S&P 500

The S&P 500 fell during the day on Wednesday, testing the 50-day exponential moving average. Because of this, I believe that we will see volatility, but as the 20-day moving average is approaching the 50-day moving average, I believe that we may see continued weakness overall. I think longer-term this is a consolidation area that will prove to be a nice buying opportunity, but if you have any leverage attached to your position at all, this could be dangerous. I still believe that the 2300 level below is the “floor” in this market, and as long as we stay above there I have no interest in shorting. I still have a longer-term target of 2400 in this market.

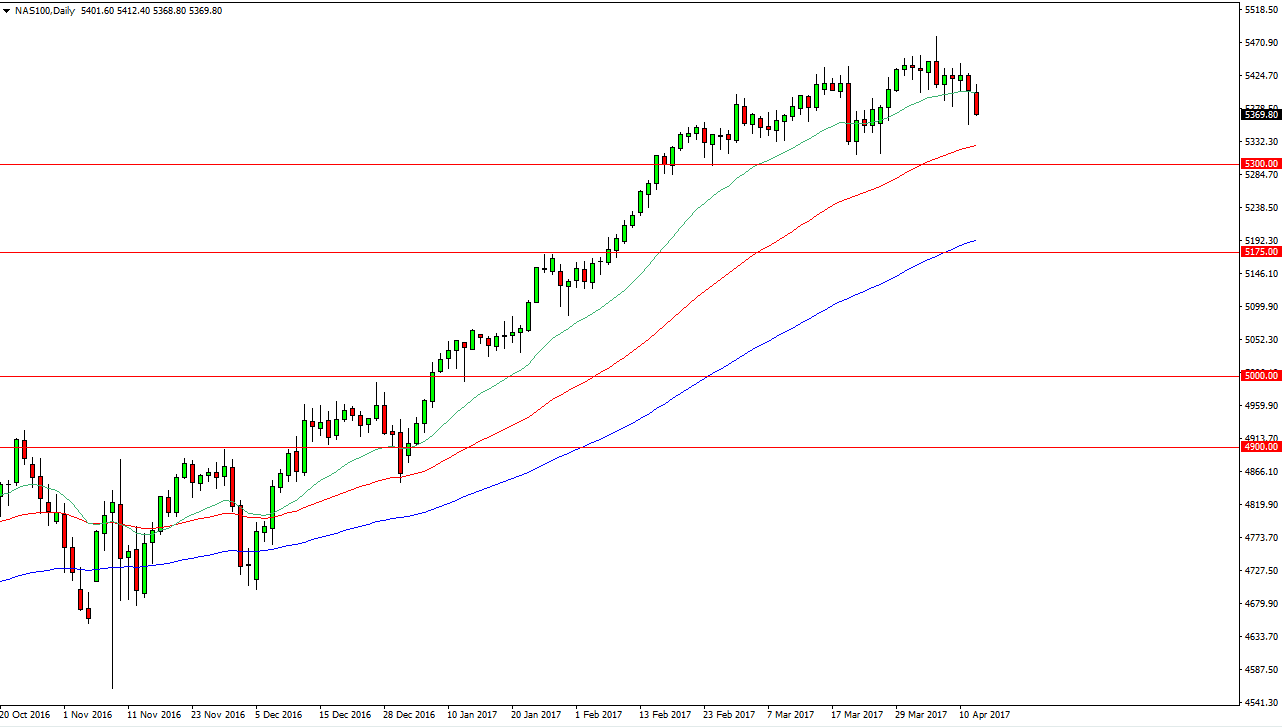

NASDAQ 100

The NASDAQ 100 got beat up during the day as well, as we are testing the bottom of the hammer from the previous session. Because of this, I feel that the market is going to find buyers below, probably near the red 50-day exponential moving average on the chart. I also recognize that the 5300 level is massively supportive, so with that in mind, I am a buyer on dips to show signs of support. Unfortunately, the candle for the session on Wednesday did not look supportive, and I suspect that we may have a little farther to fall. If that’s the case, you should be able to pick up “value” at lower levels. I think the market will reach towards the 5500 level above, where it would find a significant amount of psychological resistance.

Having said that, we are very much in an uptrend, so I am not worried about the psychological resistance being an issue. I honestly believe that we will sliced through their like it wasn’t even a big deal, but it may take a couple of attempts. With this being the case, I remain bullish but cautious.