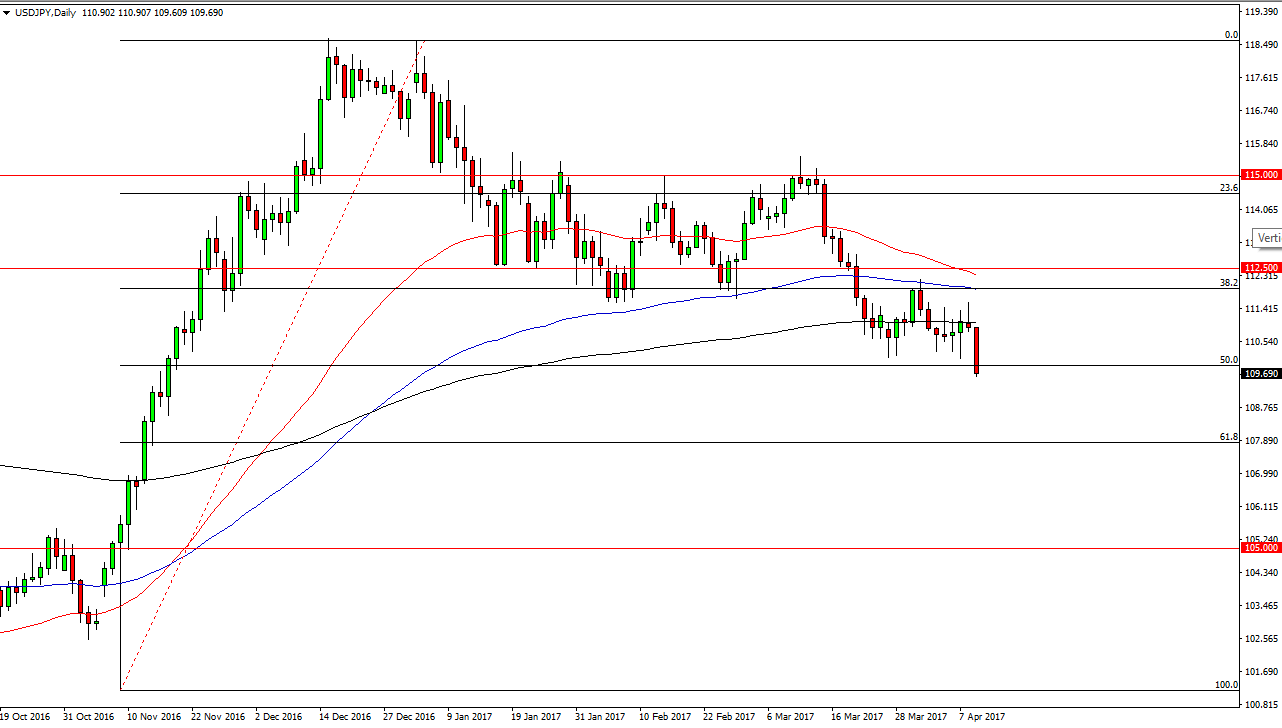

USD/JPY

The USD/JPY pair had a very rocky session for the day on Tuesday as we finally broke the law you 110 handle. By doing so, it shows that there is building downward pressure on this market, and it’s likely that we will continue to struggle to rally. I believe that short-term rallies will be selling opportunities on signs of exhaustion, and it’s likely that we will go to the 61.8% Fibonacci retracement level underneath, reaching towards the 108-level underneath. Because of this, I believe that this market is very difficult to start buying, and as a result I think it’s only a matter of time before the sellers assert there will in a market that clearly is showing a bit of risk aversion at the moment.

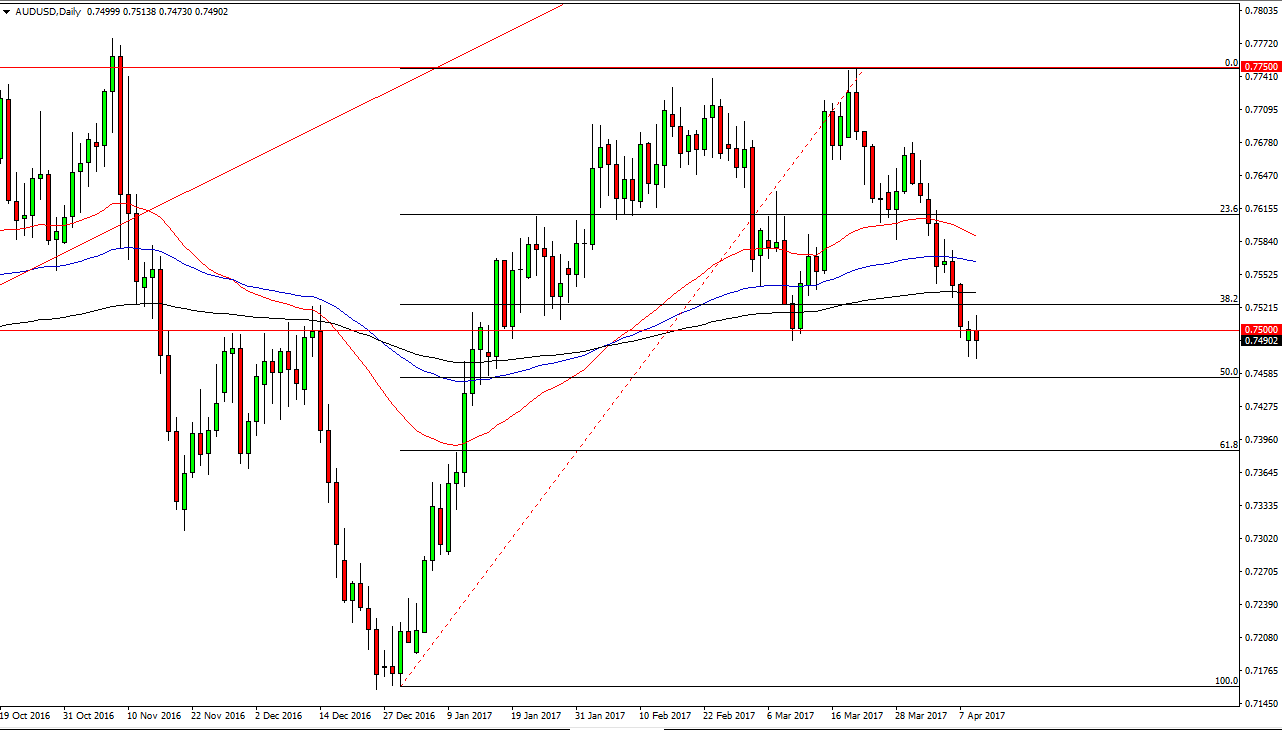

AUD/USD

The Australian dollar went back and forth during the day on Tuesday, as we slam around beneath the 0.75 level. I find this to be an interesting move, mainly because the gold markets did manage to break out to the upside, but that did not help the Australian dollar as this seems to be more of a “risk off” type of situation. If that’s the case, we will more than likely go lower but I think it will be difficult as there are a lot of trades just below that could cause support. A break above the top of the candle is bullish, but I also recognize that would be a very choppy move just waiting to happen. I think that this pair is probably best left alone and the short-term, as it will have to decide as to where once to go longer term. In the meantime, I believe that both the Australian dollar in the New Zealand dollar are probably dangerous markets to put any real money to work and as I would anticipate lots very choppy conditions.