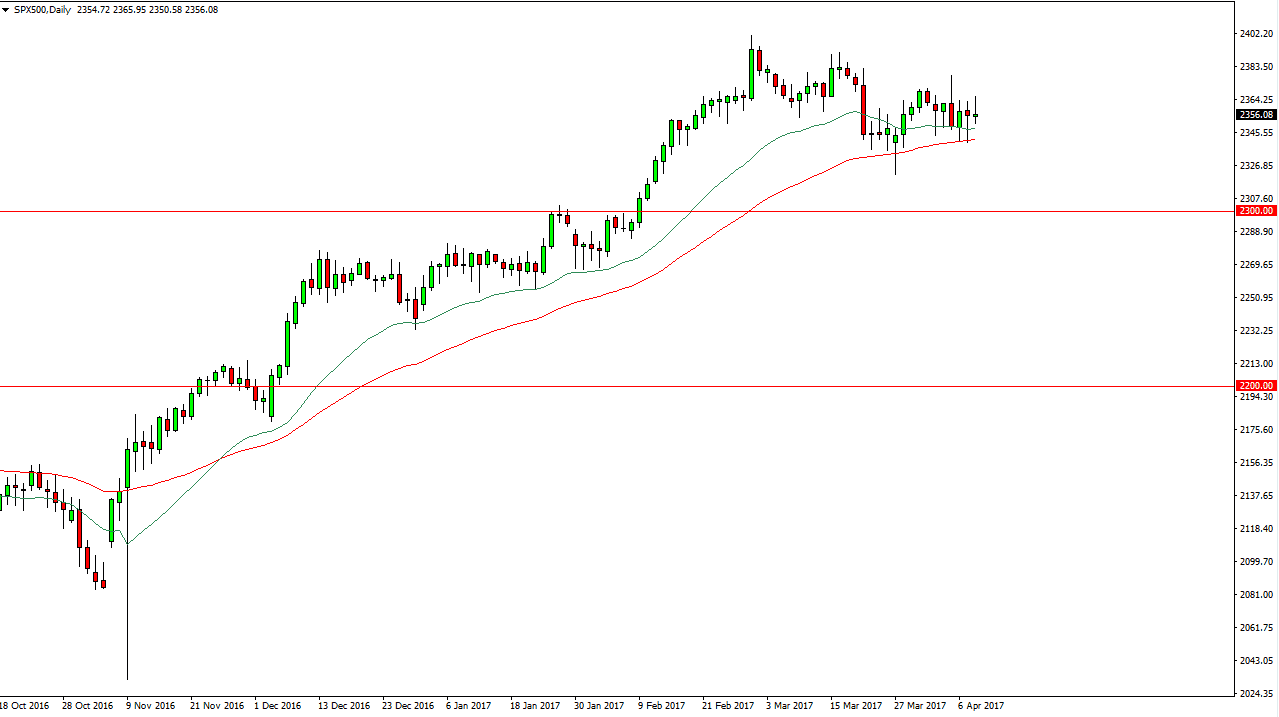

S&P 500

The S&P 500 went back and forth during the day on Monday as we continue to chop sideways. I still think there’s plenty of support below, so I don’t have any interest in shorting but I also recognize that it is going to be difficult for the market to go higher in the short term. I believe that the rent 50-day exponential moving average on the chart continues to offer dynamic support, and eventually the buyers will return and push the market higher. I believe in “buy on dips”, but I also believe in getting out of the market rather quickly. This is a short-term trading environment that we find ourselves and as we consolidate and trying to pick up enough momentum to go higher over the longer term.

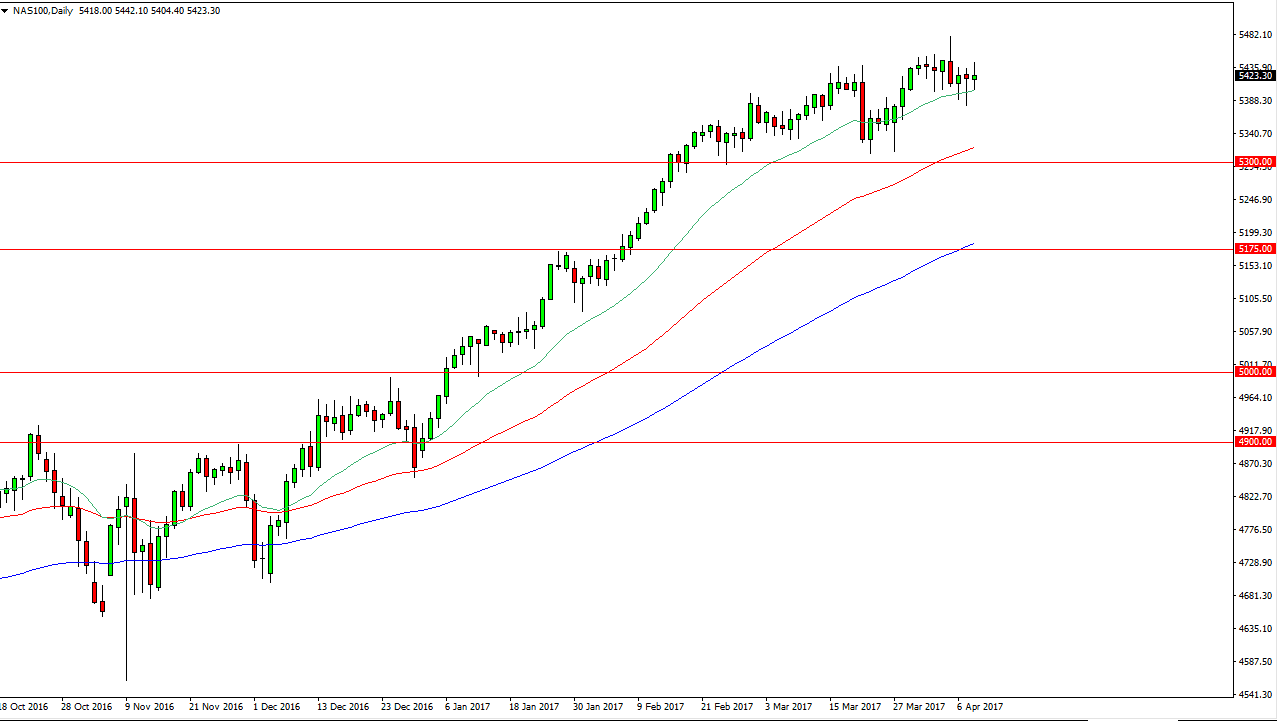

NASDAQ 100

The NASDAQ 100 went back and forth during the day as well, bouncing off the 20-day exponential moving average. The neutral candle suggests that the market is ready to go sideways and the short-term, but I do recognize that every time we pull back, buyers will return to this market. I believe that the “buy on the dips” mentality prevails over in this market as well, and that the 5300-level underneath is massively supportive. I also believe that we will eventually reach towards the 5500 level, so given enough time it is more than likely going to be a market that finds bullish pressure.

The NASDAQ 100 has seen quite a bit of bullish pressure over the last several months, and has lead the rest of the US indices higher. I believe this will continue to be the case, and by extension continue to be the case with world indices as well as the NASDAQ 100 has performed so strongly. Going forward, I have no interest in shorting this market as we continue to see buyers jumping in.