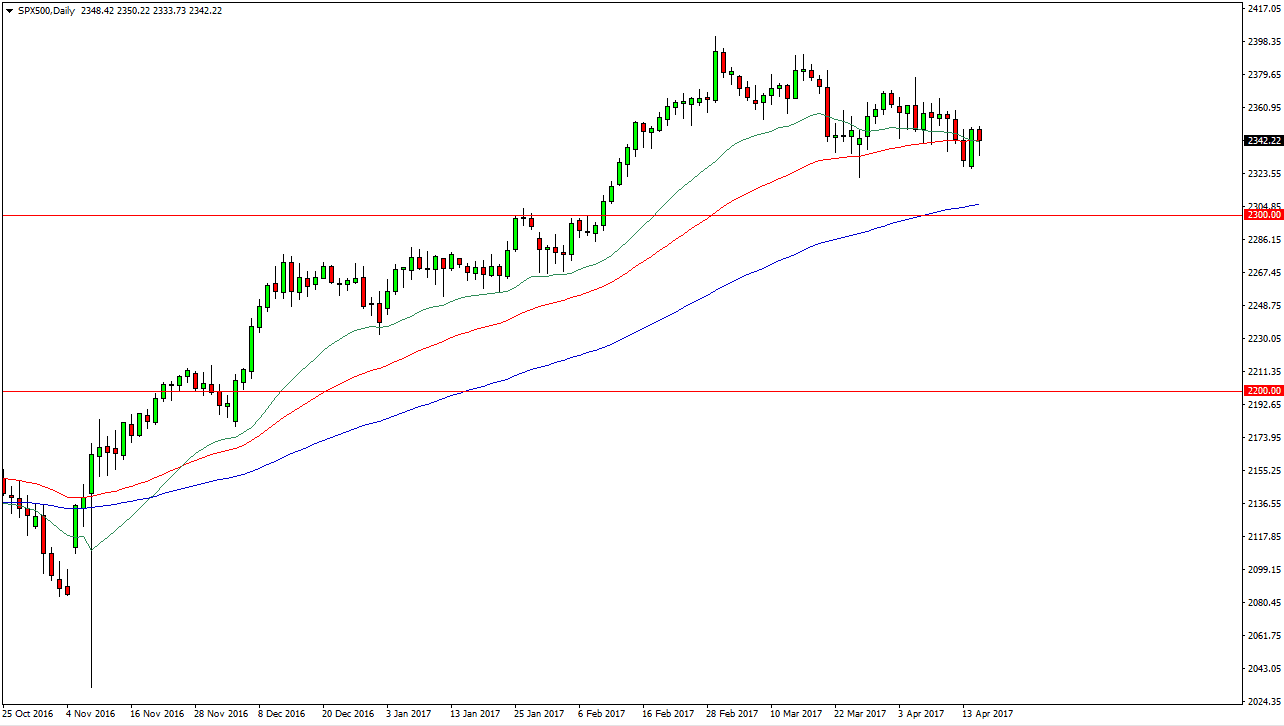

S&P 500

The S&P 500 fell on Tuesday, but turned around to form a bit of a hammer. That being the case, it looks as if the 50-day exponential moving average is starting to act as support, and because of that it’s likely that a break above the top of the candle should send this market grinding its way towards the 2400 level again. Even if we fell from here, I would not be looking to sell, as I believe that the 2300 level below is massively supportive. Because of this, I believe that it’s only a matter of time before we rally but I recognize that the earnings season is going on, and that can cause quite a bit of volatility. I believe in the longer-term uptrend.

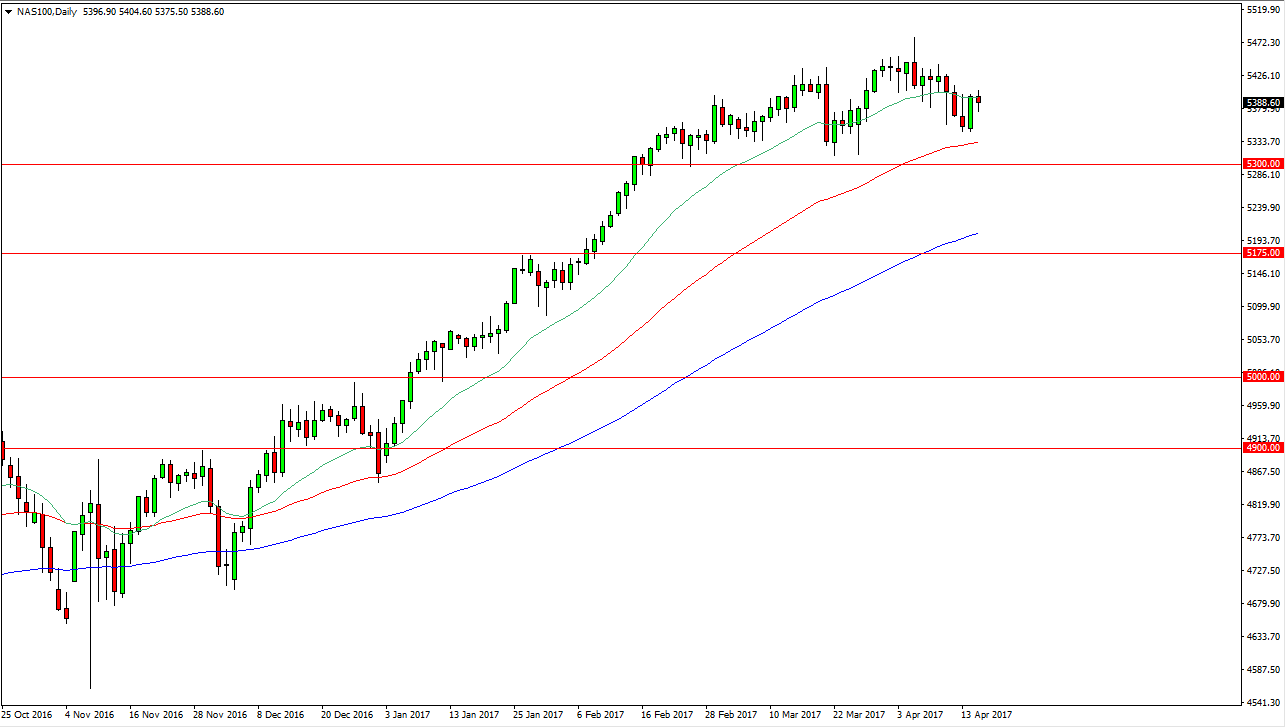

NASDAQ 100

The NASDAQ 100 fell initially during the session on Tuesday, but found enough support to keep the market somewhat afloat. Because of this, I think that the market will continue to go higher, and a break above the top of the range for the day should send this market towards the 5450 handle. If we can break above there, the market should then go to the 5500 level above which is my longer-term target. I believe that the 5300 level underneath is the floor, and if we can stay above there I have no interest in selling this market as it has lead the way for other indices around the world and most certainly in the United States.

Buying on the dips might be the way forward, but keep in mind that we are bit overextended so having a quiet session makes a lot of sense as we wait for earnings to shake out and show us how the US economy is going. So far, earning season has been decent, so therefore I think eventually we will go higher.