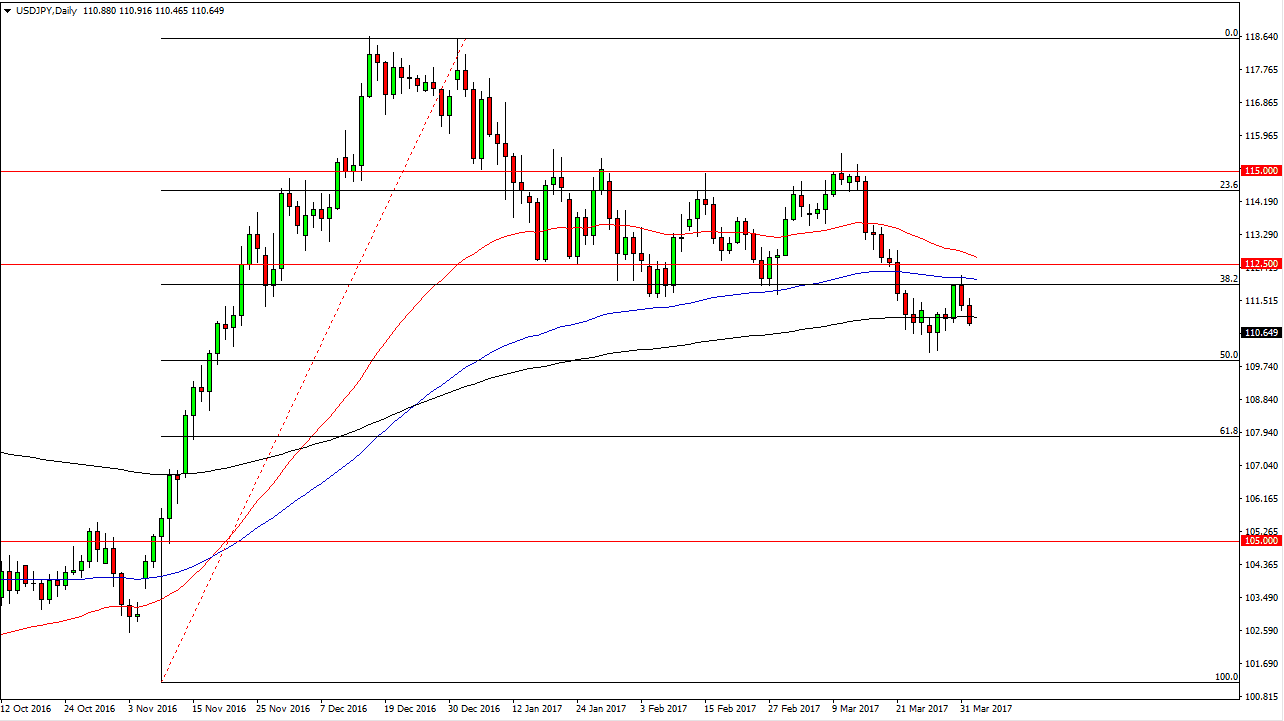

USD/JPY

The USD/JPY pair fell on Monday, slicing through the 200-exponential moving average again. However, I do see quite a bit of support below at the psychologically important 110 level, and of course the 50% Fibonacci retracement level being there helps a lot to. So, having said that I think we will see buyers return to this market sooner rather than later, but I don’t know if the can hold the support. A breakdown below the 110 level should send this market looking for the 108 level, and although I believe in the longer-term move higher, there has been a lot of frayed nerves in the market recently, and that of course tends to support a lower move in this currency pair. Because of this, I think there’s probably more downside risk than up now.

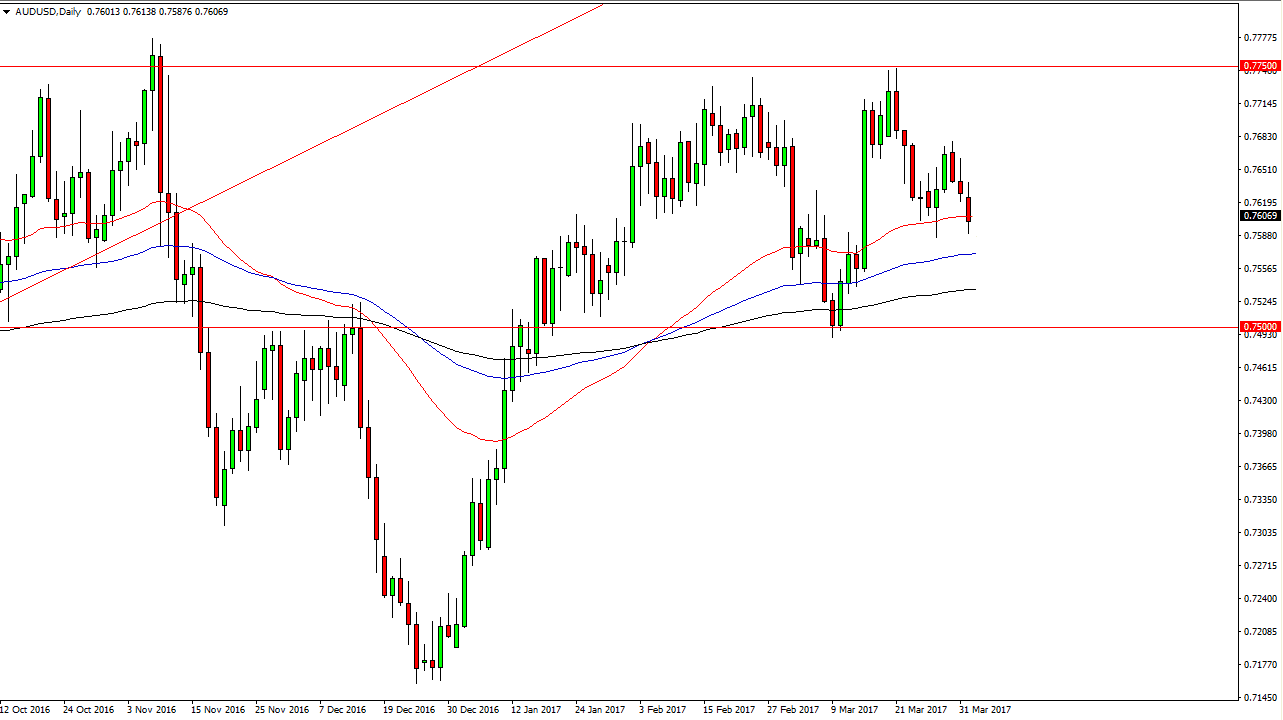

AUD/USD

The Australian dollar fell below the 50-day exponential moving average on Monday, as traders came back and sold off risk assets in general. However, there is more than enough support below to keep this market afloat from what I can see, so I believe the buyers will return rather quickly. The 50-day exponential moving average has been an area of interest lately, and I think that will continue to be the case. I also recognize that the 100-day moving average is just below and of course the 200-day moving average is below there. In other words, I think it’s only a matter of time before somebody gets the bright idea to start going long.

If gold could finally break out that would be a huge catalyst to send this pair higher. However, gold is struggling at the $1262 level, and doesn’t look ready to break out quite yet. With I think you will continue to see quite a bit of choppy volatility but I do look at pullbacks as potential buying opportunities in a currency that should go higher over the longer term.