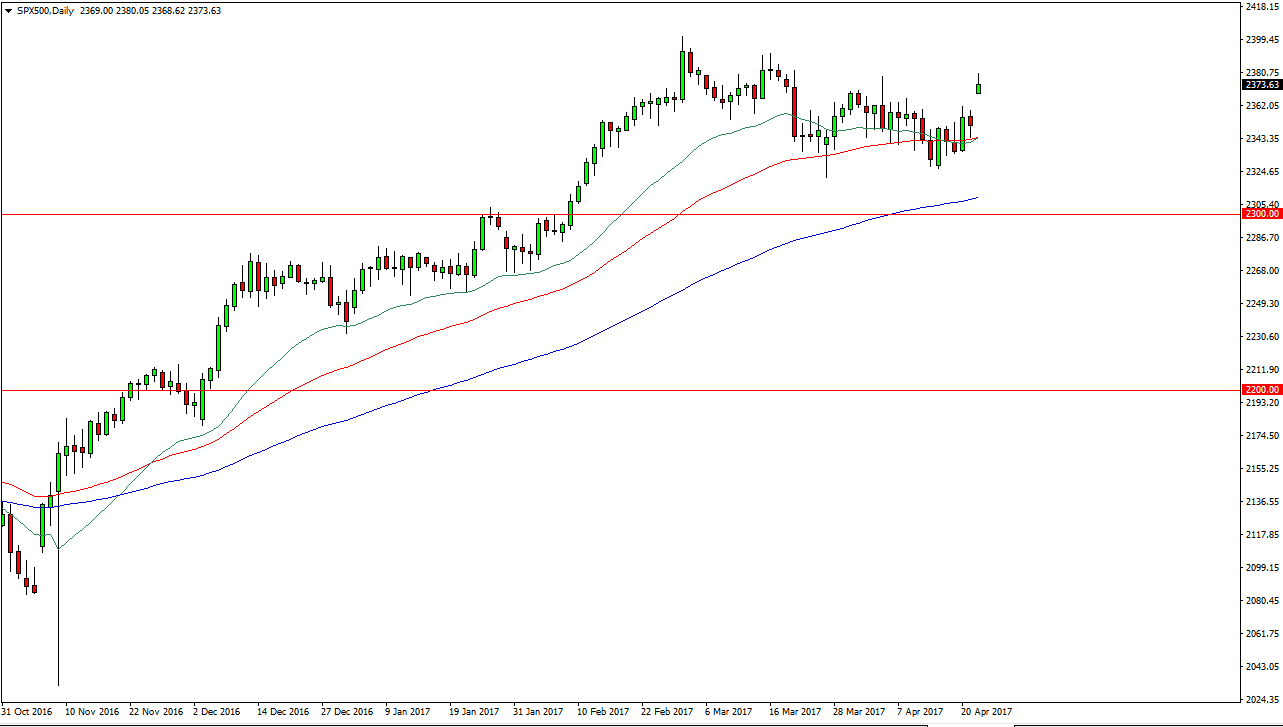

S&P 500

The S&P 500 gapped higher at the open on Monday, as word got out that the French election went in more of a centrist attitude. Because of this, it’s likely that we will pull back a little bit and fill the gap, but at that point I would expect to see buyers return. Alternately, if we broke above the top of the candle for the session, I would expect buyers to push this market towards the 2400 level. I have been bullish of the S&P 500 for some time, and that has not changed. I believe that we will continue to see buyers on dips, and it’s only a matter of time before reach towards my longer-term target of 2500. I have no interest in shorting.

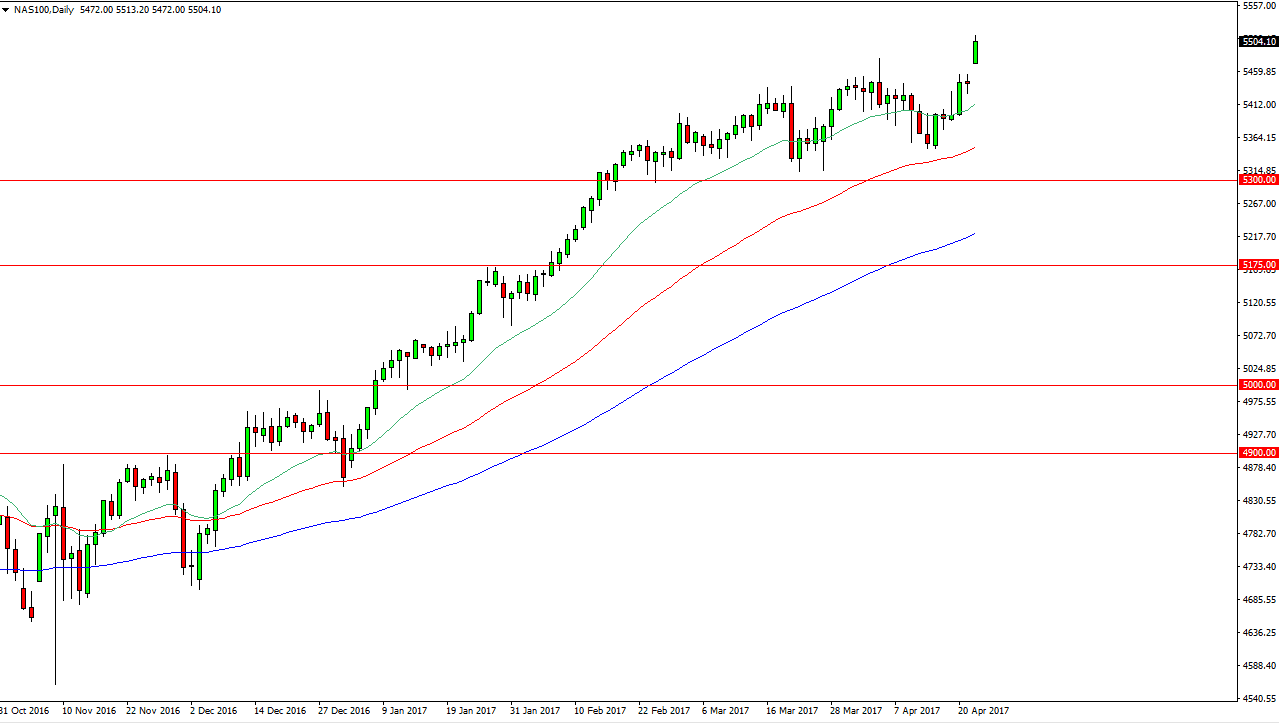

NASDAQ 100

The NASDAQ 100 also gapped higher but unlike the S&P 500 it has been a leader for some time. Now that we are above the 5500 level, I believe that the market continues to reach to the upside and will continue to make fresh, new highs. I believe the pullbacks continue to be buying opportunities in a market that is extraordinarily strong. The 5300 level below is the absolute floor in this market, but I believe that the floor could be moving to the upside from here and perhaps to the 5400 level soon. I think once we clear the 5500 level, it could even slide up to that level.

Pullbacks in the future should continue to attract buyers, and I believe that will be used for entries going forward. Short-term “buying on the dips” could be the way forward, and I have no interest in selling. I believe that the NASDAQ 100 will not only lead the rest the US indices higher, but should continue to lead the rest of the world’s indices higher as well.