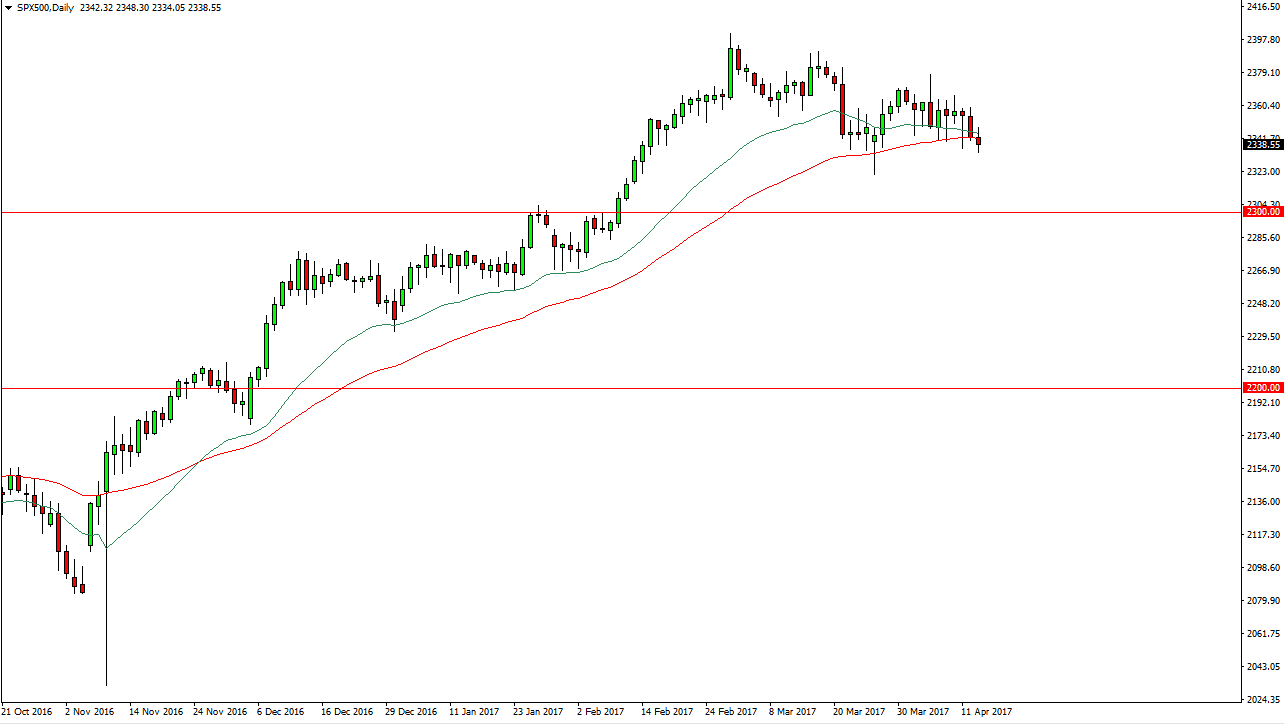

S&P 500

The S&P 500 had a slightly negative session on Thursday as traders closed out the week in America. With today being Good Friday, the only trading that you will have access to will be the CFD markets. However, when I do see on this chart is a significant amount of support just below in a slightly negative market. I think we’re going to gradually drift a little bit lower, until we can find some type of massive support. Ultimately, I think that the buyers will return but right now it does not look like they are ready to do so. Because of this, I am very cautious about buying but certainly don’t want to short this market.

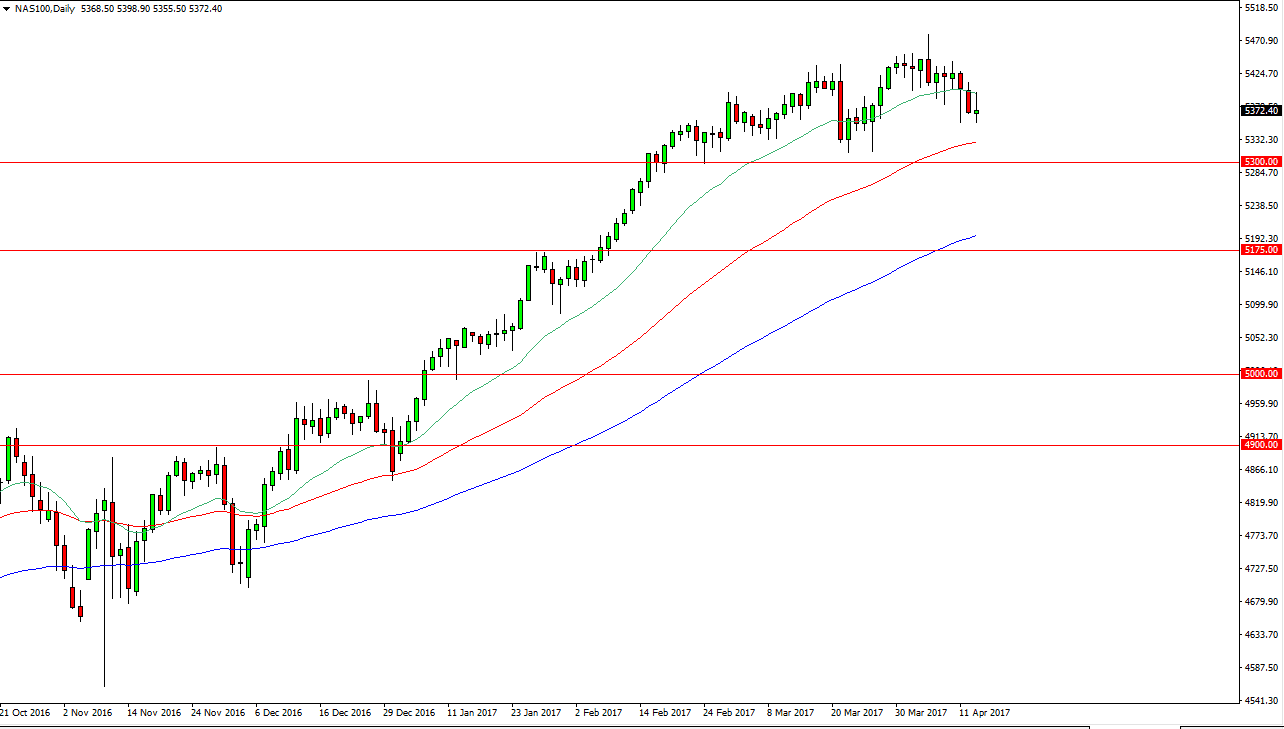

NASDAQ 100

The NASDAQ 100 looks a little bit more primed for falling than the S&P 500 shortly. I believe that the 5300 level below will more than likely offer support anyway, but I think we may have to test that area again. Alternately, if we can break above the top of the shooting star from the session on Thursday, that would be a bullish sign and could have the buyers return. Until that happens, I must assume that the NASDAQ 100 is going to drift slowly to the downside, as we grind sideways and look for buyers. I don’t think that it’s going to be a significant move, I just think that the market is taking a break overall as the news flow is in a “wait-and-see” type of scenario, and of course earnings season is just starting. Obviously that will influence the markets, but right now it appears that the index itself isn’t ready to go anywhere anytime soon.