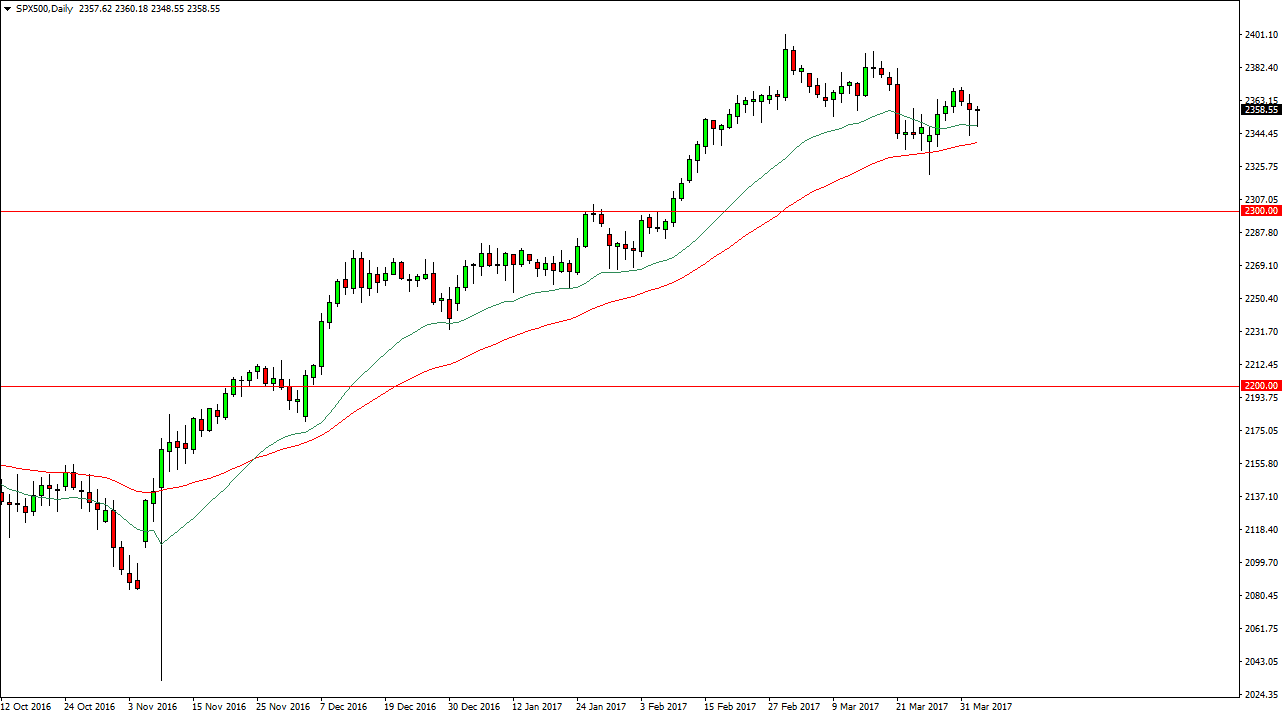

S&P 500

The S&P 500 initially fell during the day on Tuesday, but found support at the 20-day exponential moving average. Because of this, looks like the markets will continue to find buyers below, as we have been in such a strong uptrend. I think that the 20-day exponential moving average is only the first place where you would find buyers, because I believe the 50-day exponential moving average will also be an opportunity to go long. I believe that the absolute floor in the market is somewhere near the 2300 level and therefore I have no interest in selling. It appears that every time we pulled back a little bit, the markets will find buyers willing to take advantage of the longer-term uptrend.

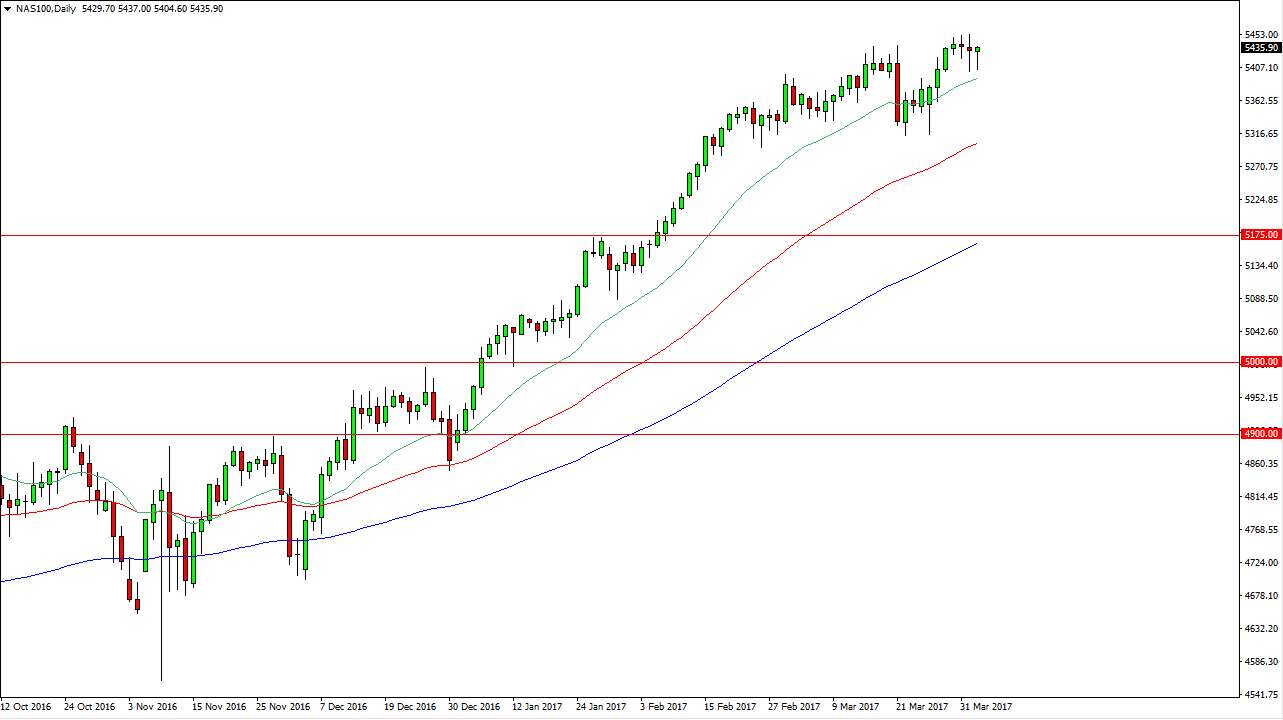

NASDAQ 100

The NASDAQ 100 fell slightly during the session on Tuesday, but found enough support below near the 5400 level to turn things around and form a hammer. This being the case, it’s likely that the market will continue to find buyers on dips, as we find plenty of support below. The 5400 level looks to be a bit of a floor, but I think there’s even more support at the 5300 level. I have a target of 5500 over the longer term, and it appears that the market has no lack of interest in it.

The NASDAQ 100 continues to be one of the better performing indices around the world, and with that being the case I look at it as a harbinger for other indices as well. Nonetheless, I look at pullbacks as potential buying opportunities that offer value that traders will continue to take advantage of. I have no interest in selling, and now believe that hardly anybody else does either. With this being the case, I’m looking to go long every time I see value in the market on a dip.