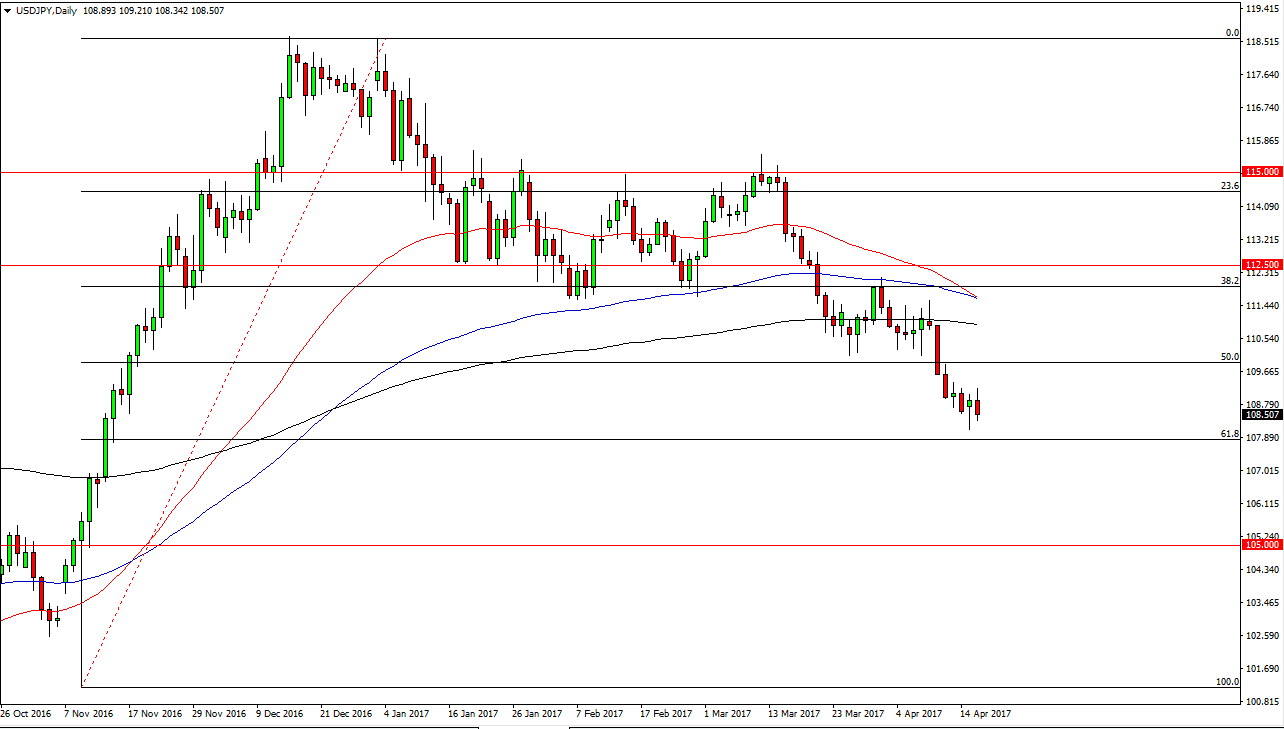

USD/JPY

The US dollar initially tried to rally against the Japanese yen, breaking above the hammer from the session on the previous session on Tuesday, but as you can see we failed to find enough buyers to drive the market any higher. Because of this, looks as if the market is going to continue to grind sideways overall, and be choppy just above the 108 handle. A breakdown below the 61.8% Fibonacci retracement level would be very negative, and a breakdown below that level should send the market down to the 105 handle. Alternately, a supportive candle could be a buying opportunity the right now I would need to see some type of daily signal to take advantage of that.

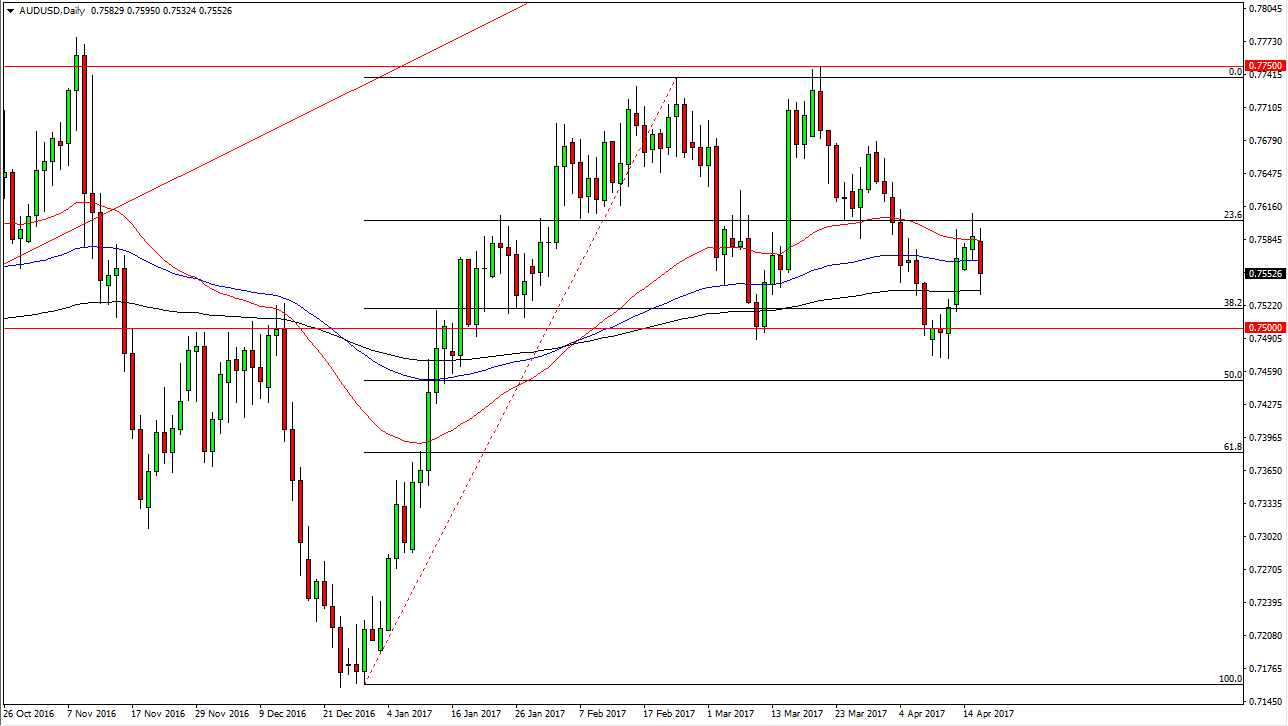

AUD/USD

The AUD/USD pair fell significantly during the day on Tuesday, testing the 200-exponential moving average but finding enough support to bounce from there. I believe that the market is going to continue to grind sideways, but if we can break above the shooting star from the Monday session, that would be very bullish and should send this market looking for the 0.7750 level above. I believe that the 0.75 level underneath is massively supportive, and as a result I think that the buyers will return on dips. I don’t have any interest in selling, but if the gold markets rallied I think that would only turbocharge the move in this market to the upside. Quite frankly, that’s what I need to see along with strong technicals to be comfortable buying the Australian dollar, as I think there is also the possibility of a lot of sideways action.

One thing I think you can count on is a lot of volatility as there are several different moving parts around the world causing headlines and causing lots of concern when it comes to trader psychology.