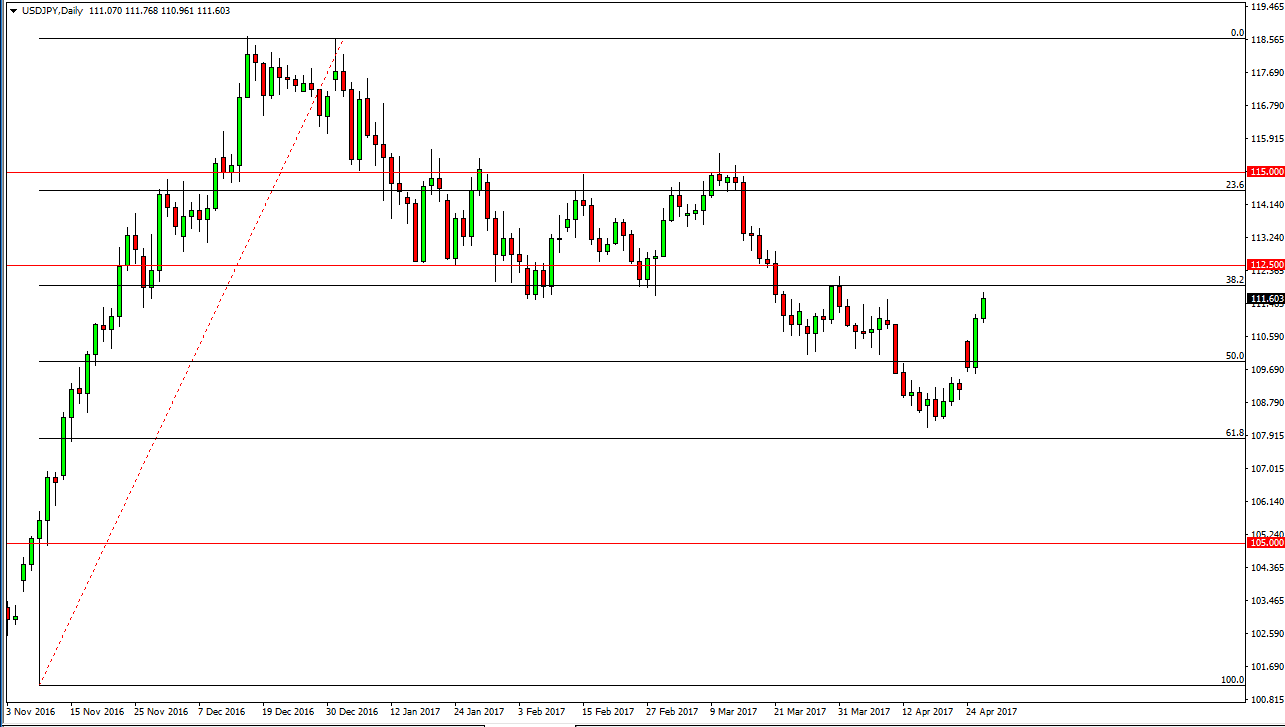

USD/JPY

The USD/JPY pair rallied during the day on Wednesday, reaching towards the 112 handle. We continue to see quite a bit of bullish pressure, but I also recognize that the 112 level is going to be resistive, and that breaking above there is going to take a certain amount of effort. Therefore, it would not be overly surprising for me if we ended up turning around and pulling back. The question then becomes whether we can pick up value below, or if is going to be a continuation of the downtrend. With this in mind, I am a buyer above the 112 level if we are above that level for more than 4 hours, or I am a seller on and exhaustive daily candle. This is an excellent place to lose money if you are not careful.

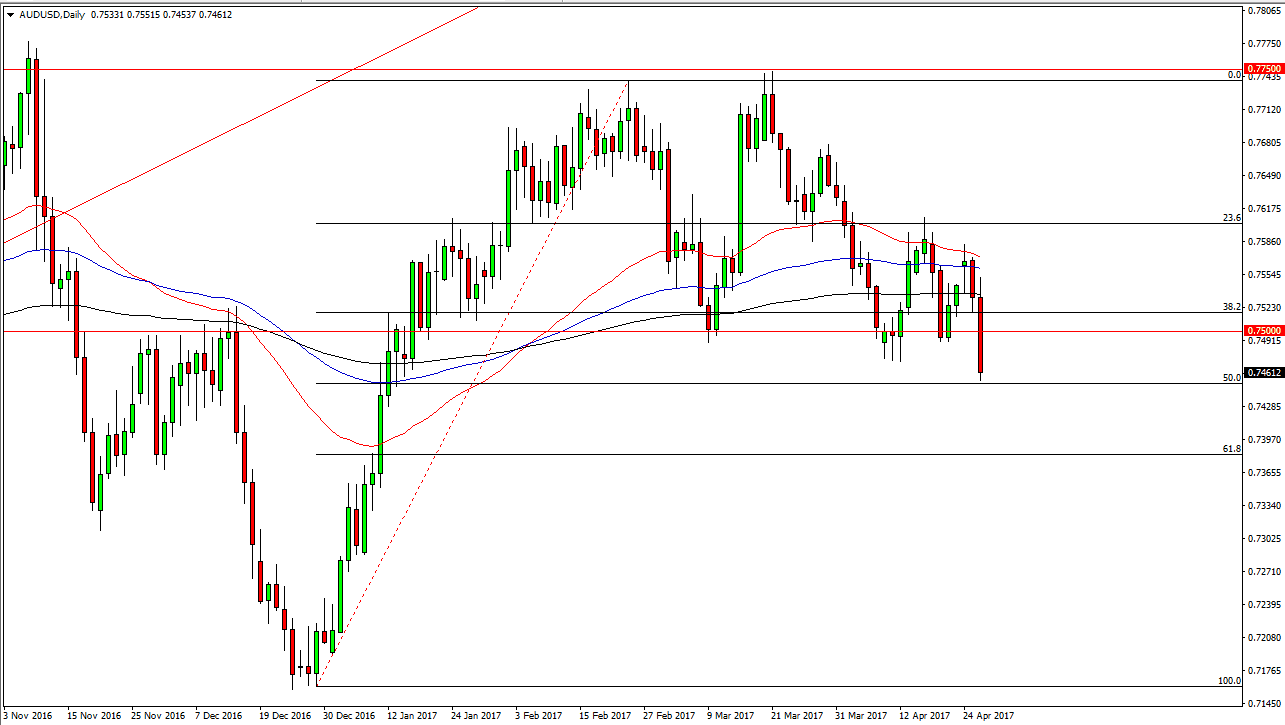

AUD/USD

The AUD/USD pair initially tried to rally during the day but fell apart and sliced through the 0.75 level. Even more importantly, it made a fresh, new loan is now testing the 50% Fibonacci retracement level at the 0.7450 level. For me, it looks as if the market will continue to go lower but I’m not sure whether we need to bounce first, or if we will just simply breakdown. A move down below the 50% Fibonacci retracement level since this market looking for the 61.8% Fibonacci retracement level underneath there. As far as buying is concerned, I don’t really have much interest in doing so, least not without the help of gold, which currently looks flat at best.

The US dollar is strengthening against most currencies in the world, so I think that’s what we are seeing here. This is a simple extension of what’s going on in other parts of the Forex markets, so the move probably has less to do with the Australian dollar, and more to do with the US dollar currently.