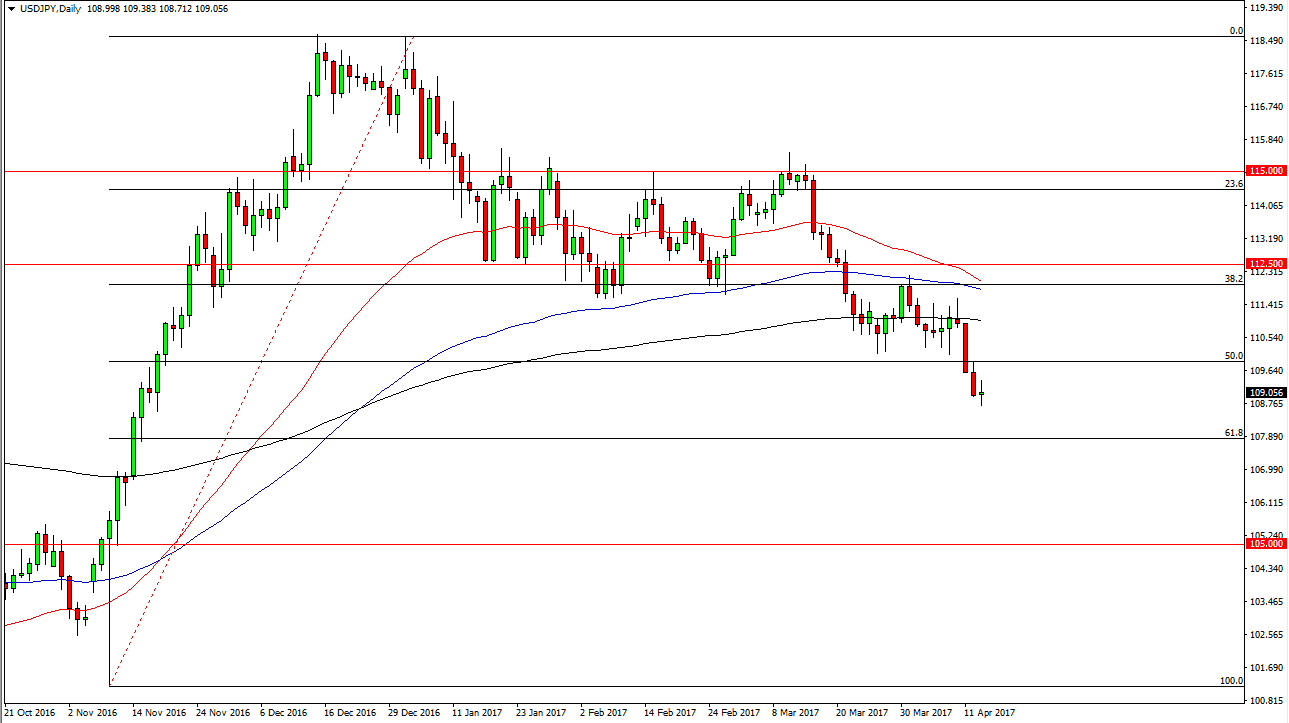

USD/JPY

The US dollar had a volatile session against the Japanese yen during the session on Thursday. The somewhat neutral looking candle suggests that we are taking a little bit of a pause in the breakdown, but quite frankly I think that the downward pressure should continue, and that the 110 level should be resistance. Because of this, the market looks likely to reach towards the 108 level, an area that is highlighted by the 61.8% Fibonacci retracement level. It is not until we break above the 200-day exponential moving average, pictured in black on the chart, that I would consider being a buying opportunity. A breakdown below the bottom of the candle for the session on Thursday is also a selling opportunity and or signal.

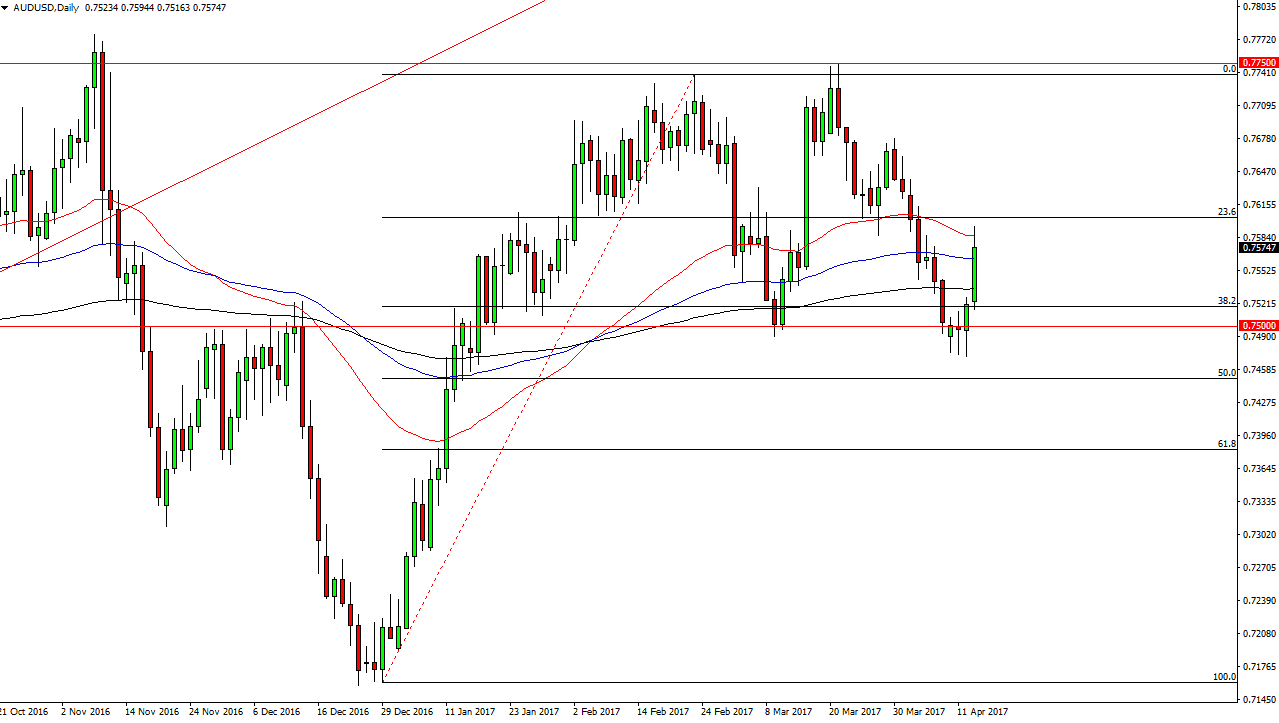

AUD/USD

The Australian dollar rallied during the session on Thursday, but found enough resistance near the 0.76 level above. Nonetheless, we had a very bullish candle and it looks as if the Australian dollar is starting to pick up significant strength. If we can break above the top of the candle, the market should continue to go higher, perhaps reaching towards the 0.7750 level above. Gold markets breaking out have of course have helped as well, so it makes sense that the Australian dollar will continue to strengthen.

Part of what has led to this move is the president of the United States suggesting that the value of the US dollar has been to strong recently, and this of course has people concerned about whether he will put pressure on the Federal Reserve to fight currency appreciation. Ultimately, there is a lot of confusion in the markets and that of course always works in the favor of “risk off” type of trades, which has been driving gold higher. The knock-on effect in gold has finally caught up with the Australian dollar, and as a result it’s likely that we will continue to see buyers.