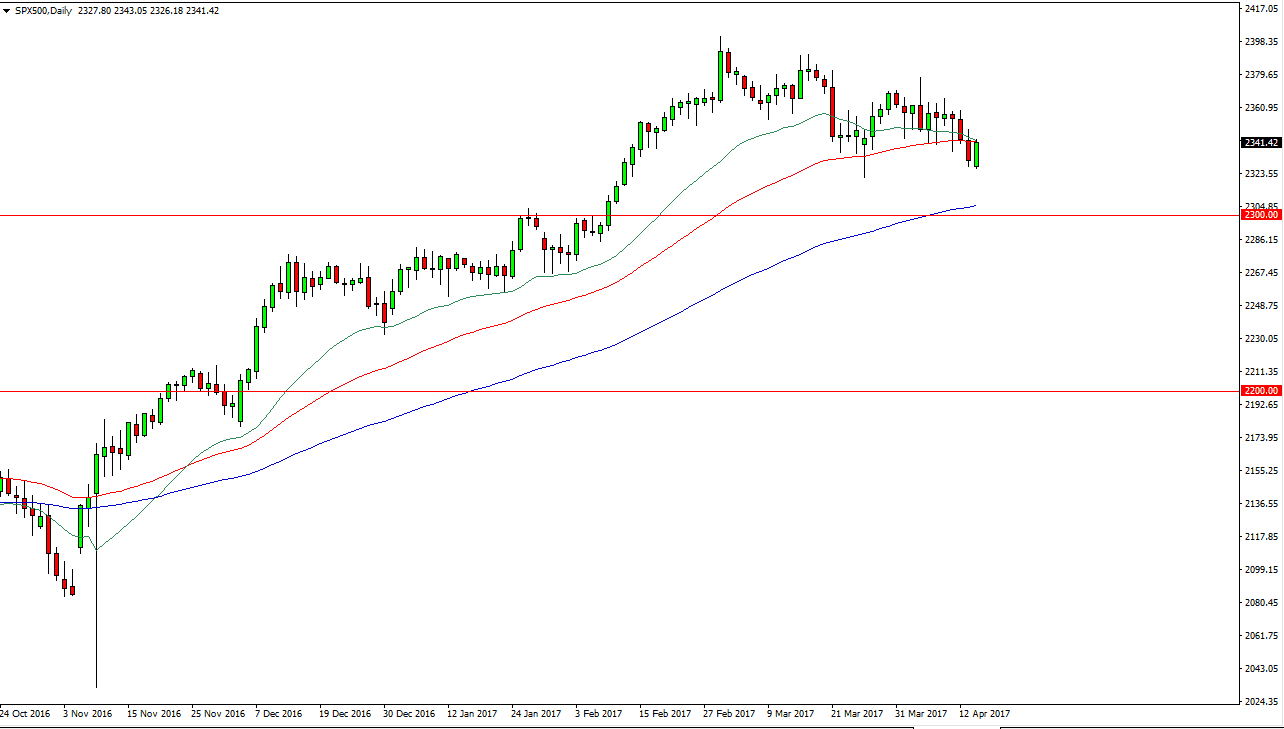

S&P 500

The S&P 500 rallied during the day on Monday, as traders came back from the Easter holiday. It looks as if we are ready to continue to go higher, but there is a significant amount of noise above. If we can break down below there, meaning the bottom of the candle for the session on Monday, we should then reach towards the 2300 level. That level should be the absolute “floor” of this market and when you look at the longer-term charts, we are still forming a bullish flag. I have no interest whatsoever in selling this market, as it has been bullish for so long and it’s not until we break well below the 2300 level that I could consider selling. I still have a target of 2400, and a longer-term target of 2500 going forward.

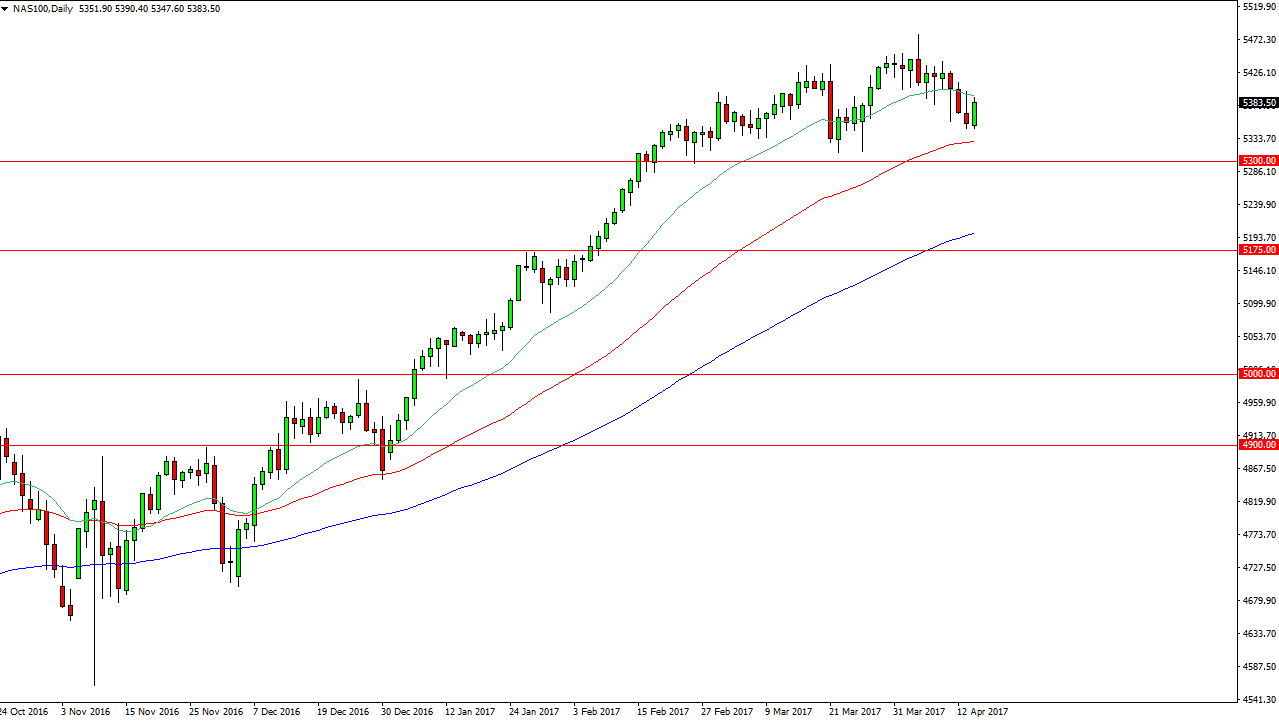

NASDAQ 100

The NASDAQ 100 rallied as well, testing the top of the shooting star from Thursday. I believe that this market should continue to reach towards the highs, somewhere near the 5500 level. I believe that the 5300-level underneath is supportive and of course the 50-day exponential moving average being just above there helps as well. This is a market that has been very bullish over the longer term, so the recent consolidation makes sense as we are trying to build up enough momentum to finally go higher. I have no interest in shorting, I believe that the market should continue to find buyers going forward.

I do think that the 5500 level will be massively resistive, but eventually we should be able to break above there as well. It will probably take several attempts, but building up enough momentum to go above is what I think it’s of happening in the end. I have no interest in selling currently, and would have to reevaluate the market if we did breakdown below the 5300 level.