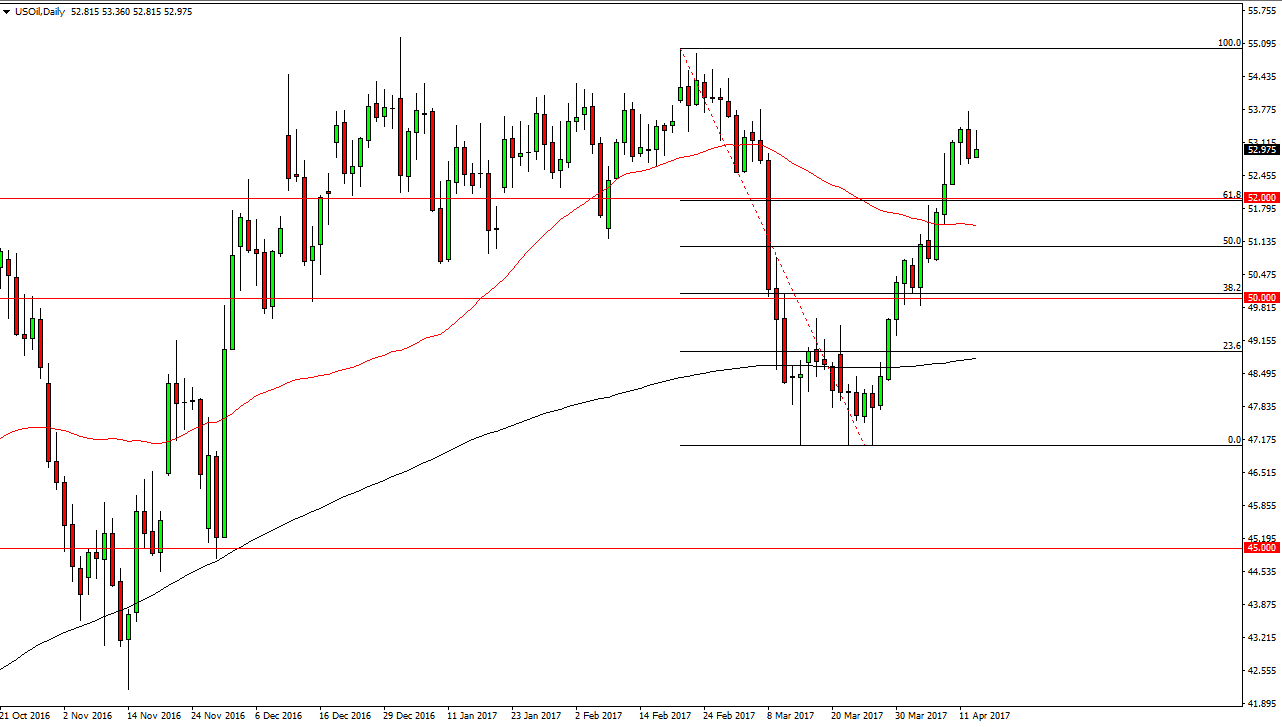

WTI Crude Oil

The WTI Crude Oil market rallied during the day on Thursday, but gave back quite a bit of the gains. Because of this, I think the market is starting to get a bit exhausted, and as a result of this I expect that the market will reach towards the $52 level underneath. That level should be supportive, it was previously important, and what is the 61.8% Fibonacci retracement level as well. Because of this, I believe that the market could find buyers in that area, and you may be best served by stepping on the sidelines for the short term. A supportive daily candle would be reason enough to go long again though.

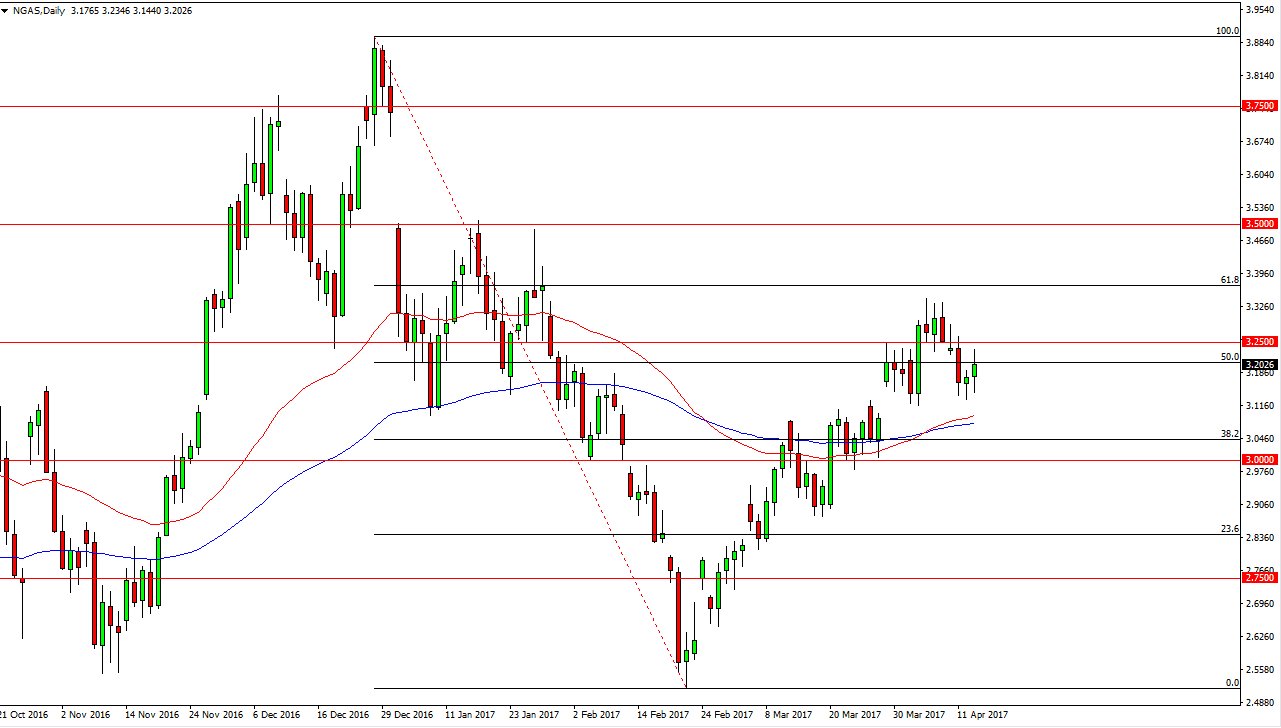

Natural Gas

The natural gas markets initially fell during the session on Thursday, but turned around to show signs of life again. The $3.25 level above offered resistance again, and it appears that we may need to back up a little bit in order to build the necessary momentum to go long. Once we break above the $3.25 level, that should be positive enough to get the market going higher, and reaching towards the 61.8% Fibonacci retracement level above.

I also recognize that there is a lot of support below at the $3.10 level as it was the scene of a massive gap. If we can break down below there, the market will almost certainly test the $3 level underneath. Ultimately, I believe that the market will find in of buying pressure to continue to go higher, as the market seems to be focusing on exports more than anything else. This should continue to be a volatile marketplace, but given enough time I think that the buyers will get their way, at least for the next several sessions. If you are nimble, you should be able to pick up “buy on the dips” type of trades.