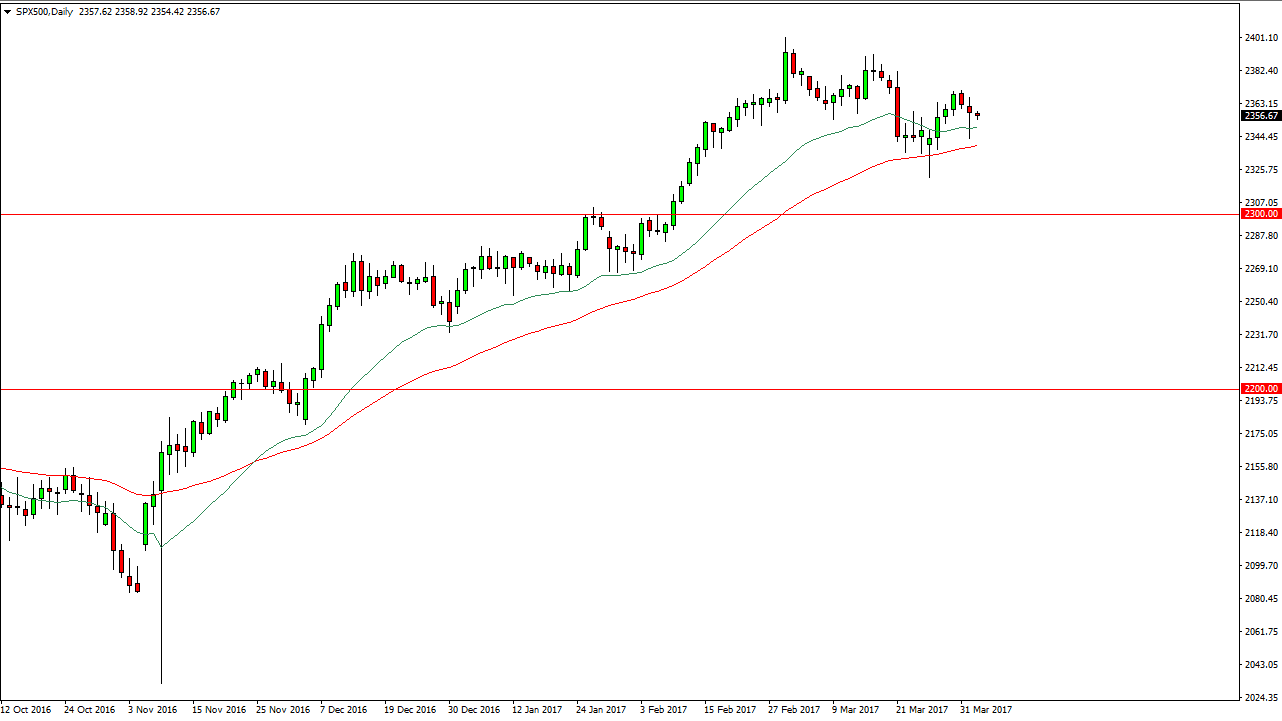

S&P 500

The S&P 500 fell rather hard during the day on Monday but ended up finding buyers late in the afternoon. The market formed a hammer which of course is a bullish sign in the 20-day exponential moving average looks to be offering support yet again. Below there is the 50-day moving average which has been even more supportive, so I believe that as the market drifts a little bit lower, buyers will continue to be attracted. I don’t have any interest in selling and I believe that there is a hard floor somewhere near the 2300 level. I recognize that we may be drifting a little bit lower, looking for value, so we may have a bit of bearish pressure and the short-term, but I don’t see that as being a longer-term phenomenon.

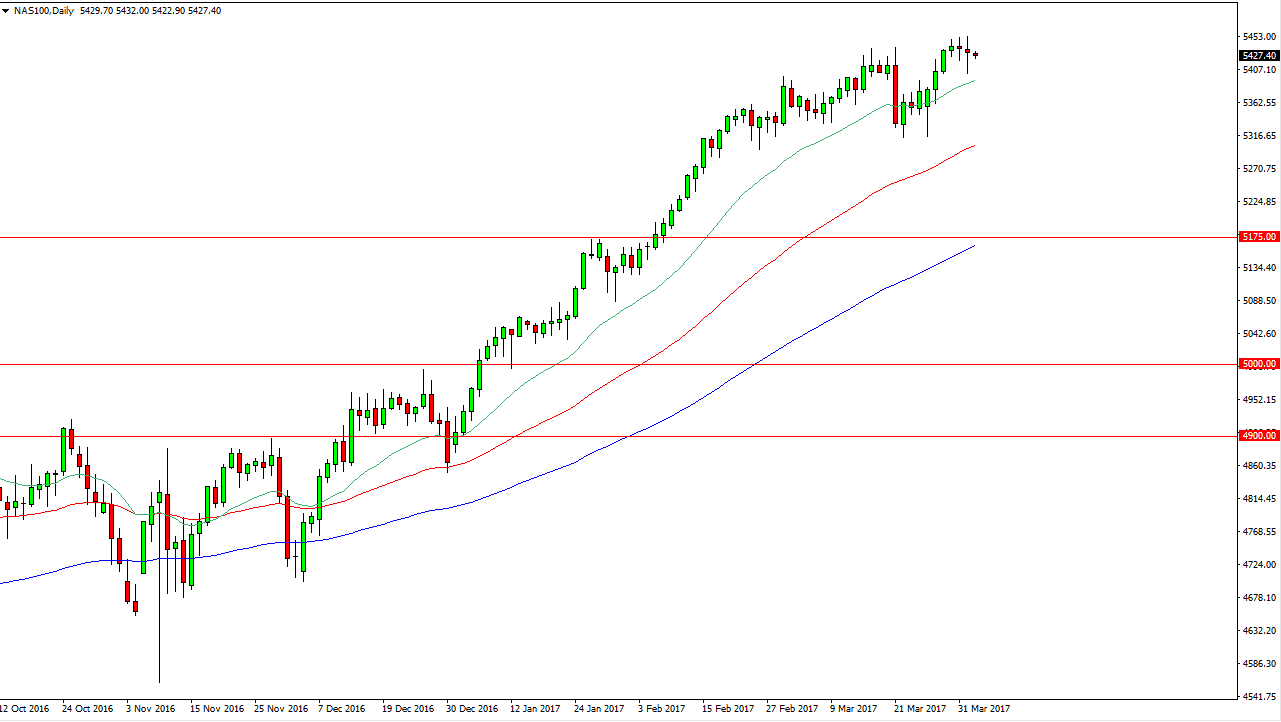

NASDAQ 100

The NASDAQ 100 also fell initially during the day on Monday but found enough support near the 5400 level to turn around and form a hammer. The market is a little bit “toppy”, but in the end, we are most certainly in an uptrend, and even if we need to pull back that should only offer value the traders will be willing to take advantage of. I don’t have any interest in shorting this market as I believe the 20-day exponential moving average just below will offer support, and the 5300 level will offer a bit of a “floor” as well. Adding more credence to the idea of a floor being below is the fact that the 50-day moving average is currently testing that area. I believe that this market will eventually reach the 5500 level above, but we are starting to lose a little bit of momentum, something that you would expect to see after such a long and protracted march higher. I remain bullish but recognize the easy money has been made.