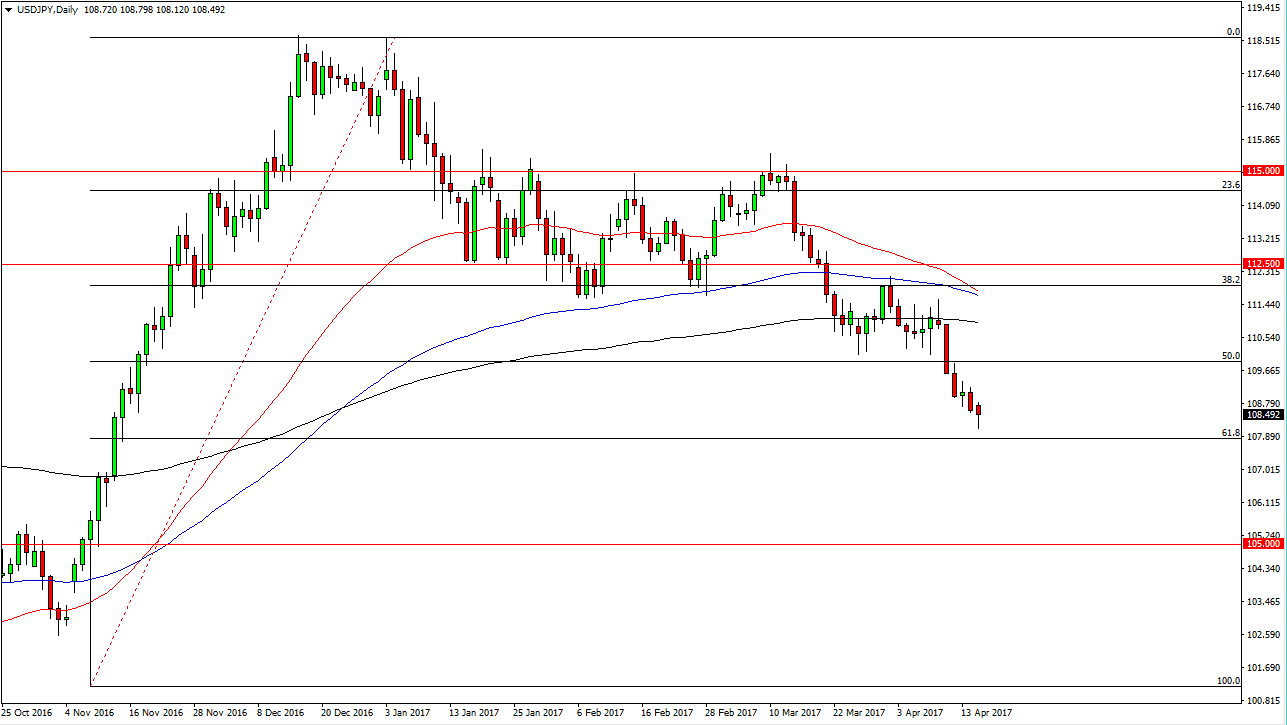

USD/JPY

The USD/JPY pair fell during the session on Monday, testing the 61.8% Fibonacci retracement level. We turned around to form a hammer and that of course is a bullish sign and we could be looking at an attempt to rally from here. If we can break above the top of the range for the day, I think the buyers will push this market back towards the 110 handle. Longer-term, we could see sellers enter the market somewhere in that area, but in the short term it looks like we are trying to find our footing. Keep in mind that this pair is highly risk sensitive, so headlines of course can move this market around rather quickly, especially when there’s bad news.

AUD/USD

The Australian dollar rallied during the day on Monday, testing the 0.76 level but finding resistance there. If we can pull back from here, I suspect that it’s only a matter of time before the buyers return and try to push this market higher. Alternately, if we can break above the top of the candle for the session on Monday, that would be a very bullish sign and should send this market looking for the 0.7750 level above.

I believe that the next 24 hours will be vital for this pair, so the daily candle for Tuesday should be rather important. I suspect that the smart money is going to stand to the side for the next day or so, waiting for the rest of the market participants to tell them where they should be trading and in what direction. I’m going to try the same thing, and will keep you abreast as to what I am doing tomorrow in my article for Daily Forex. Currently, I am in a “wait-and-see” type of attitude.