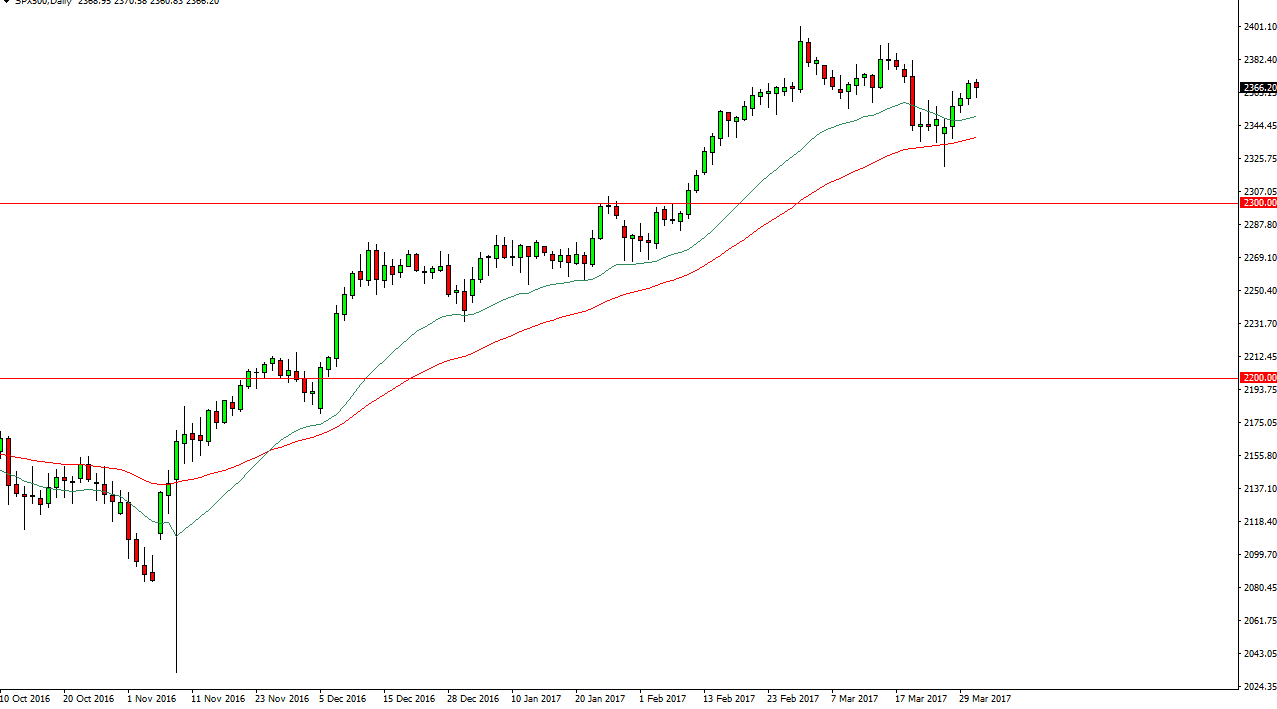

S&P 500

The S&P 500 fell slightly during the day on Friday, as the quarter ended. However, I still think there’s plenty of support underneath and given enough time I believe that the market will reach towards the 2400 level. I believe that will break above there as well, perhaps reaching towards the 2500 level. I believe that the Monday session that formed a hammer was the signal that we were going to continue to see bullish pressure. The 50-day exponential moving average, pictured in red on the attached chart, should continue to offer significant support. I believe that the absolute floor is somewhere near the 2300 level. The 2500 level will be my longer-term target, and could cause a significant amount of resistance due to psychological significance, but at this point I don’t think there’s any argument to be made for shorting.

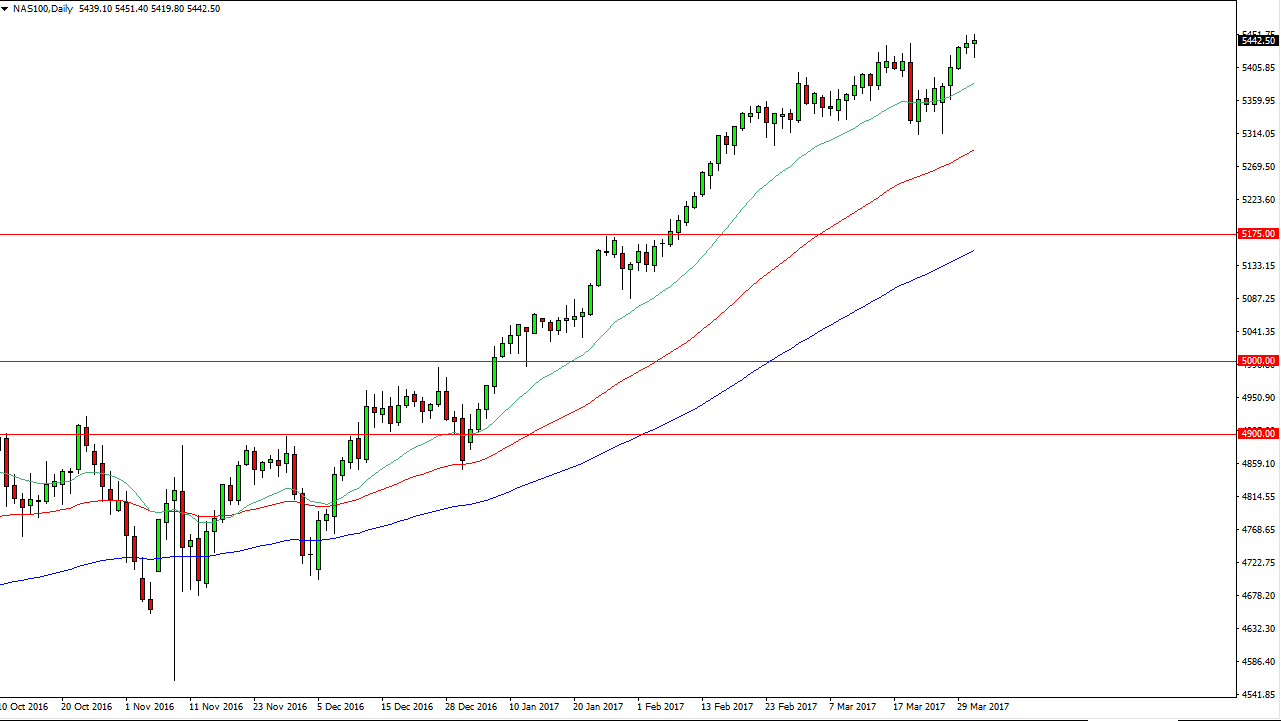

NASDAQ 100

The NASDAQ 100 fell during the day on Friday, but found enough buying pressure underneath to turn things around and form a hammer. The hammer suggests that we are going to continue to go higher, as the NASDAQ 100 continues to lead the way for US and other indices. I believe that pullbacks to the 20-day exponential moving average, pictured in green on the daily chart, should continue to offer dynamic support. I believe that the 5500 level above the should be resistive, but mainly due to psychological significance more than anything else. I believe the pullbacks continue to offer value and I also believe that we will eventually break above the 5500 level, going much higher. If this market goes higher, other indices do as well.

I believe that the 5300 level below is probably the closest thing to a “floor” in the market, and with this I have no interest in shorting between here and there. I will continue to for value.