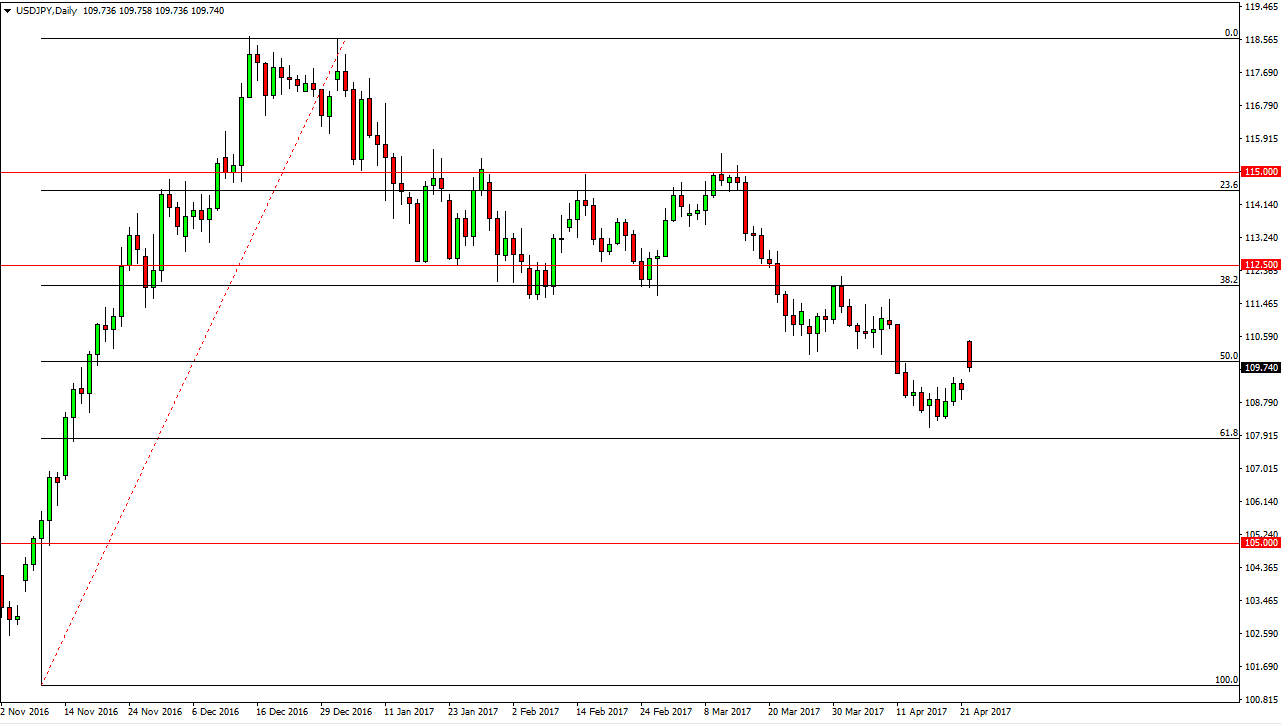

USD/JPY

The USD/JPY pair initially gapped higher at the open on Monday, as news came across the wire that the French elections look more centrist than feared. This put a bit of a “risk on” attitude into the marketplace, and that normally influences this pair to the upside. However, we spent the rest of the day falling and at this point I believe we are going to try to fill the gap. That means we should see some short-term bearishness, but I think that the buyers may return somewhere near the 109.50 level. This is going to be a choppy marketplace, but I think we are starting to see the Japanese yen soften a bit.

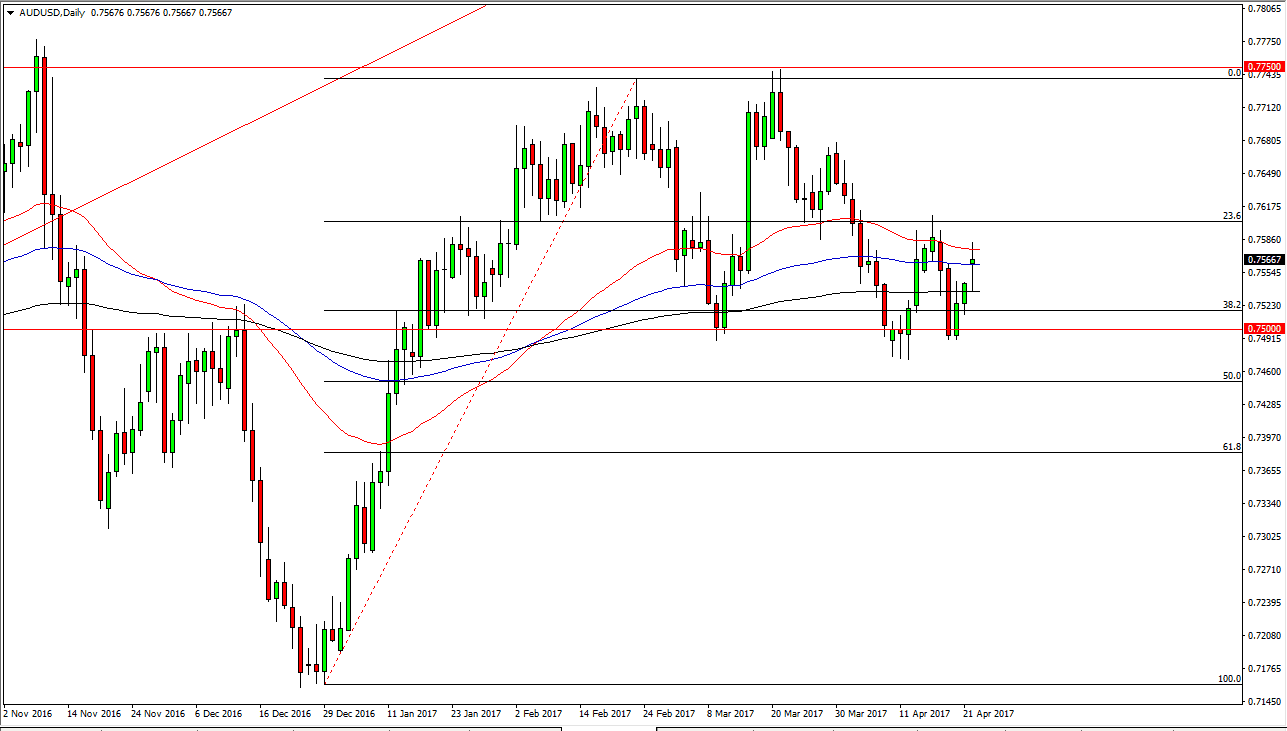

AUD/USD

The Australian dollar had a very choppy session as we continue to hang about the 100-day exponential moving average. Pay attention to the gold markets, they will of course have a significant influence on the Aussie dollar, as per usual. There is significant resistance above at the 0.76 handle, and a significant amount of support below at the 0.75 level, extending down to at least the 0.7450 level. Because of this, I think we still have more of an upward bias, but we should probably wait until we break above the 0.76 level to start putting long positions on in the market.

Once we do get that move, I believe that the market will reach towards the 0.7750 level above, which had been resistive a couple of times in the past. If we did manage to break down below the 0.7450 level however, that would be very bearish and have me selling this market. Currently, I expect to see a lot of volatility in this pair and will wait until we get some type of clarity as far as where the next direction of the market is going to reach towards.