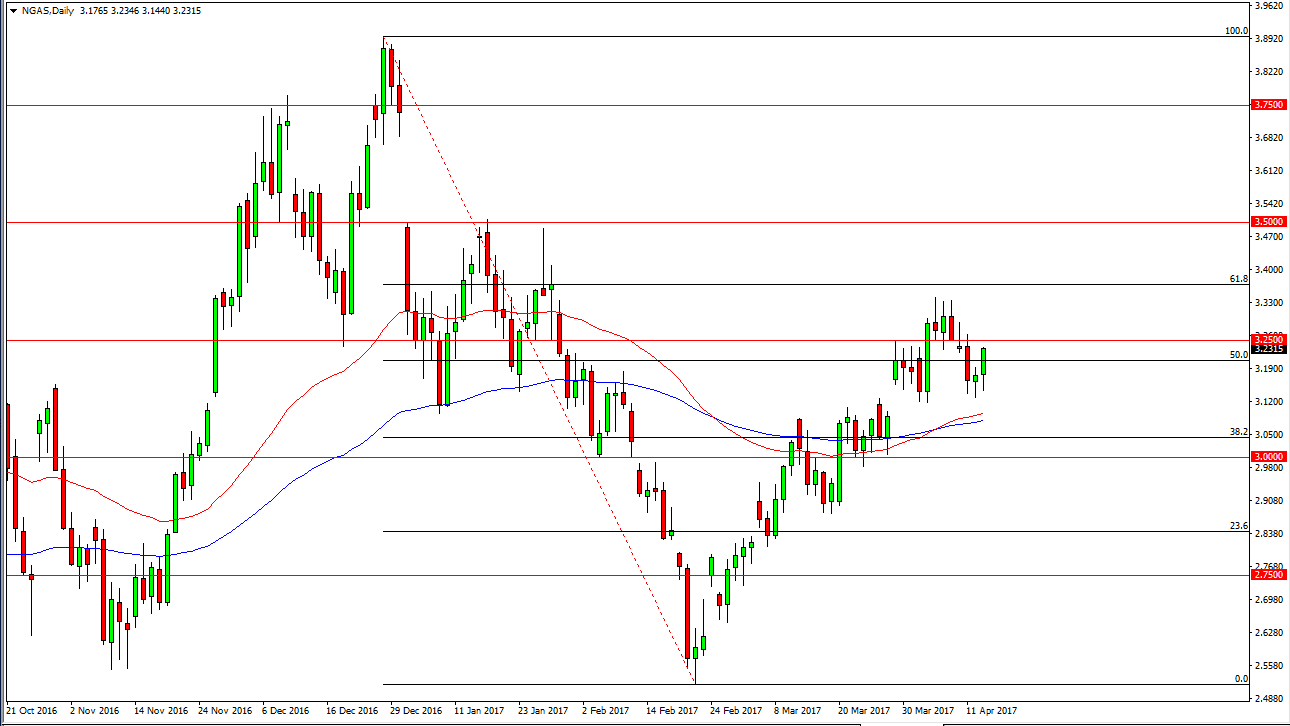

Natural Gas

The natural gas markets were closed on Friday but you can see that the Thursday candle was very bullish. It looks as if the $3.25 level will be challenged, but I think it’s only a matter of time before we break above there and reach towards the $3.33 level after that. A break above there should send this market to the 61.8% Fibonacci retracement level, which is just above. Once we get above there, the market should then reach towards the $3.50 level beyond that. I have no interest in shorting this market now, there is far too much bullish pressure below. This is especially true near the gap that formed at the $3.13 region, and of course the 50-day exponential moving average has recently crossed above the 100-day exponential moving average. Because of this, there are several signs that the buyers are still very much involved in this market. Longer-term, I still see major issues, but right now it appears that the trading community is paying attention to US exports.