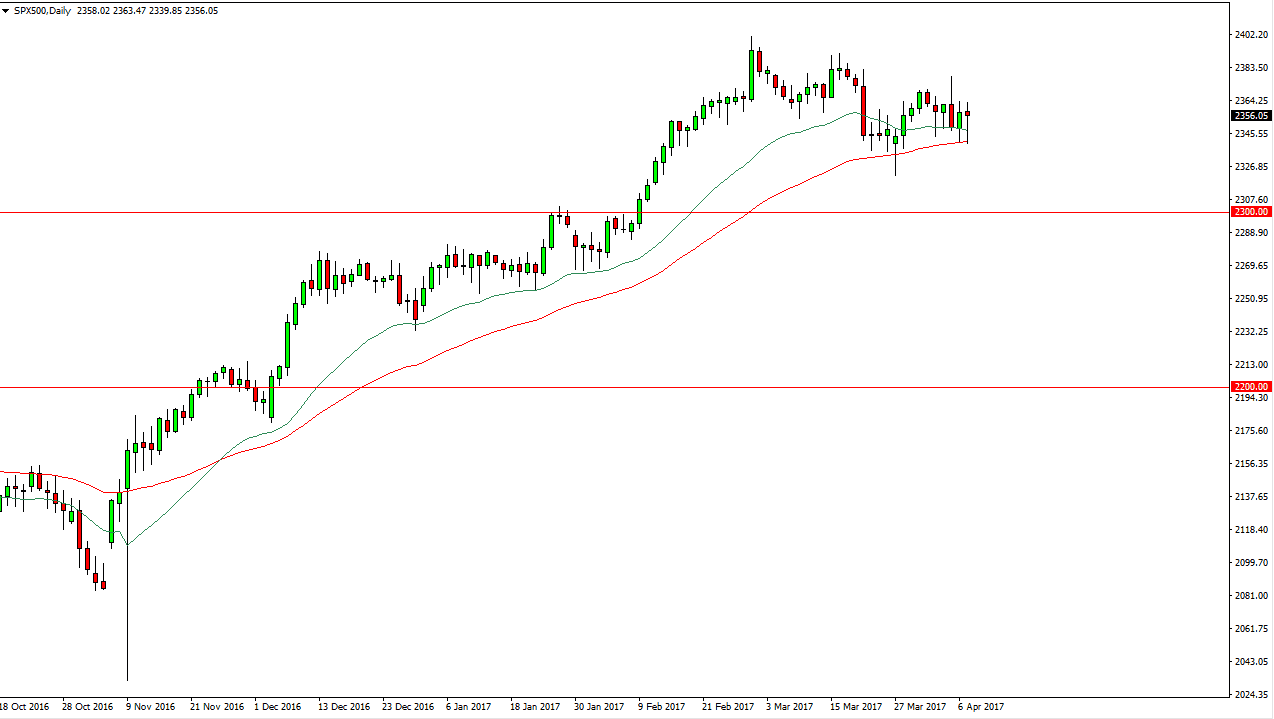

S&P 500

The S&P 500 initially fell on Friday as we received a very poor jobs report, but we found enough support at the 50-day exponential moving average to turn things around and form a hammer. The hammer of course is a very bullish candle stick, so I think this just shows how much pressure there really is underneath to push this market higher. Because of this, I believe that the S&P 500 will continue to find buyers and reach to higher levels. The 2400 level would be the next target, but longer-term I believe that the markets will be looking for the 2500 level. I have no interest in shorting, US equities have proven to be very resilient.

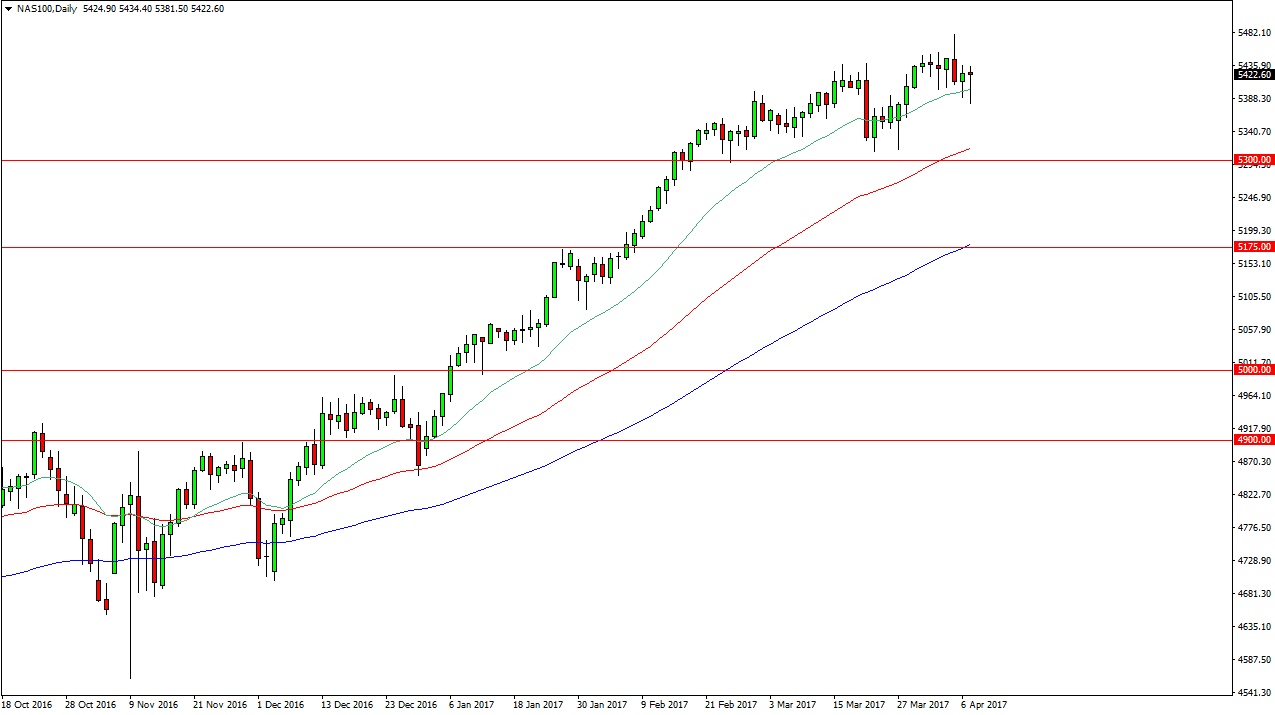

NASDAQ 100

The NASDAQ 100 initially fell as well, breaking below the 20-day exponential moving average. This moving average has been a very reliable support level recently, so traders jump back in to turn this market around to form a hammer. Because of this, the market looks as if it will continue to find buyers every time we dip, and I think the 5500 level is the initial target. I think that this is a market that can only be bought, and the 50-day exponential moving average being near the 2300 level shows that it could be a floor in the market. Ultimately, this market will continue to be a “buy on the dips” situation for short-term traders, and I believe that it will continue to be very choppy in general. The NASDAQ 100 has lead the rest of the US indices higher, and I think it will continue to do so.

The 5500 level above will more than likely be a significant psychological resistance, but I believe that eventually we will break out above there and continue to go much higher. I am “buy only.”