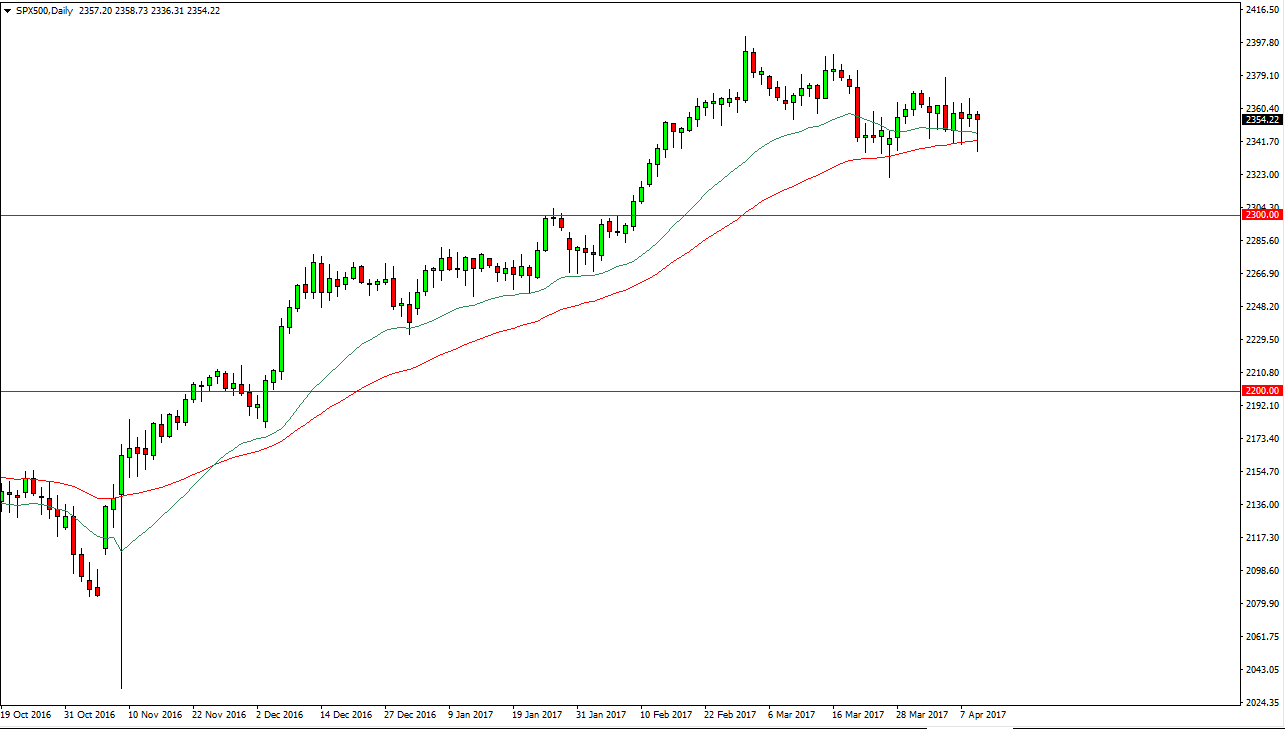

S&P 500

The S&P 500 initially fell rather significantly during the day on Tuesday, but found enough support to turn things around and form a massive hammer. This is a very bullish sign and it shows just how much in the way of underlying support there is for this market. Ultimately, it looks as if the market will continue to go higher, but I preferred to “buy on the dips” as this market seems to react positively to pullbacks as value. Ultimately, I still believe that we are going to try to reach the 2400 level above, but it will be choppy between now and then. I believe the absolute “bottom” is near the 2300 level.

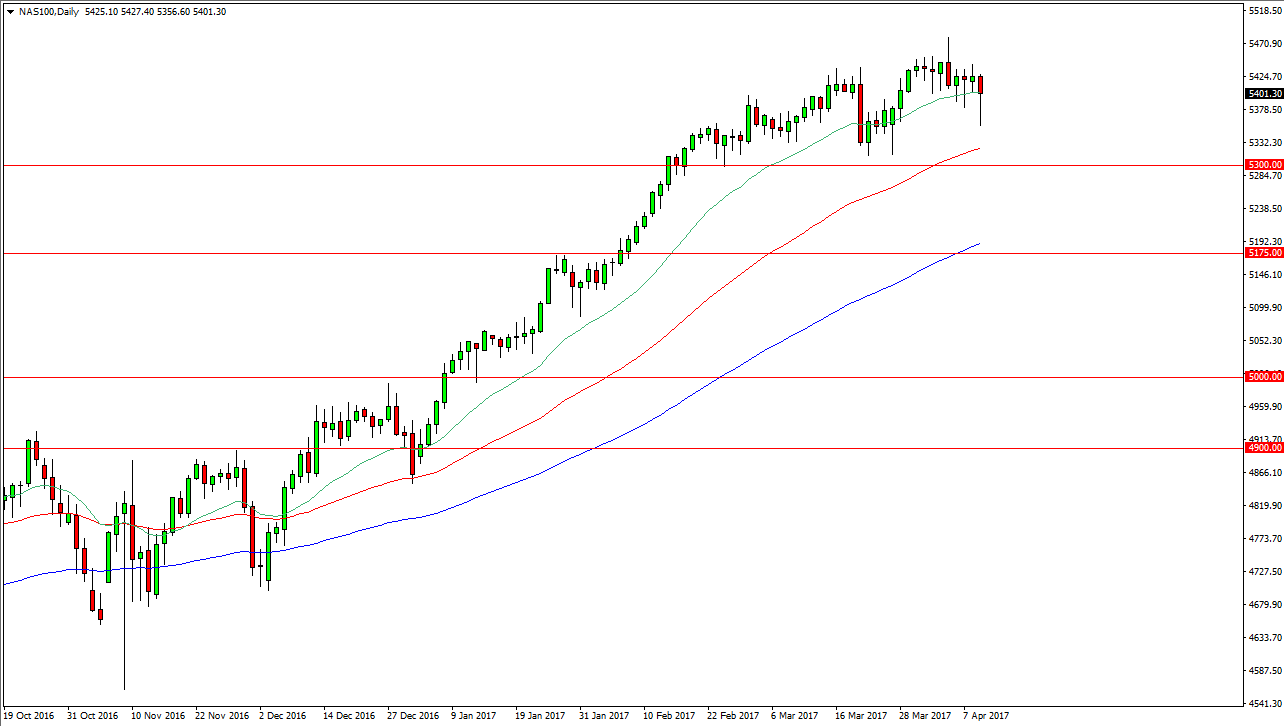

NASDAQ 100

The NASDAQ 100 fell during the session as well, but turned around to form a massive hammer. This is a very bullish sign and it appears that closing at the 20-day exponential moving average only tells us that we are going to continue to see more of the same. I still have a target of 5500 above, and I believe the dips will continue to offer value. I believe most traders feel like this as well, so it makes sense that the markets will find buyers every time we pull back. I have no interest in shorting and I believe that the 5300 level below is the “bottom” of the market. I believe that we will not only reach towards the 5500 level, but we will more than likely breakout above there. I have no interest in shorting, this has been a leader of US indices for some time now, and by extension has been a leader of world indices. It is not until we break significantly below the 5300 level that I would remotely consider shorting this market. I recognize that the 5500 level will be massively resistive, but I believe it’s only psychological resistance.