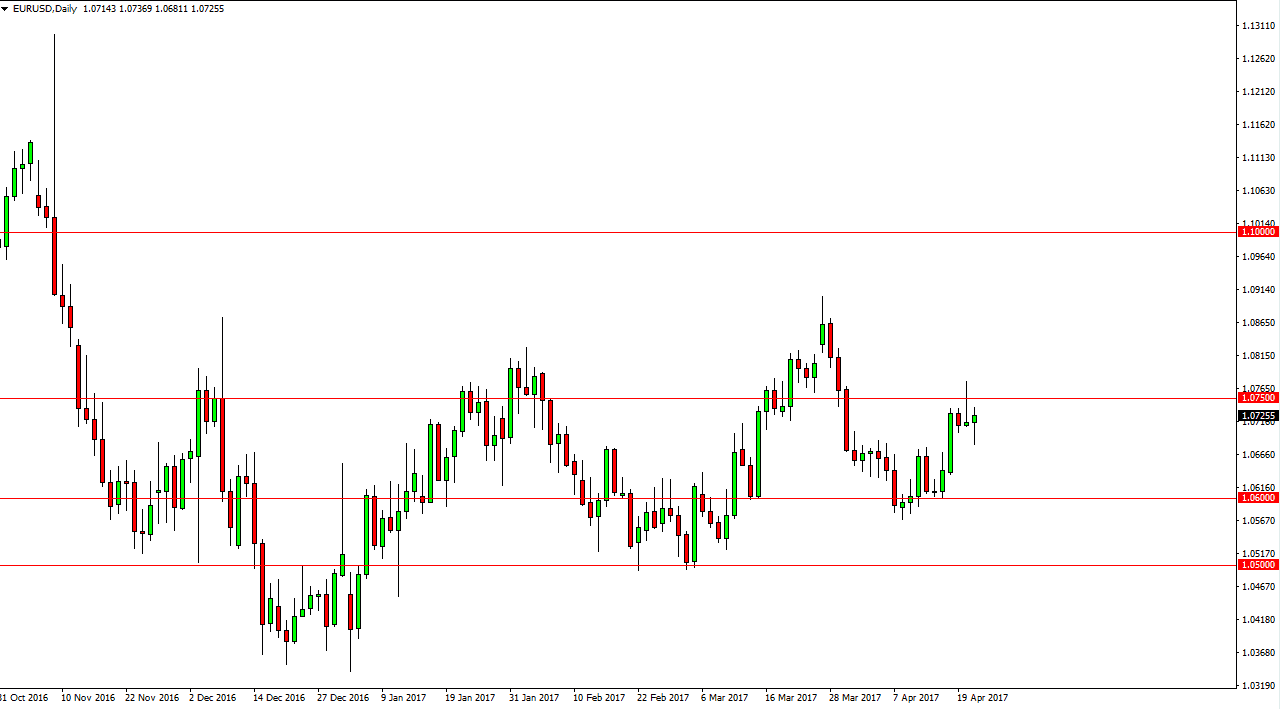

EUR/USD

The EUR/USD pair initially fell during the day on Friday, but turned around to form a hammer which is a bullish sign. However, we had a shooting star from the previous session, so this shows quite a bit of indecision. I believe that the market will continue to be very volatile because of the French elections and of course all the other moving pieces. However, if we can break above the top of the shooting star from the Thursday session, the market should then be able to go to the 1.09 level. A breakdown below the bottom of the hammer would be negative, perhaps sending the market down to the 1.06 handle. Because of this, it’s likely that the market will continue to be volatile regardless what happens.

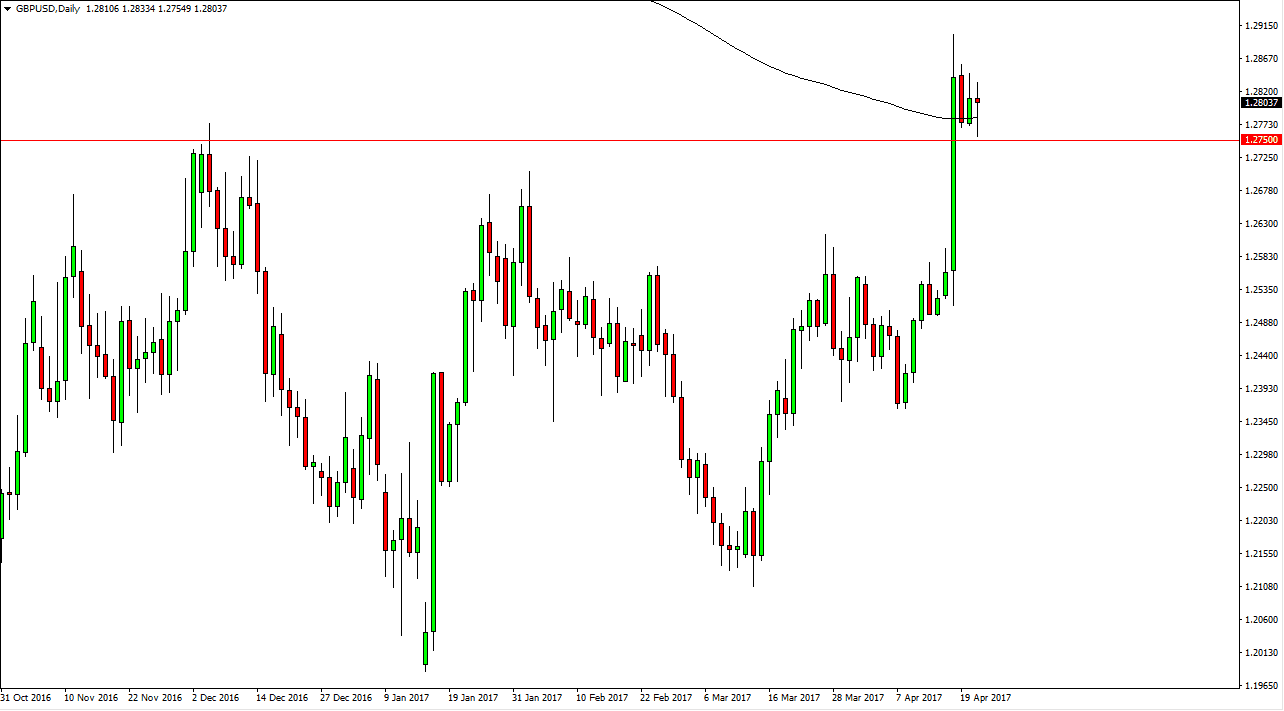

GBP/USD

The GBP/USD pair initially fell during the day on Friday, but found support at the previously resistive 1.2750 level. That being the case, the hammer suggests that we are going to continue to go higher, and the fact that we are above the 200-day simple moving average suggests that perhaps the buyers are going to get involved. Ultimately, if we can break above the top of the candle and more importantly the impulsive candle from last week, the market should continue to go much higher. I currently believe that we will reach towards the 1.3450 level above, which is the top of the consolidation area from several months ago. I believe that the British pound has quite a bit of bullish pressure underneath it, and we should continue to go higher.

I have no interest in shorting this market unless of course we broke down below the impulsive candle from early in the week, something that doesn’t seem very likely anytime soon. Because of this, I remain a “long only” trader of this pair.