Gold prices rose $12.03 on Wednesday as the dollar weakened after U.S. President Donald Trump said the dollar was “getting too strong” and he would prefer the Fed keep interest rates low. The XAU/USD pair extended its gains as expected after the resistance in the $1277.35-1236 area was broken, and traded as high as $1287.87 an ounce. It seems that investors, who are seeking to hedge against declines in the major stock markets linked to rising tensions over U.S. relations with Russia and North Korea, will continue to park their cash in gold.

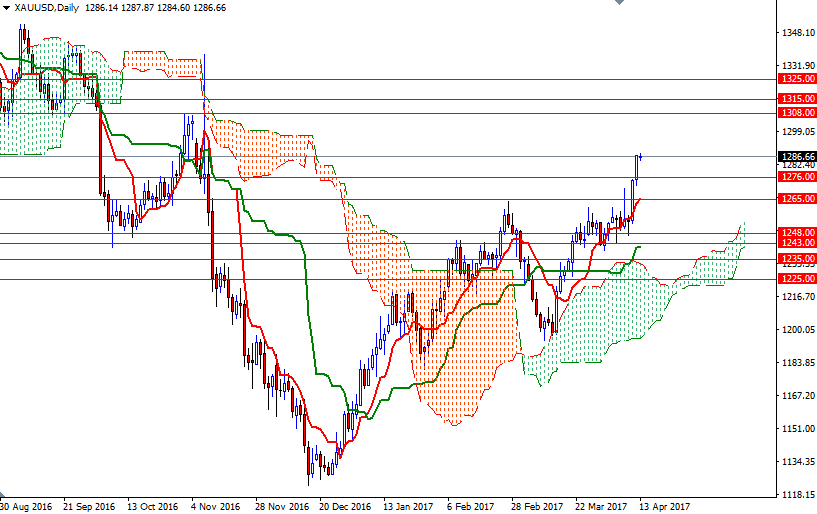

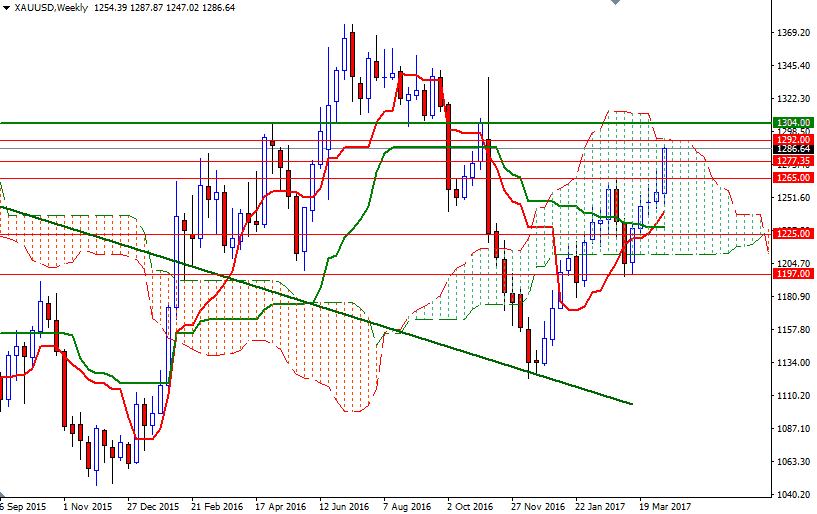

The market is trading above the Ichimoku clouds on the daily and the 4-hourly charts. In addition to that, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on almost all time frames. All these suggest that the bulls have the medium-term technical advantage.

The first hurdle gold needs to jump is located at around the 1292 level, which happens to be the top of the weekly cloud. If the market breaks through this tough barrier, then we may head towards the 1308/4 region - a solid technical resistance on the weekly chart. However, a failure to climb above 1292 could lead to some profit taking and drag prices back to the 1277.35-1276 zone. If XAU/USD dives below 1276, then the 1272/69 area might be the next port of call.