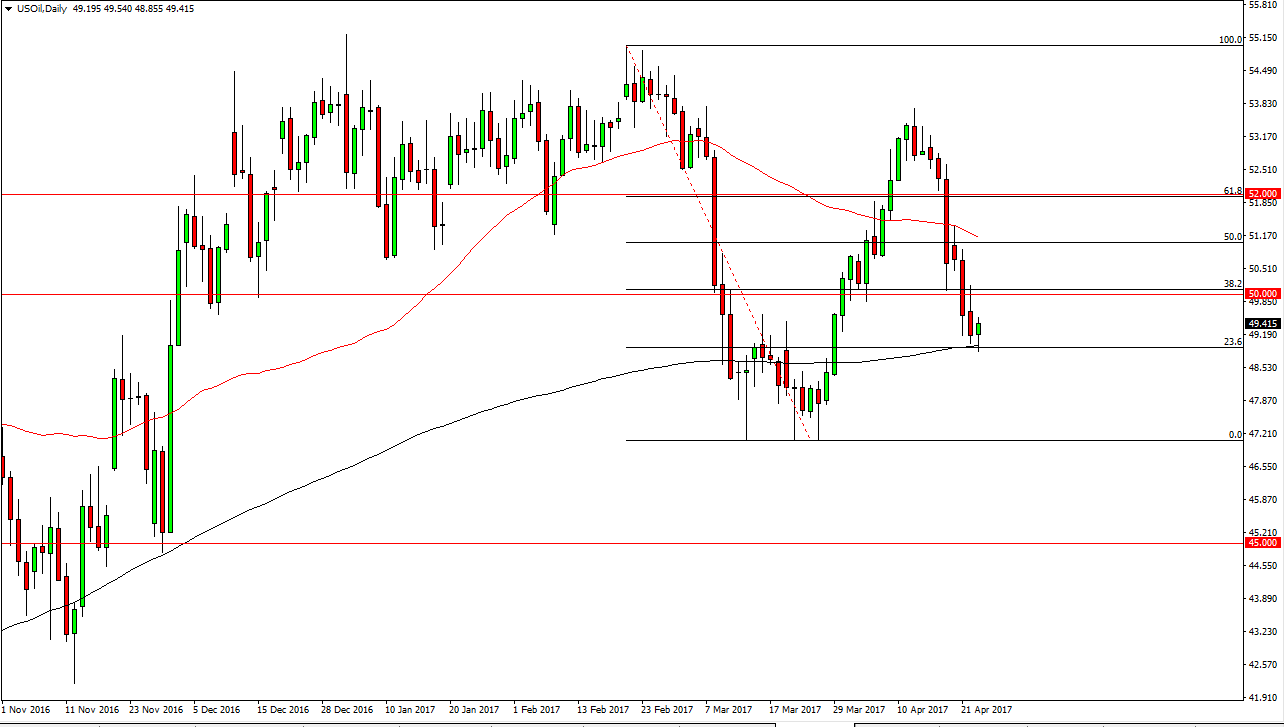

WTI Crude Oil

The WTI Crude Oil market fell initially during the day on Tuesday, but found enough support at the $49 level to turn around and form a hammer. The hammer is sitting right at the 200-day exponential moving average, so that of course is a bullish sign as well. However, we get the crude Oil Inventories announcement coming out during the session, and that will of course offer quite a bit of volatility to this market. I believe that as long as we stay below the $50 level, there’s a good chance that we sell off again. A breakdown below the bottom of the hammer would also be very negative, sending the market down to the $47.20 level underneath.

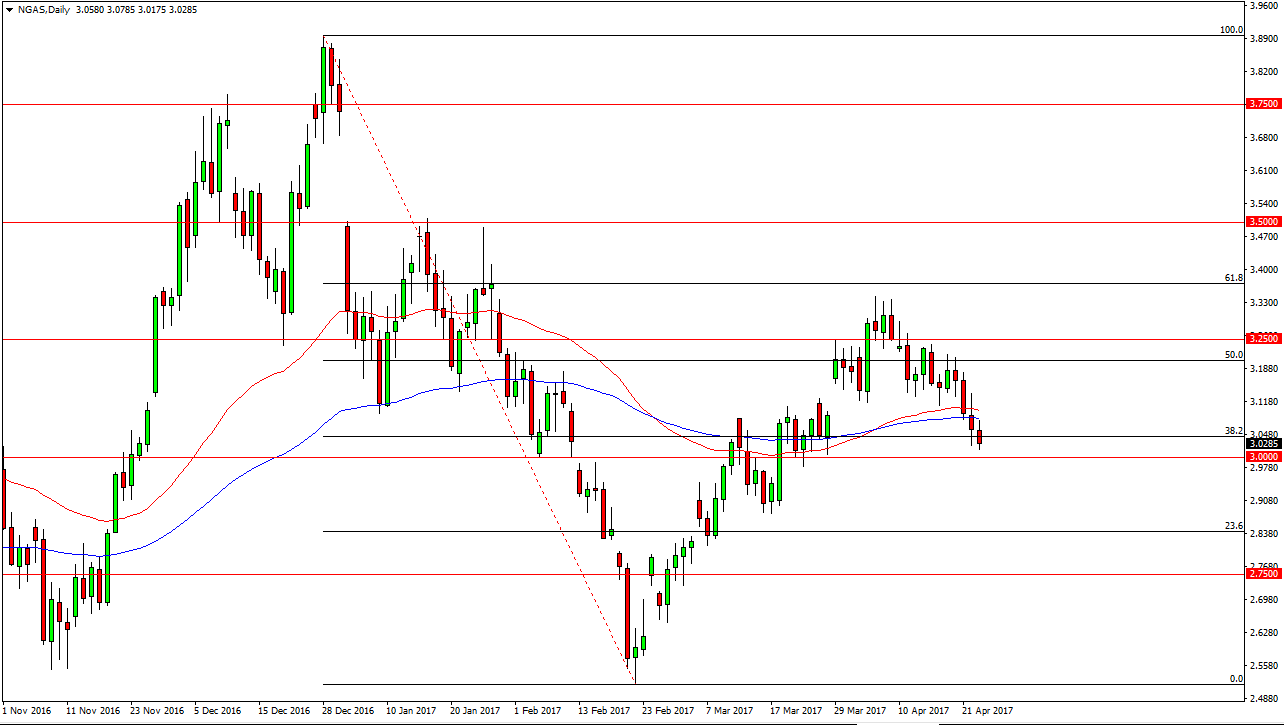

Natural Gas

Natural gas markets continue to look very soft, as we reached towards the $3 handle on Tuesday. If we can break down below that level, that would be a very bearish sign and should send this market down to the $2.90 level. Alternately, if we can break above the candle from Monday, the market should show signs of strength again. I believe that we are starting to pay more attention to the lack of demand and the oversupply issues that we are starting to face in the United States. We are starting to reach into the warmer months, so exports have taken a backseat to the seasonal fundamentals that we see in this market.

Not being said, if we did break out to the upside, the market should then go to the $3.25 level above, and then possibly even the $3.33 level after that. All things being equal though, I believe that the sellers are more likely to take control of the market in the near term as a breakdown below the $3 level should be yet another reason for sellers to get involved.