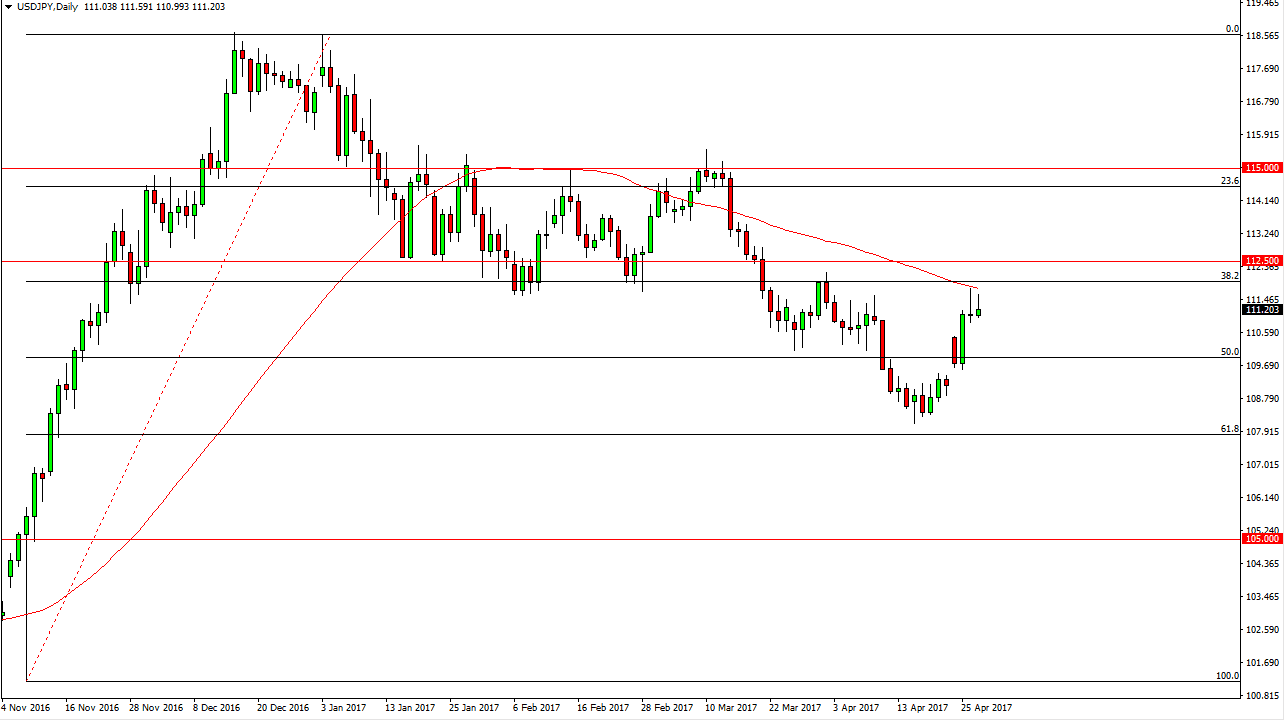

USD/JPY

The USD/JPY pair initially tried to rally during the Thursday session, but found resistance at the 50 day exponential moving average again. Because of this, looks as if the market is going to roll over from here, and a breakdown below the candlestick from the session on Wednesday should have sellers jumping into this market. I think it opens the door to a move lower, as we continue to consolidate. Ultimately, it’s likely that the market is going to be volatile, but if we can break above the 50 day exponential moving average, and more importantly the 112 handle, the market could go higher from there. Currently though, forming a shooting star over the last couple of days suggests that the resistance above is indeed very strong.

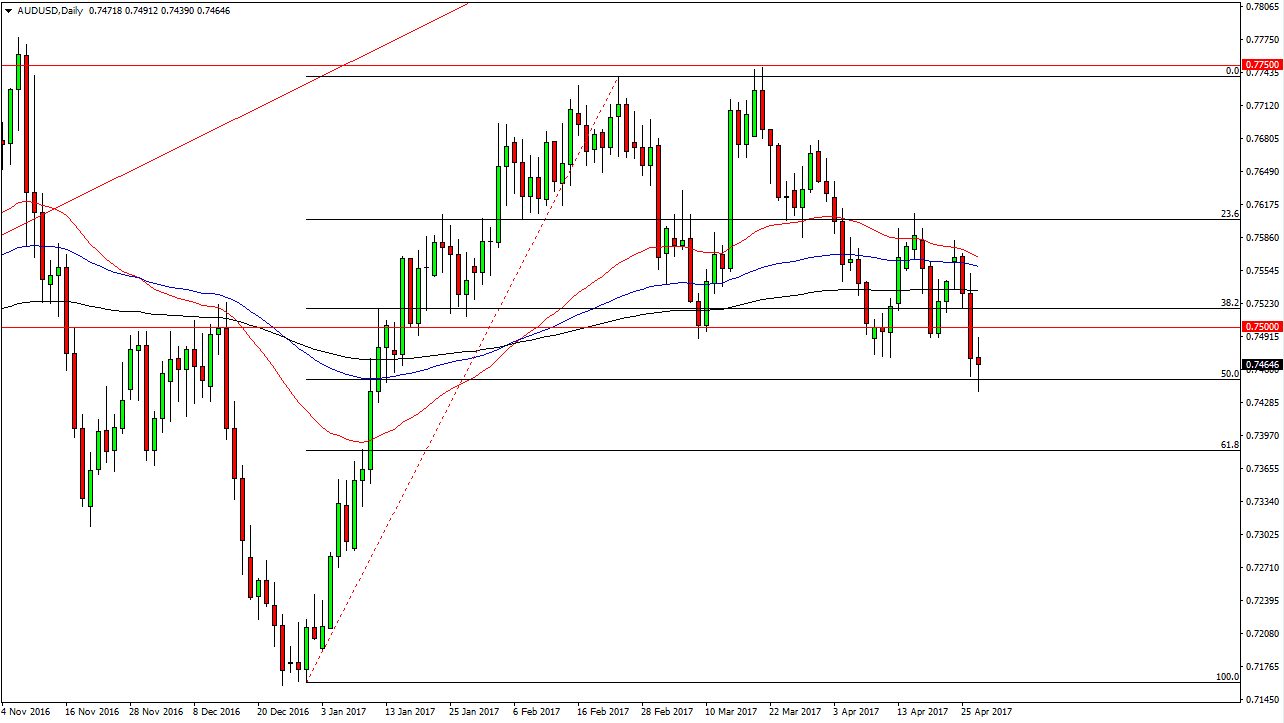

AUD/USD

The Australian dollar went back and forth on Thursday, showing signs of support by the end of the day. However, I think that a breakdown below the bottom of the range for the session would be a very negative sign and should send this market looking for the 61.8% Fibonacci retracement level, which is currently at the 0.7375 area. Alternately, if we can break above the 0.75 handle, the market could reach towards the 0.7575 level. Ultimately, this is a market that I think continues to see quite a bit of volatility and certainly needs the gold markets to help. If gold can start rallying again, that might be a boost for the Aussie, but until then I would be very suspicious of rallies as this currency pair has been beaten down rather significantly.

One thing I think you can count on is quite a bit of volatility, but I do not think that we will get clarity anytime soon. I believe that the market will continue to be of a short-term nature over the next several sessions.