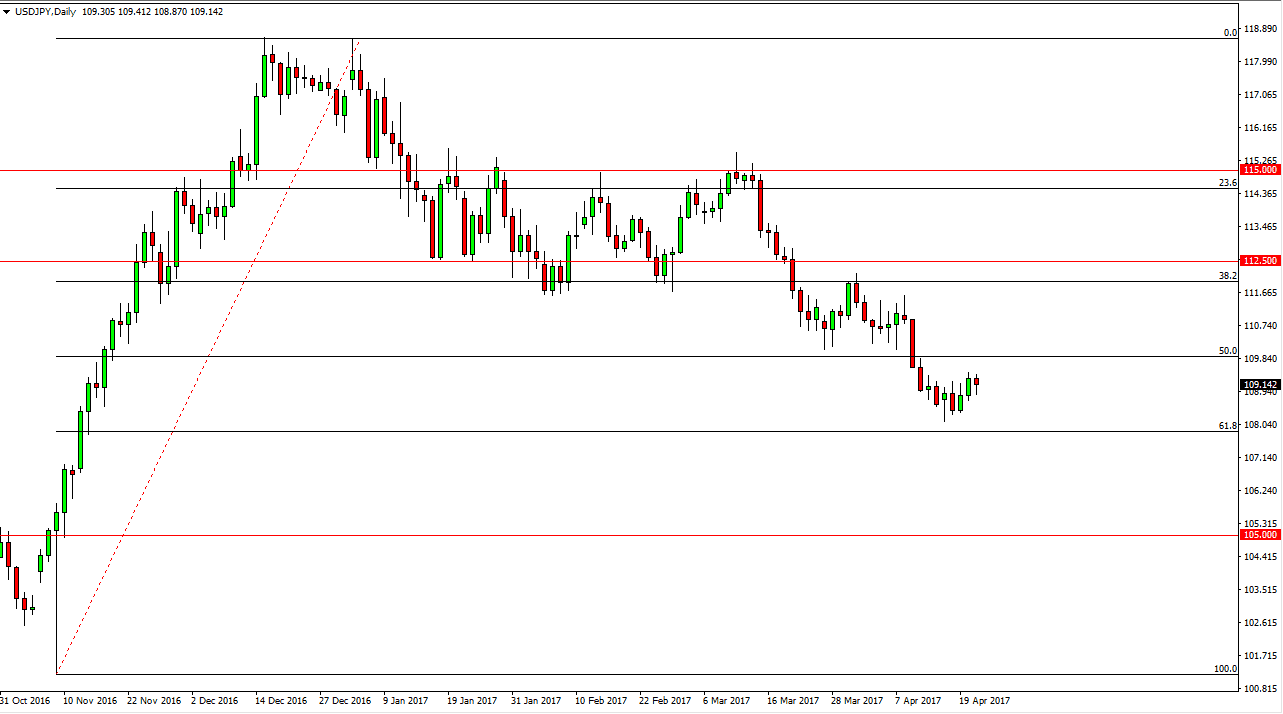

USD/JPY

The USD/JPY pair fell initially on Friday but turned around to form a hammer. The hammer sits on top of the 109 level so I believe that the market is going to continue to build up slight bullish pressure, perhaps reaching towards the 110 level above which had previously been supportive. That should now be resistive, so I would be looking to sell a resistive candle in that area. Alternately, if we can close on a daily candle above that level, the market will more than likely reach towards the 112 level above. It is worth noting that the 61.8% Fibonacci retracement level has held as support so far. Keep in mind that this pair does tend to be sensitive to risk overall.

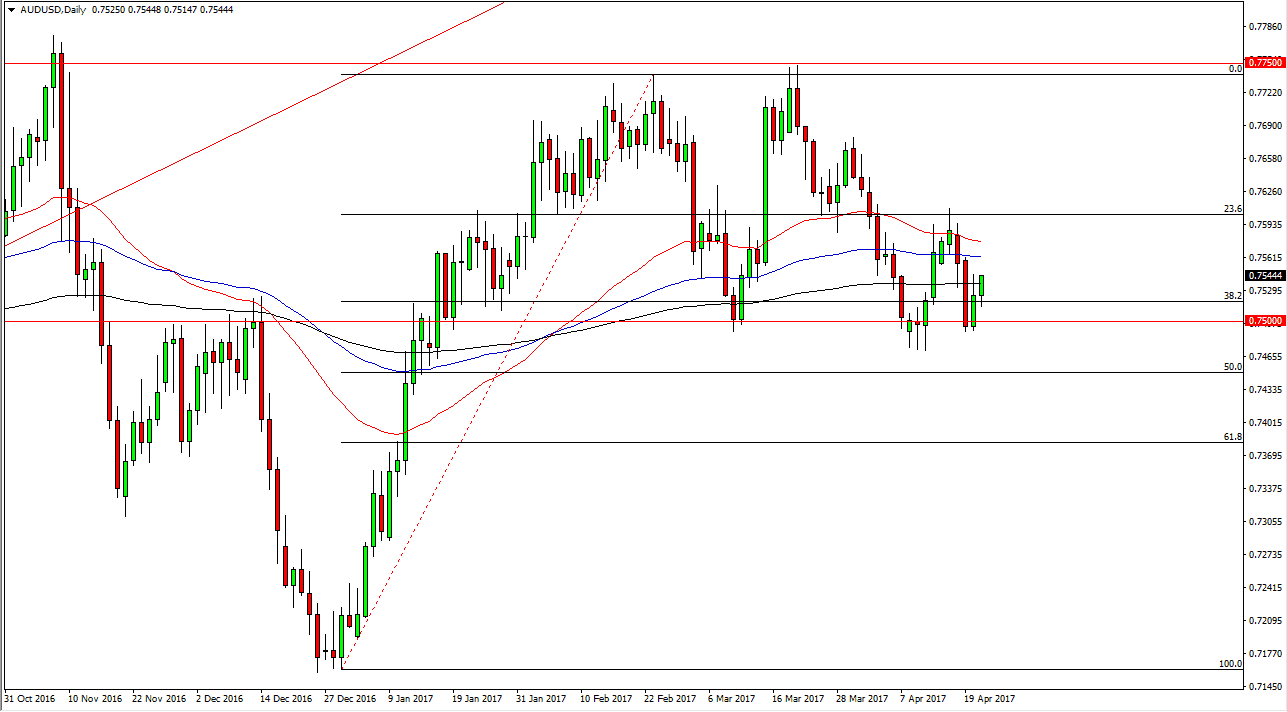

AUD/USD

The Australian dollar fell initially during the day but continued to go higher and with this it looks like we will probably try to reach towards the top of the consolidation area which is the 0.76 level. If we can break above there, the market should then go to the greater consolidation area, meaning that it should reach towards the 0.7750 level above. I think that if the market can break down below the 0.7450 level, the market should then continue to go even further to the downside. I believe that the gold markets will have a massive influence or we go next, and they look like they are trying to build up enough momentum to break out. So, because of this, I think that short-term move is probably easier to the upside.

With this in mind, I believe that it will be volatile but I still prefer the short-term buying opportunities over anything else. The markets seem to be a bit stagnant, so I’m not looking for anything major, just a simple continuation of the choppy sideways type of action that we have seen as of late.