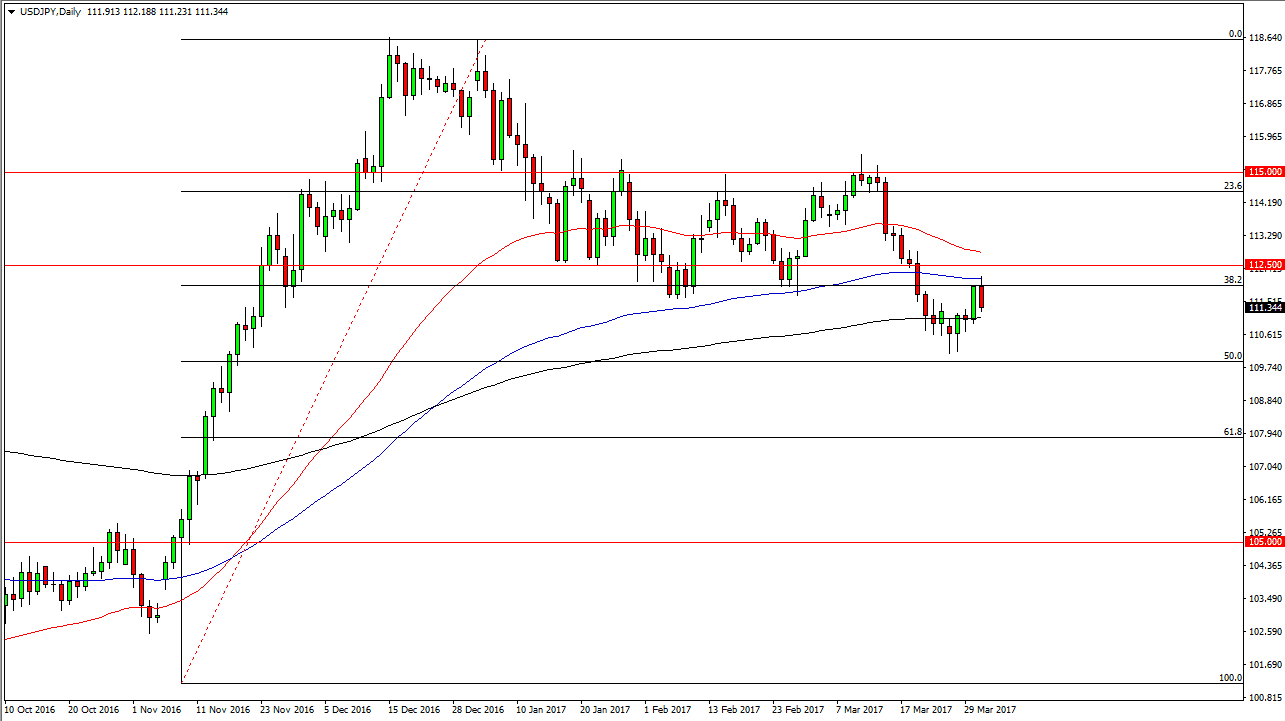

USD/JPY

The USD/JPY pair initially tried to rally during the session on Friday but found enough resistance at the 100-day exponential moving average to turn things around. This is a market that has a significant amount of support at the 200-day exponential moving average below, and of course the 50% Fibonacci retracement level at the 110 level. Ultimately, I believe that if we can break above the 112.50 level, that would be a very bullish sign and the market will probably reach towards the 115-level given enough time. Alternately, if we break down below the 50% Fibonacci retracement level, the market should then go to the 61.8% Fibonacci retracement level down at the 108-level underneath.

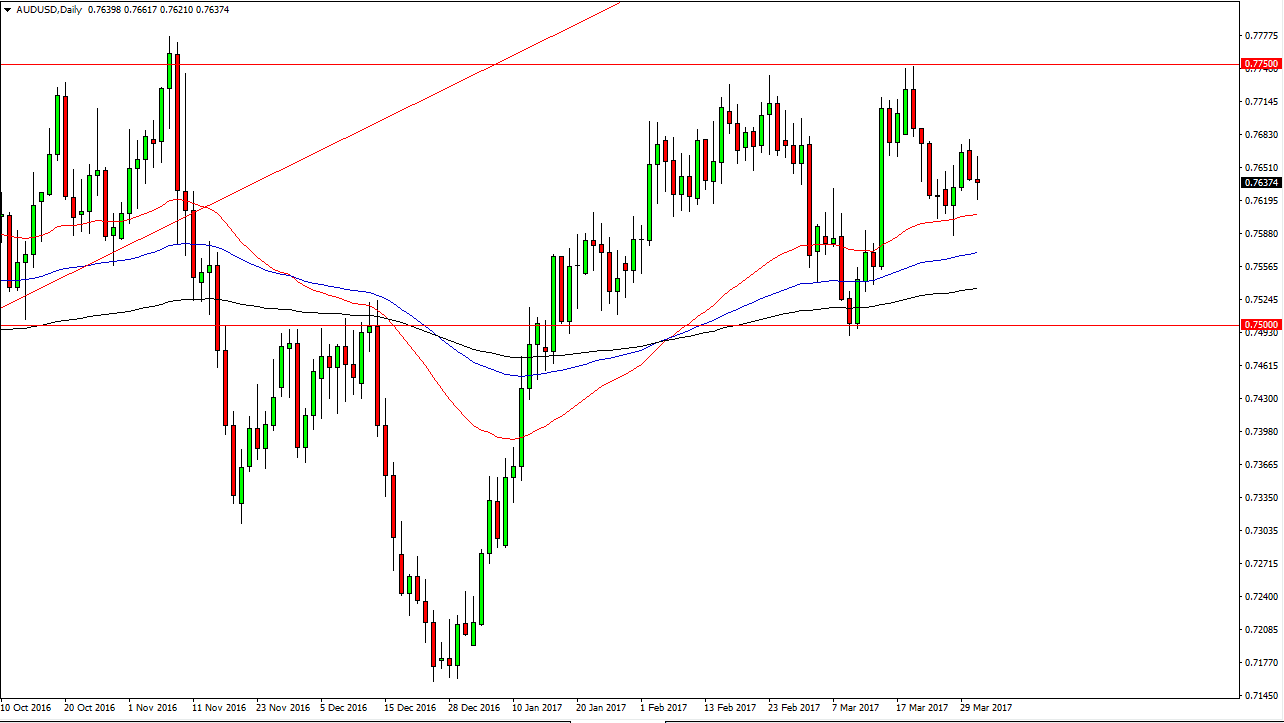

AUD/USD

The Australian dollar was rather choppy during the day on Friday, forming a rather neutral candle. It still looks as if the 50-day exponential moving average underneath should continue to offer support, pictured in red. I believe that the gold markets will continue to have an influence on the Australian dollar as per usual, and currently they are looking to break out to the upside and above the $1260 level. We have not done that yet, but given enough time I think we will.

Pullbacks continue to be value as far as I can see, and given enough time I would like to see this market reach towards the 0.7750 level above. If we can break above there, the market should then go to the 0.80 level, but we probably need the gold markets to break out to achieve that. The markets will continue to find buyers below, and currently I have no interest whatsoever in shorting the Aussie as it looks to be rather stubborn about falling. This will be a choppy market going forward though, so having said that it’s likely that the volatility is going to be a major issue, but longer-term I believe that long positions will pay off.