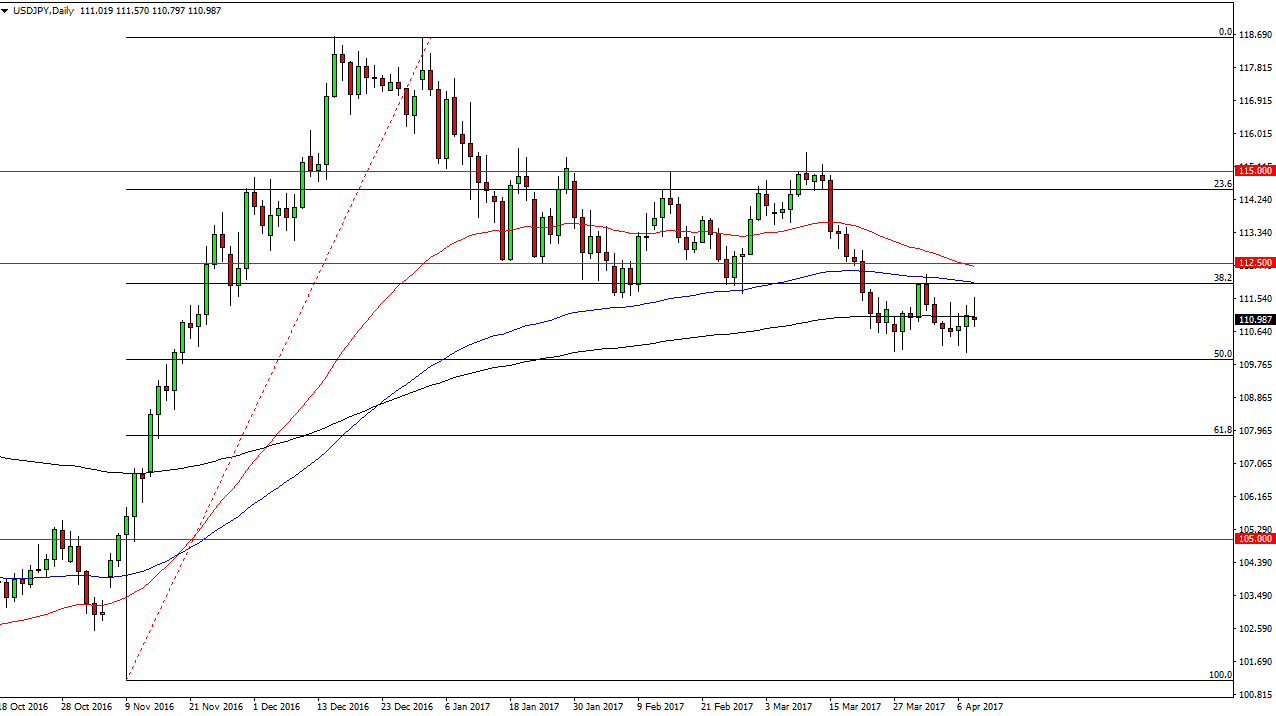

USD/JPY

The USD/JPY pair tried to rally at the open on Monday, but ran into enough trouble to turn things around and completely lose the gains. Ultimately, I believe that this market is consolidating between the 50% Fibonacci retracement level below, which is the 110 handle, and the 38.2% Fibonacci retracement level above which is the 112 level. Until we break out of this box, it’s more than likely going to be a scenario where we go back and forth. We are hugging the 200-day exponential moving average, and this shows that the longer-term traders are interested, but they don’t have enough momentum to push this market higher. If we break down below the 50% Fibonacci retracement level, the market should then go towards the 108 level near the 61.8% Fibonacci retracement level, which typically attracts a lot of volume.

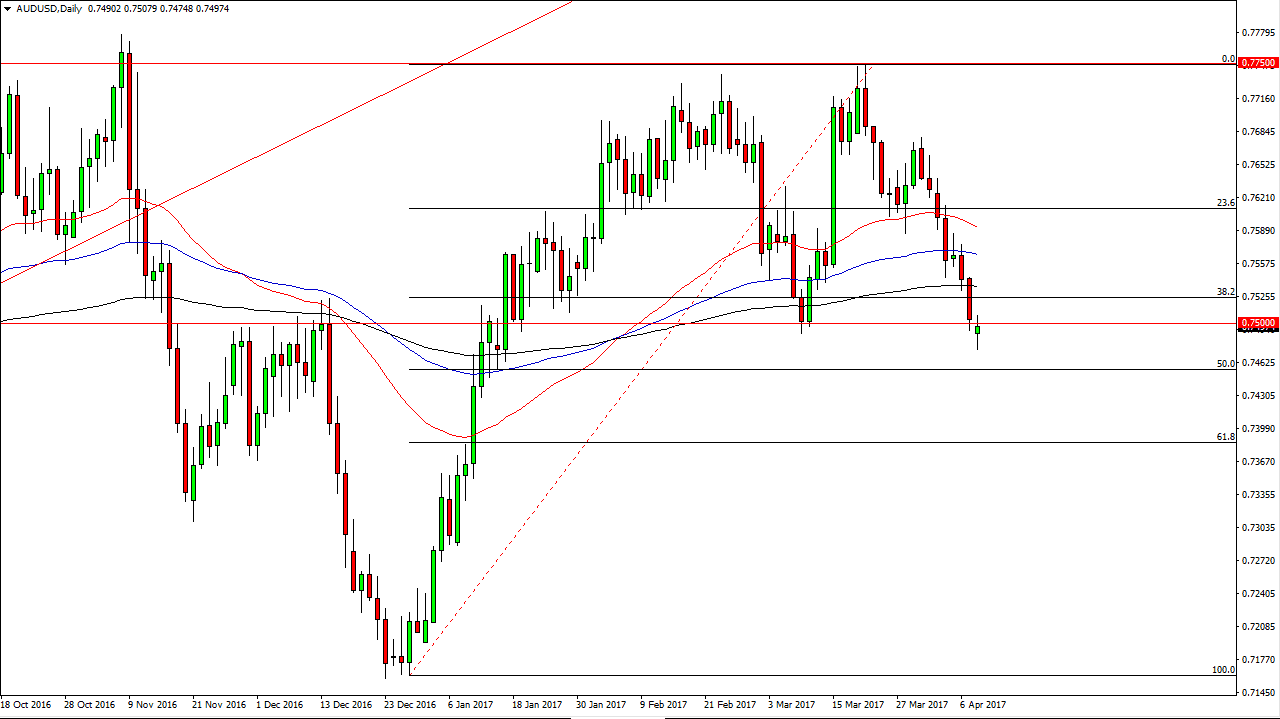

AUD/USD

The Australian dollar had a choppy session on Monday, as we bounced around just below the 0.75 handle. There is a lot of noise underneath, so it does not surprise me that we struggle to break down. Because of this, I think that it is going to be difficult to fall from here and we may find ourselves trying to bounce to find more sellers. If we broke above the top of the Friday candle, then I would be interested in buying but right now it looks as if the market is very flat. On top of that, the gold markets seem to be consolidating and don’t know which direction to go yet either, although I think longer-term they should rise. That might help the Aussie dollar, but I don’t think it’s going to happen in the next session or so. Because of this, I believe that the Australian dollar is probably best left alone currently. With this, I have my parameters to trade but don’t think they will be fired off anytime soon.