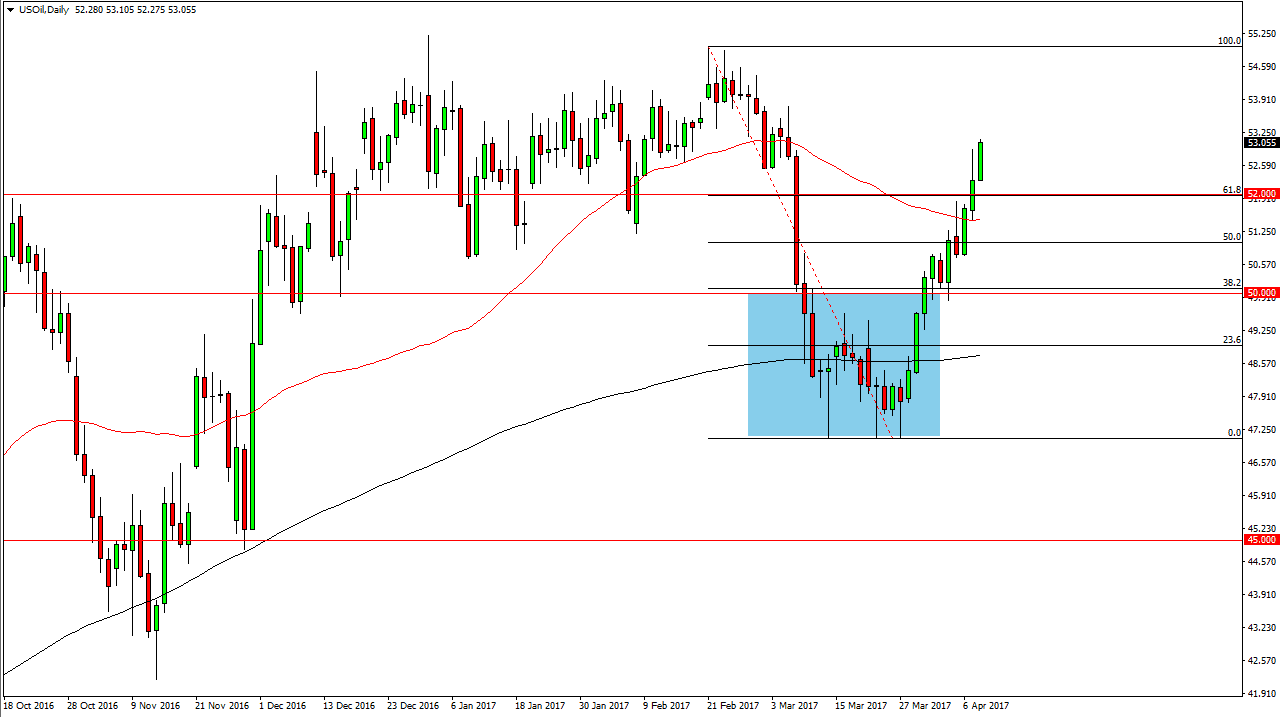

WTI Crude Oil

The WTI Crude Oil market continues to show significant strength, so having said that it looks like the buyers are still very much in control in this market. However, we are getting a bit overbought at this point so I’m going to wait for some type of pullback to start buying. The $52 level could be an excellent buying opportunity, and I think at this point were going to reach towards the $55 level. Short-term pullbacks can be buying opportunities as well if you are nimble enough, but right now I would prefer to see a significant pullback just so that we can build up momentum yet again. It’s not to be easy, but I believe that we are going to go higher over the longer term.

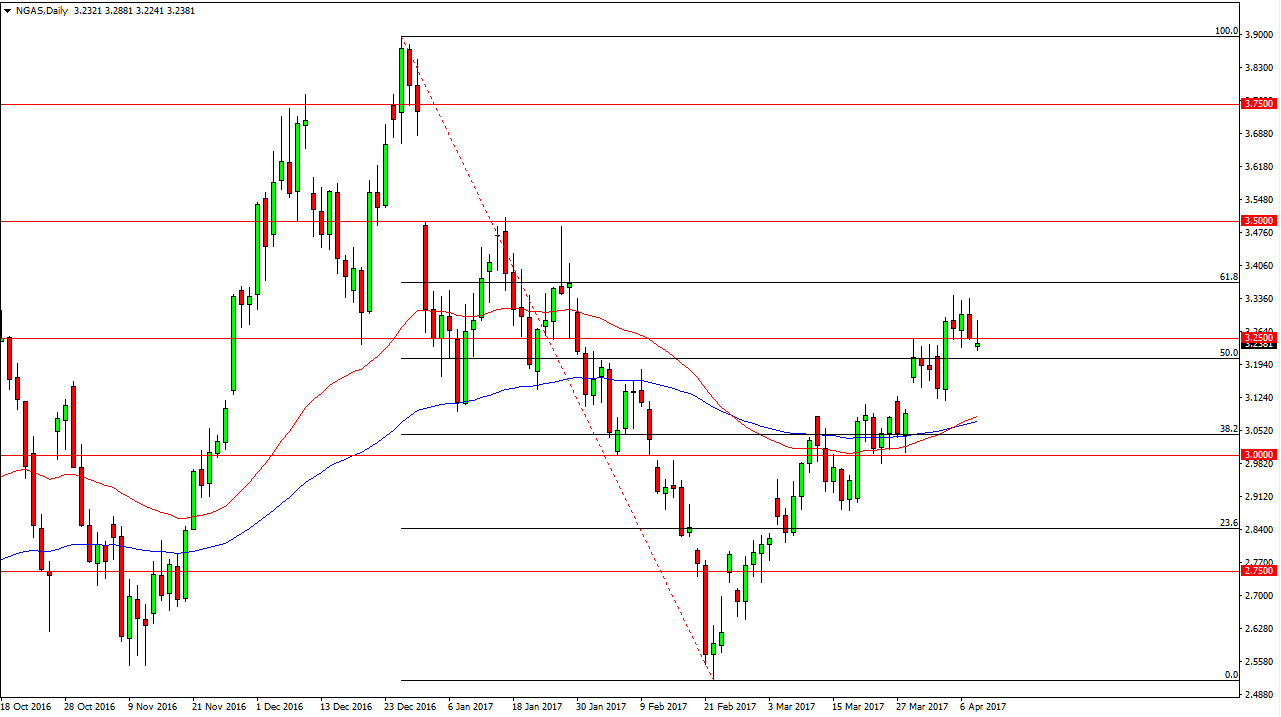

Natural gas

The natural gas markets gapped a little bit lower at the open on Monday, but then turned around to try and stretch to the upside. However, there’s enough resistance above the $3.25 level to keep the market a bit soft, but I also see a significant amount of support below. If we can break down below the bottom of the shooting star, the market could find itself reaching towards the $3.12 handle below which was the scene of the most recent gap. The 50-day exponential moving average has recently crossed above the 100-day exponential moving average, which of course is a longer-term buying signal. Having said this, I believe that pullbacks will offer opportunities below, but I also recognize that we are in a massive area of noise.

Short-term, I think we are going to pull back, but I think that the buyers will return sooner rather than later. Nonetheless, I think that we have longer-term issues but currently right now it appears that the market is focusing on the upside and not the downside.