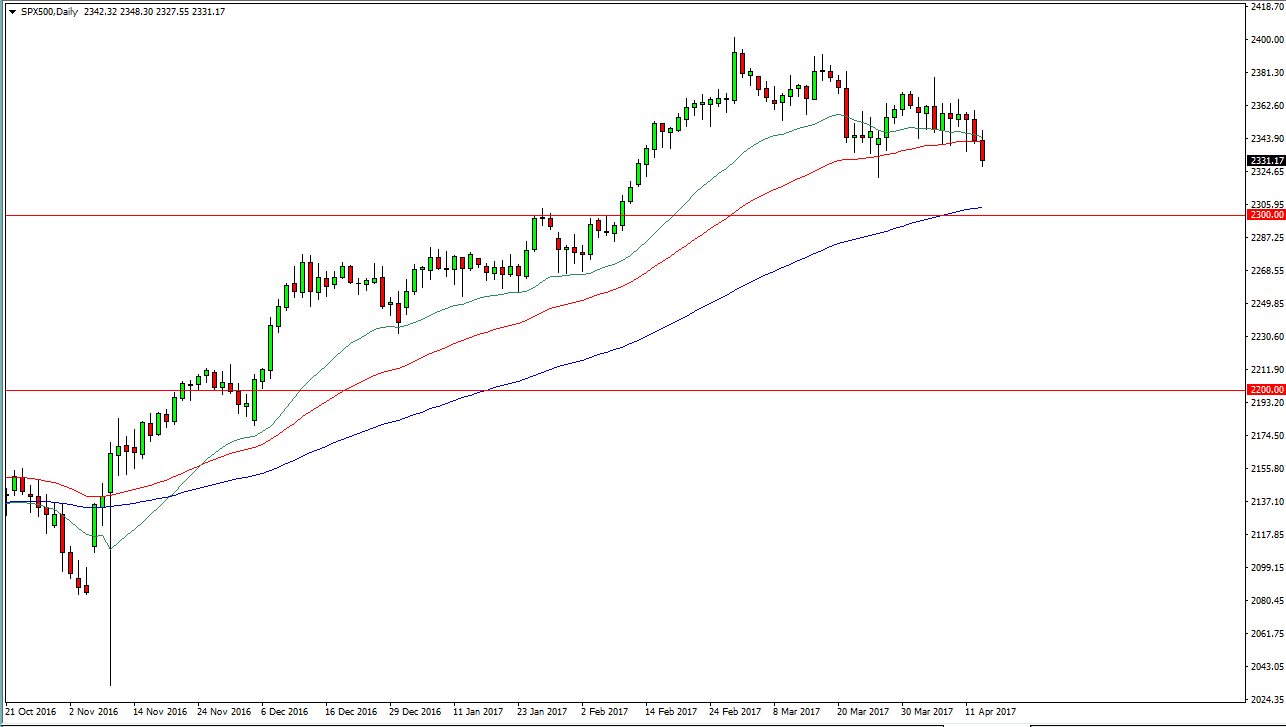

S&P 500

The S&P 500 initially tried to rally on Thursday, but then turned around and fell significantly. Friday of course was Good Friday, and that of course means that the market was closed. Nonetheless, looks as if we are getting ready to drop from here, perhaps reaching towards the 2300 level. Longer-term, and on the weekly chart, I can see that there is a bullish flag so unless we break below the 2300 level, I don’t think that selling is going to be prudent. We are heading into earnings season, and that of course means that we could get fuel for a move higher from here. I am still very bullish, but I’m waiting for a bullish candle or a supportive candle at the very least on the daily chart to start buying again.

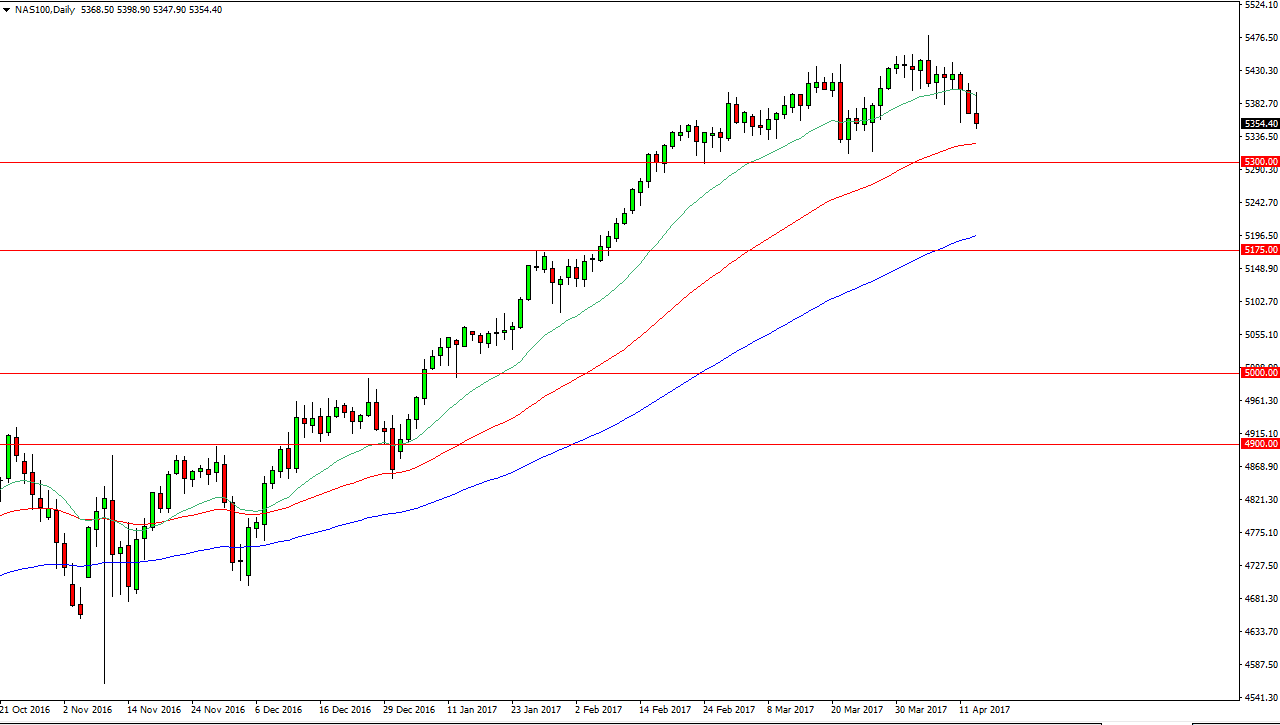

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day on Thursday, but turned around to form a shooting star. Ultimately, I think we are going to go looking for support below, near the 5300 level for that matter. I think that the 50-day exponential moving average is going to offer support, and I also believe that given enough time the buyers will return. The NASDAQ 100 has been extraordinarily strong over the last several months, so this pullback is not much of a surprise and quite frankly it’s healthy. Waiting for a daily supportive candle or an impulsive green candle on the daily chart is how I plan to trade this market, and I have no interest in trying to short it. I believe that the NASDAQ 100 will continue to lead the rest of the US stock markets higher, especially considering that the index has lead the rest of the US indices and by extension the world over the last several months. I am extraordinarily bullish in this market but realized that the breather is needed.