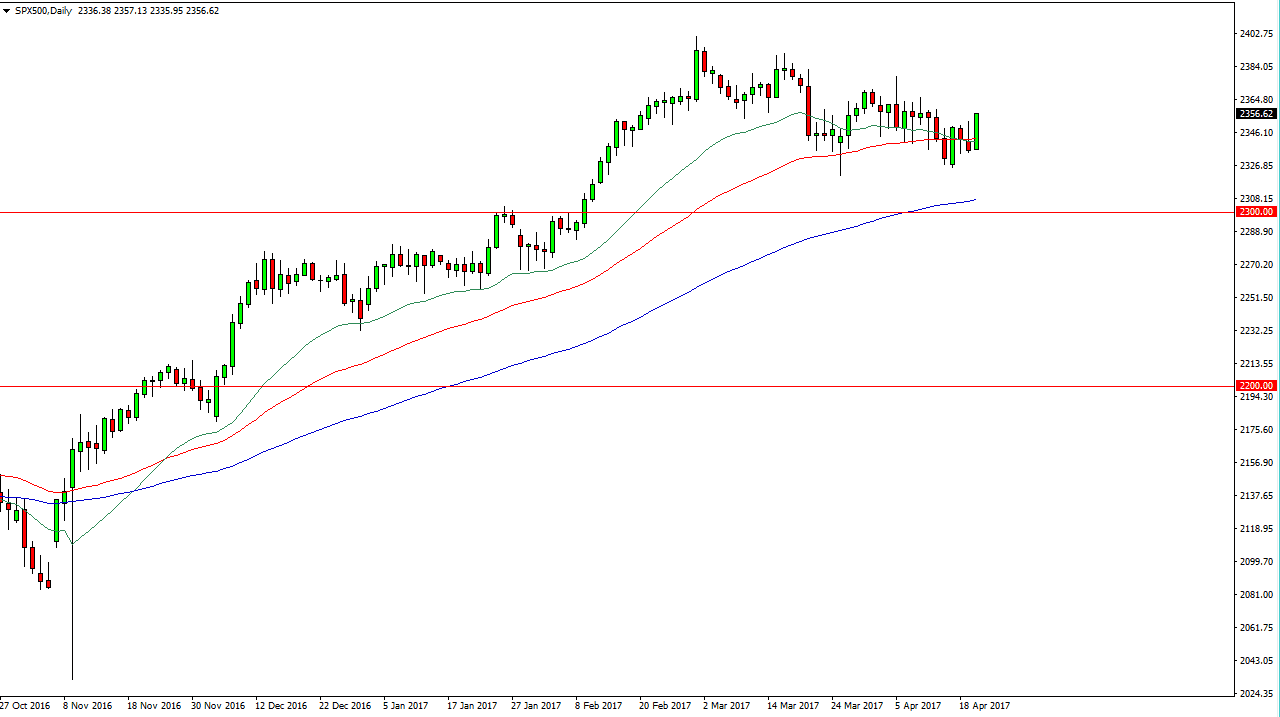

S&P 500

The S&P 500 rallied during the Thursday session, breaking above the top of the shooting star from Wednesday, which of course is a very bullish sign. I believe that short-term pullbacks continue to be buying opportunities as the market has been consolidating through earnings season. I think that it isn’t until we break out a running season that the market can go a lot higher, but currently I think that short-term buying opportunities present the opportunity that traders should be looking for. I have no interest in shorting, I believe that the S&P 500 will go higher over the longer term. The 2400 level is my target, but I think it will take quite a while to go to that level.

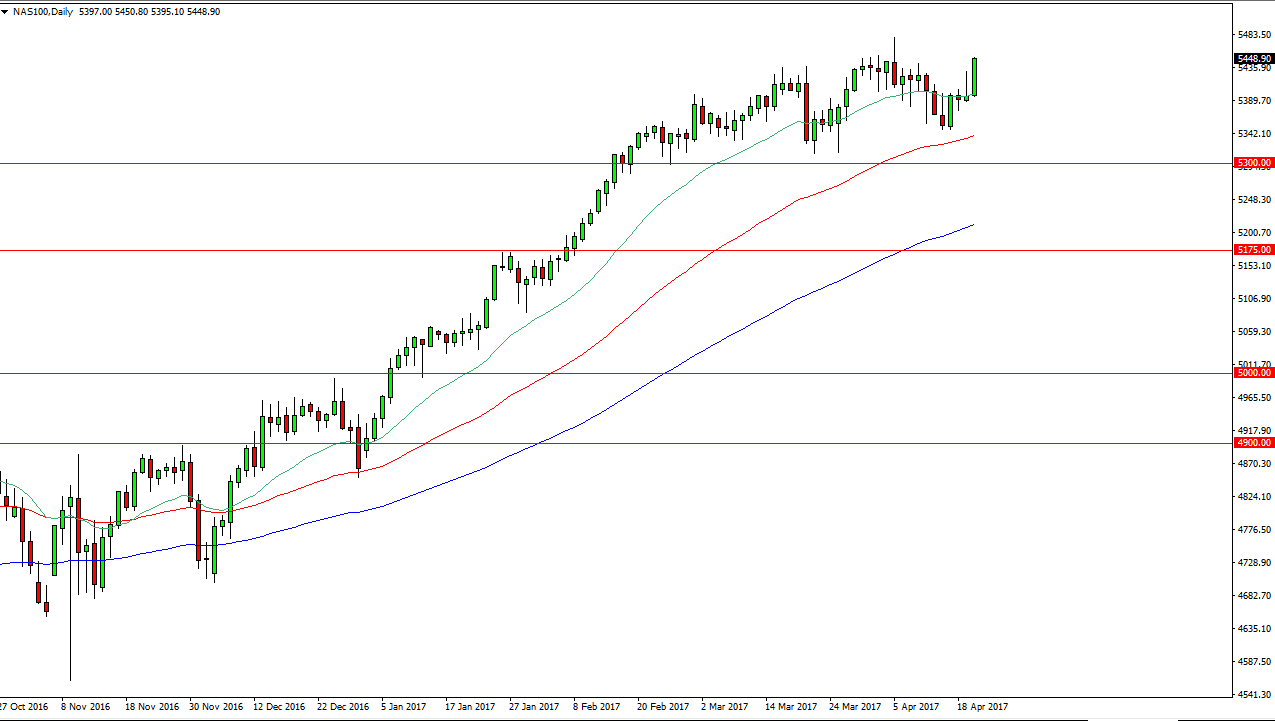

NASDAQ 100

The NASDAQ 100 broke higher during the session as well, clearing the top of the shooting star from the previous session. Because of this, I believe that the NASDAQ 100 will continue to lead US stock indices higher, and by extension the rest of the world as has been the case for several months. Pullbacks at this point should continue to be buying opportunities, and the 5500 level will be targeted. The market should be able to break that level given enough time, but we may need to pull back from time to time. Ultimately, I believe that once we break the 5500 level, the market should then go much higher.

I believe that the 5300-level underneath is the “floor” in the market, so until we can stay below there for any real length of time, I believe that the market is still in a relatively strong uptrend, and the recent slowing down of the move higher is probably a good thing as we were getting a bit overextended anyway. I’m a buyer on dips, I’m also a buyer on fresh, new highs. I have no interest in selling.