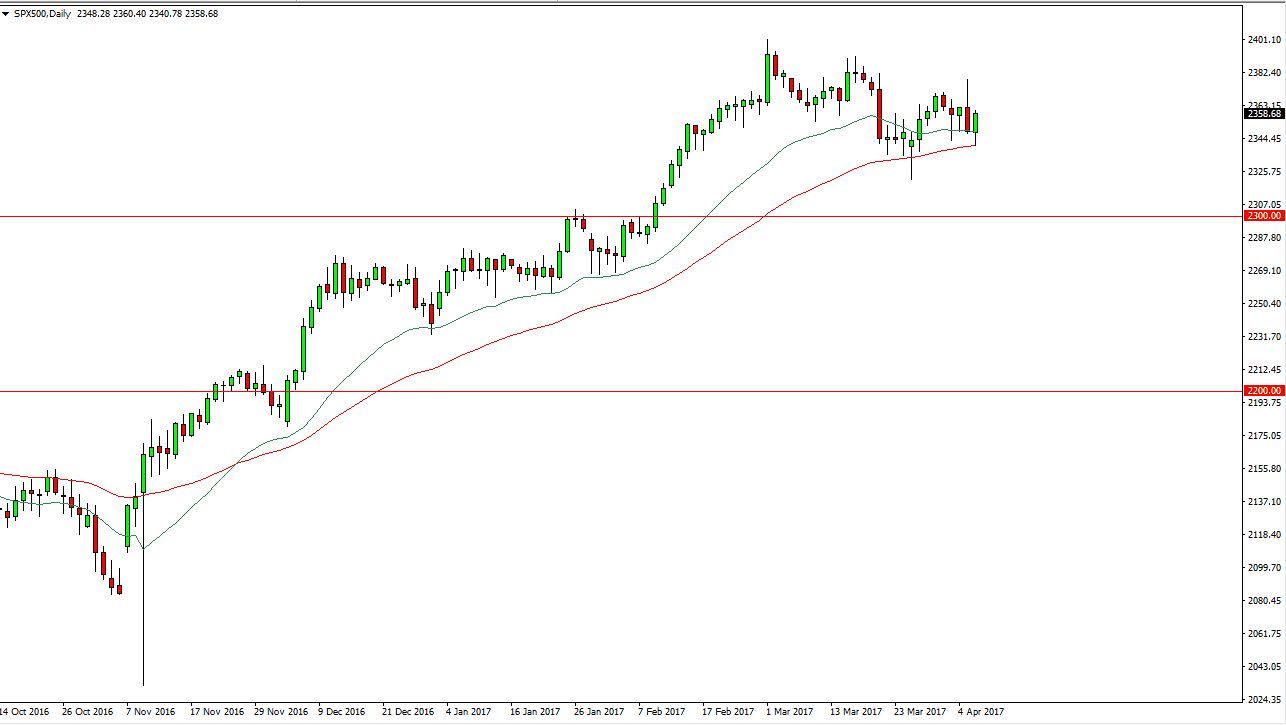

S&P 500

The S&P 500 initially fell during the day on Thursday but found enough support at the 50-day exponential moving average to turn things around and form a hammer. Ultimately, this is a market that is bullish overall, but we have seen quite a bit of a pullback, and with this I think the market is simply trying to build up enough momentum to continue the longer-term uptrend. With the jobs number coming out today, it’s obvious that the markets will react to that, as it typically does. The market is looking for 175,000 jobs added for the month of March, the markets will react accordingly. If we get more than that number, the market should continue to go higher. Otherwise, we may pull back but I think there is a massive amount of support at the 2300 level.

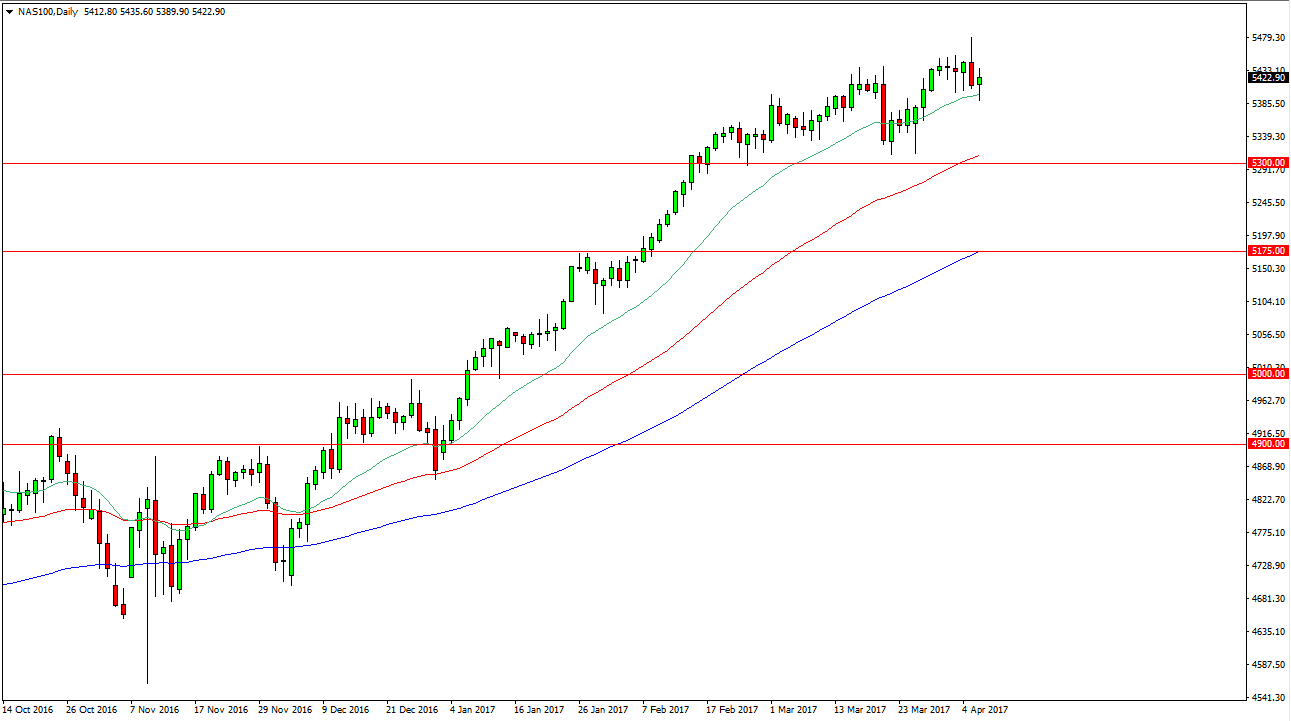

NASDAQ 100

The NASDAQ 100 had a volatile session on Thursday, testing the 20-day exponential moving average again. This is a market that has been in a very strong uptrend. The fact that we went neutral during the day makes it obvious to me that the markets are trying to flatten out and get away from taking risk on ahead of the jobs number. Ultimately, I think a pullback should offer buying opportunities in a longer-term uptrend. I think that the 50-day exponential moving average below, pictured in red, should continue to be dynamic support.

Ultimately, I believe that the market is going to try to reach towards the 5500 level. That’s an area where I expect to see quite a bit of psychological resistance, but given enough time I think that we will break above there as well. I think pullbacks offer value, and that should continue to be the mantra of traders in the market as the NASDAQ 100 has lead the other indices higher.