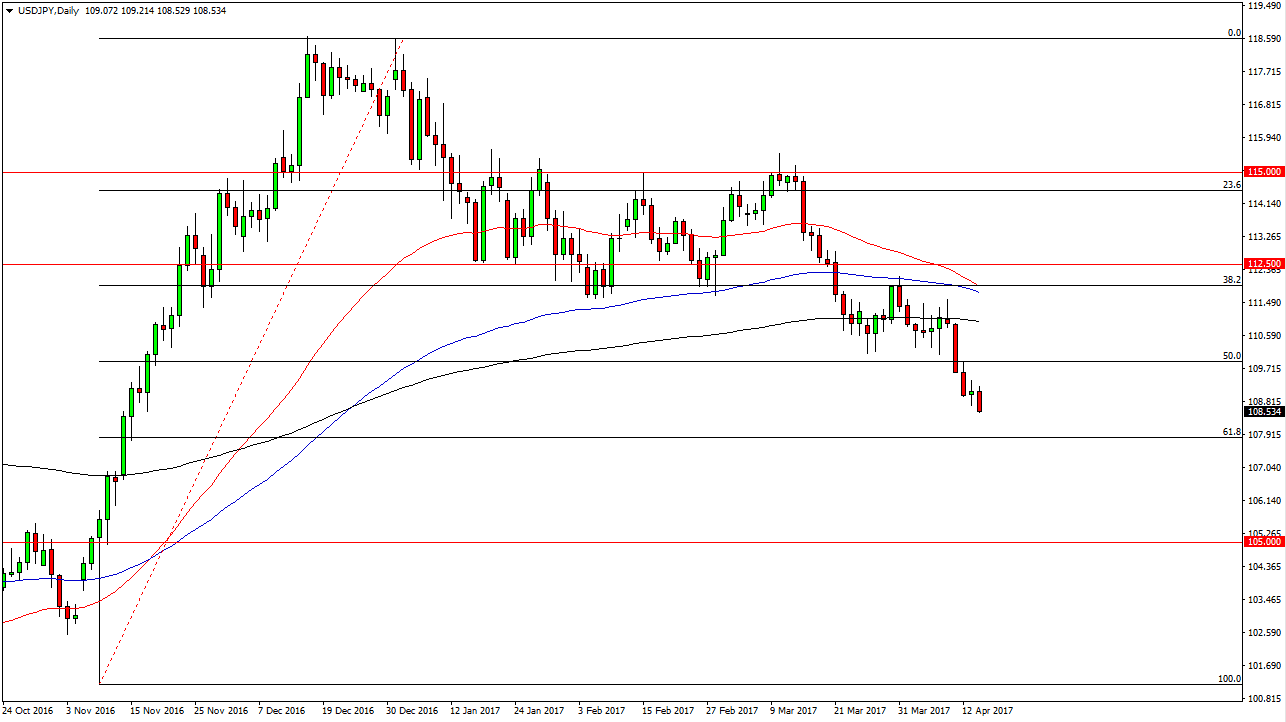

USD/JPY

The US dollar fell again on Friday, breaking the bottom of the neutral candle from Thursday, showing continuation. We have broken significantly below the 110 level, which was the 50% Fibonacci retracement level. This is a very negative sign, and we will more than likely find the market reaching towards the 108 handle below, as it is the 61.8% Fibonacci retracement level. Remember, this is a “risk off” type of move, and as a result we are starting to see the Japanese yen strengthen everywhere. After all, there are a lot of geopolitical risks out there, and because of this the Forex traders are trying to seek safety in the Japanese yen and of course gold markets. I believe this continues, and the president of the United States mentioning that the dollar was overvalued of course put a supercharge in the move lower.

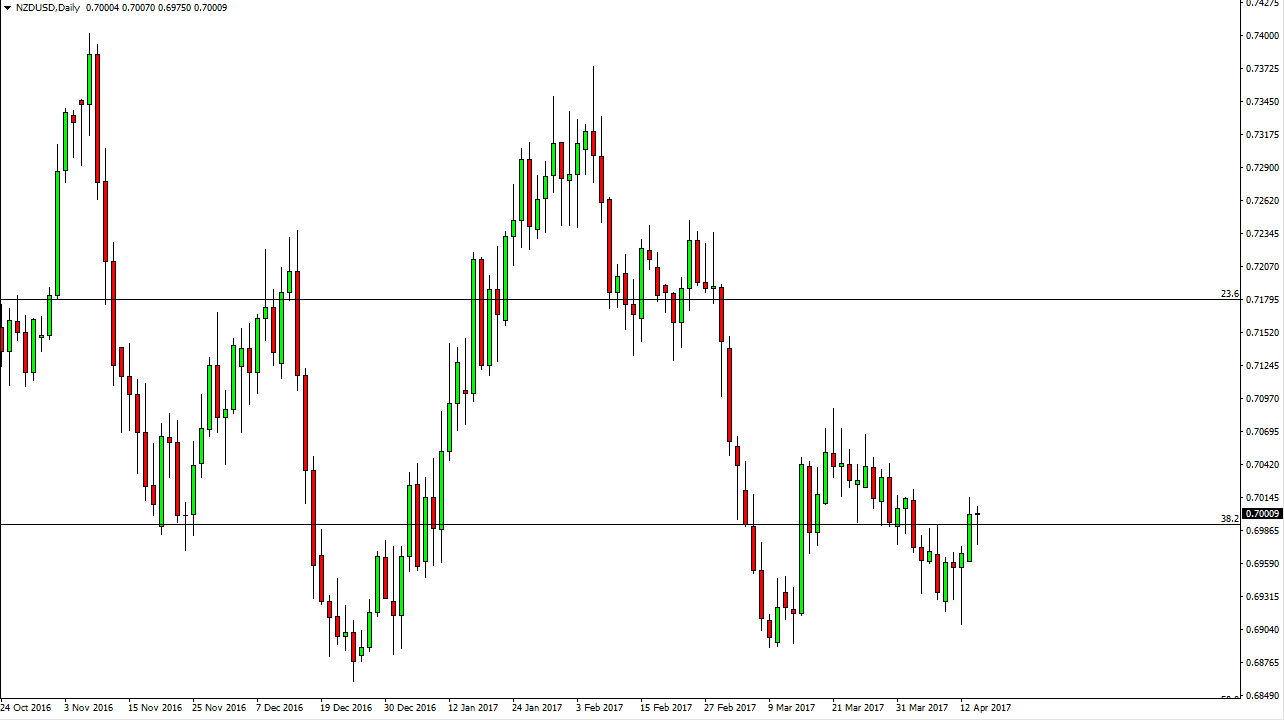

NZD/USD

The New Zealand dollar initially fell during the day but turned around to form a hammer on Friday. The hammer is sitting right at the 0.70 level, so I think if we can break the top of the candle, we more than likely will reach towards the 0.71 handle. That level has been resistance in the past, and I would anticipate that it will be in the future. If we can break bass there, then the market can go higher. In the meantime, I think we will get a short-term pop, but that’s about it. If we break down below the bottom of the hammer from the session on Friday, that would be negative and have this market reaching towards the 0.69 level.

Ultimately, expect a lot of volatility and I also expect that this market may drop longer-term, but clearly, we are not ready to do so yet. A breakdown below the 0.6850 level would be massively bearish, but it’s not something that’s going to happen today.