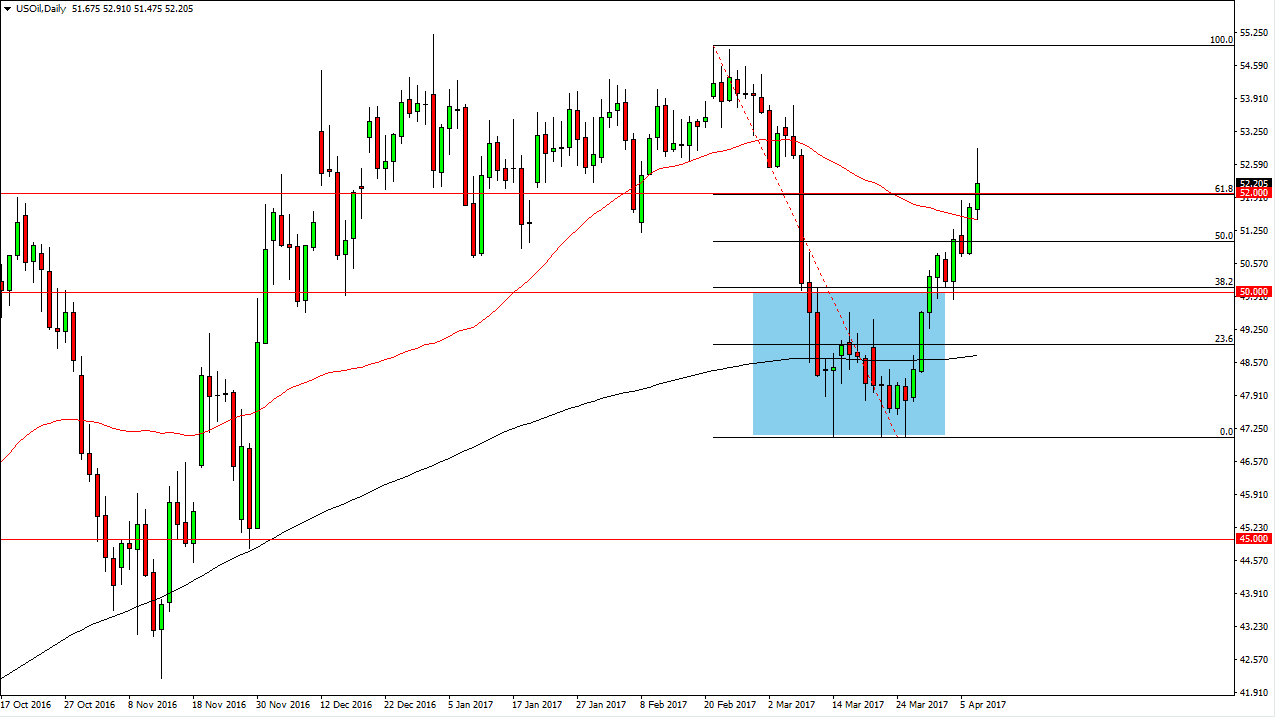

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the day on Friday, mainly in reaction to a nice uptrend, and of course the US airstrikes against the Syrian military. However, a less than stellar job report turned everything around and we ended up forming something akin to a shooting star. While I do not suspect that this market’s going to break down right away, I do recognize that the market is starting to run out of momentum. Because of this, a breakdown below the bottom of the candle would be and I selling opportunity and should send this market looking for the $51 level, and then possibly the $50 level. A break above the top of the candle should be a buying opportunity in theory, but there is a lot of noise above that will come into play, making it a very difficult trade.

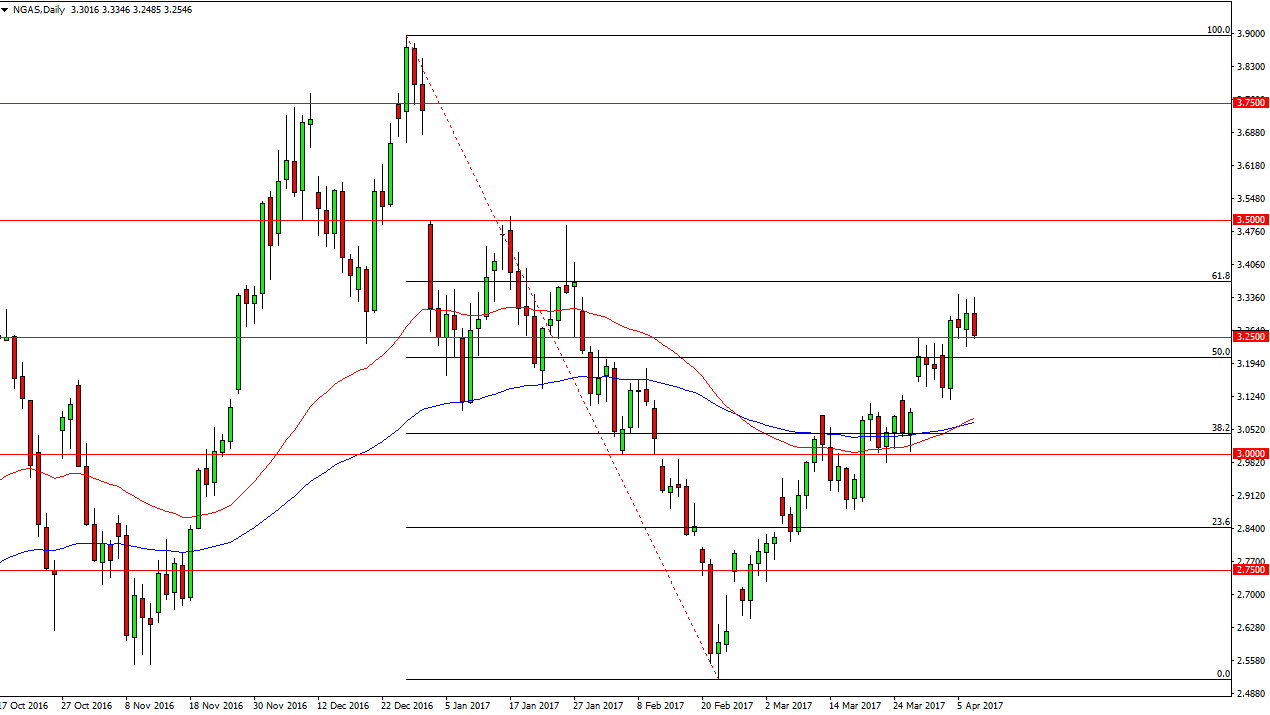

Natural Gas

The natural gas markets rallied initially as well, but turned around to test the $3.25 level. The market breaking down below there could send the market down to the $3.13 level, an area that has been supportive. There is a gap down there, so I think that at this point we will more than likely will find buyers that will keep the market somewhat afloat. At this point, it looks as if choppy conditions will continue, but it’s more than likely going to be bullish in general. Short-term, I’m looking to sell but I do expect to see the buyers return.

If we broke down below the $3.10 level, then I think the trend may turn around, but we have seen such a move higher and the fact that the 50 and the 100-day exponential moving averages have crossed suggests that there is still a significant amount of bullish pressure underneath in the natural gas markets.