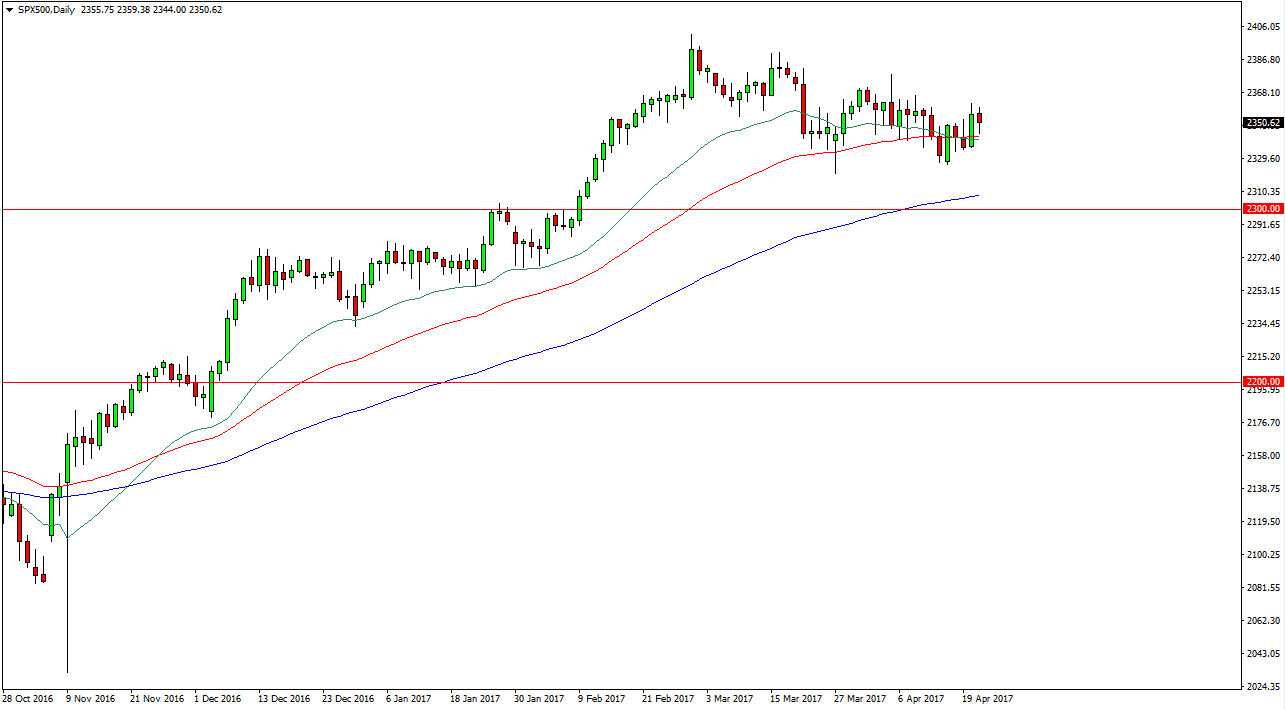

S&P 500

The S&P 500 initially fell on Friday but turned around to find enough support and form a hammer. We are currently in the middle of earnings season so that of course makes quite a bit of noise in the market. I still believe in the longer-term uptrend, and that it’s only a matter of time before we break out to the upside. The hammer suggests that the buyers are willing to step in on the dips, and because of that I think the market will then go looking for the 2400 level. I don’t have any interest in selling, I believe that the 2300 level is the absolute “floor” of the market.

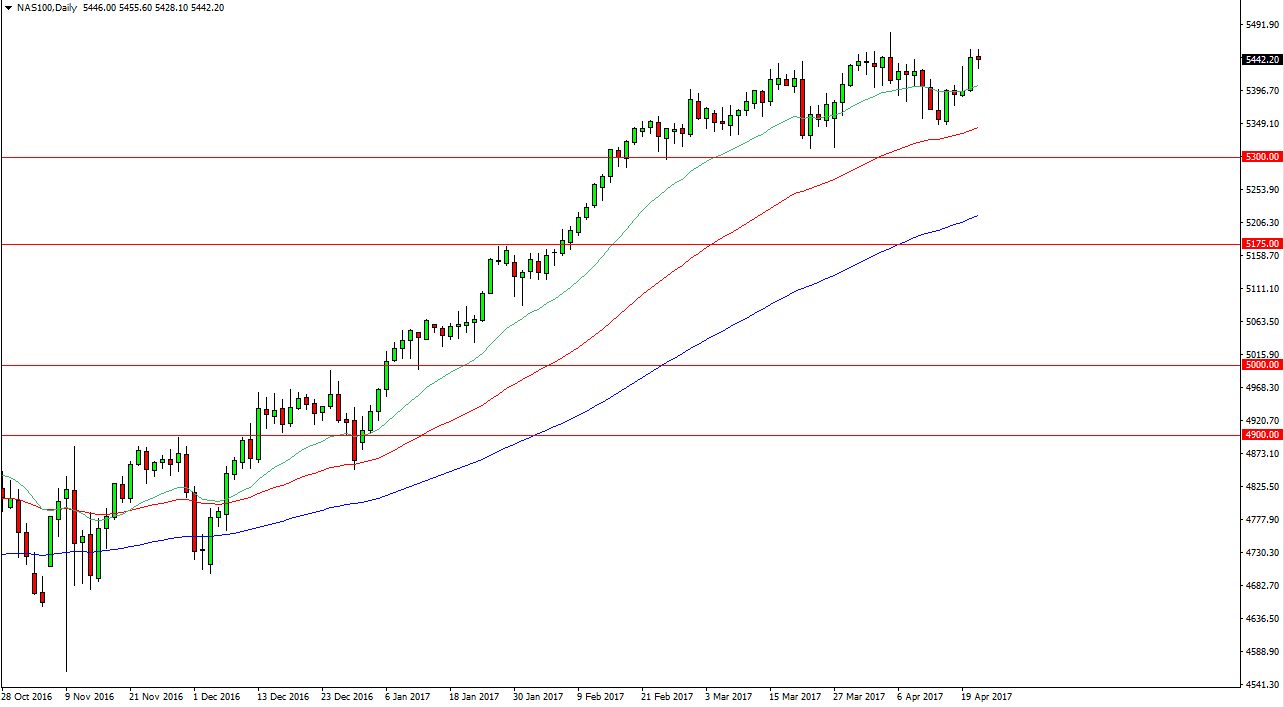

NASDAQ 100

The NASDAQ 100 had a choppy session on Friday as well, as we continue to see buyers jumping to this market. The market looks as if it is ready to reach towards the 5500 level, which I think will eventually get above that level continue to go much higher. I think pullbacks continue to be buying opportunities, as the market has lead the rest of the indices around the world higher. The 50-day exponential moving average, pictured in red on the chart, continues to offer massive support as does the 20-day moving average, pictured in green. The 5300 level below is the absolute floor in the market, and I don’t see any chance of selling whatsoever as I believe longer-term drivers will continue to push the market higher.

Investors have been hanging on to the NASDAQ 100 for quite some time, and this week will be very interesting as several of the world’s largest tech companies announce earnings. Unless they are an absolute disaster, I suspect that any drop from those announcements what and of being a value play overall as the NASDAQ 100 continues to find reasons to accelerate to the upside.