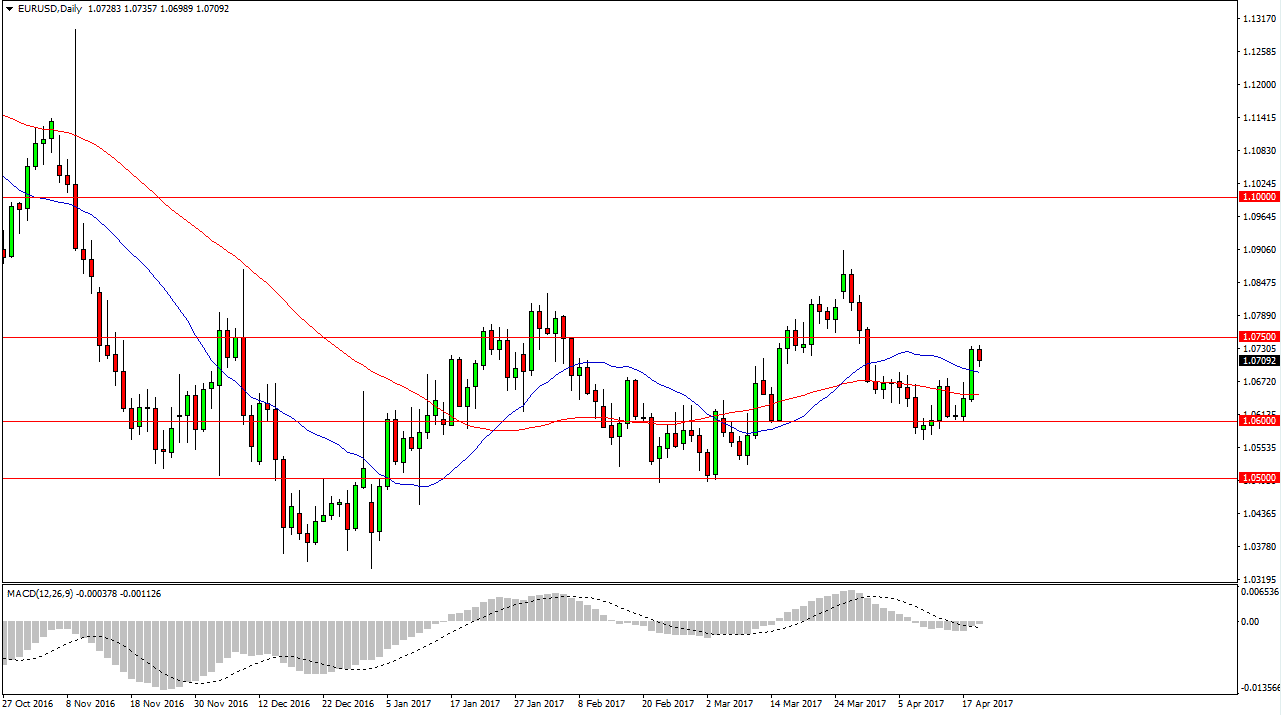

EUR/USD

The EUR/USD pair fell during the day on Wednesday, as the market reaches towards the 1.07 level. Ultimately, this is a market that I think will see buyers enter the market every time we pull back, as we have seen since December 2016. I have no interest in selling this market, least not until we break below the 1.06 handle, which would be a violation of the channel that we have seen since the end of last year. I believe that the market will continue to be choppy, but quite frankly I favor the upside as we continue to see a lot of stubbornness when it comes to the Euro. If we did breakdown, the market could find itself reaching towards the 1.05 level, which has been support in the past.

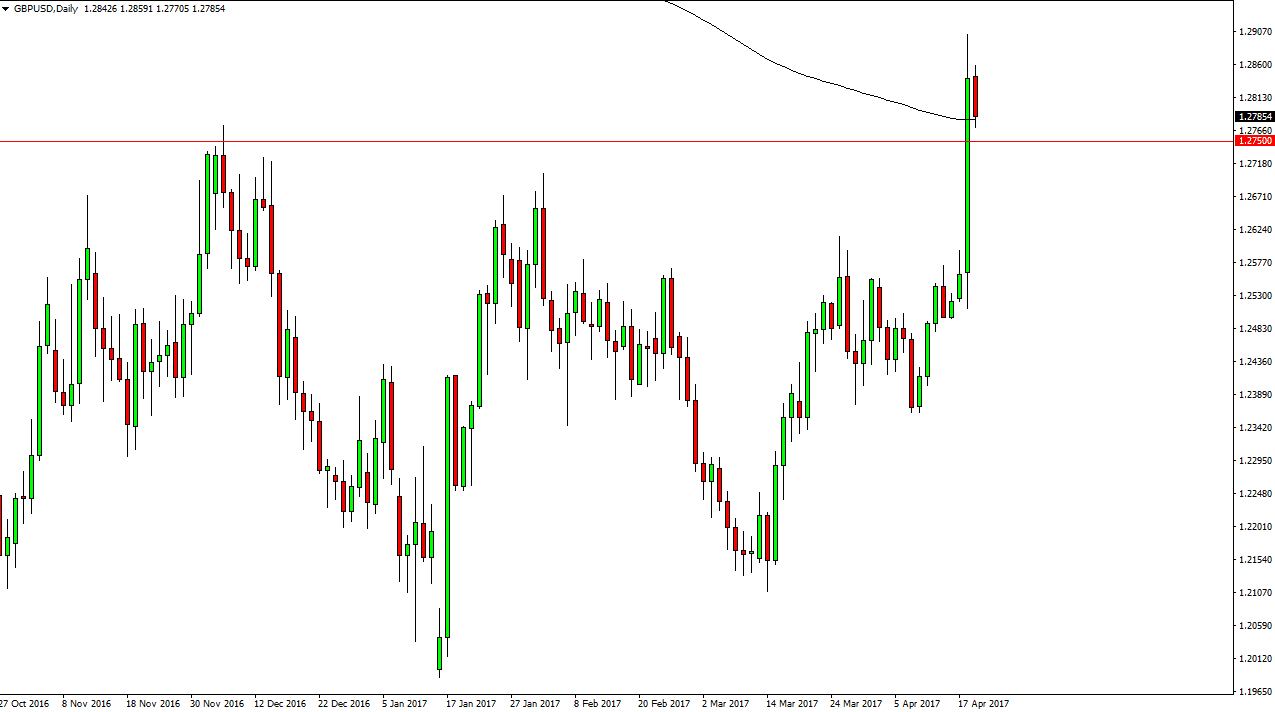

GBP/USD

The British pound fell during the day on Wednesday, after an explosive moved to the upside on Tuesday. However, later in the US session the 200-exponential moving average seems to be attracting significant buying pressure, and the 1.2750 level which had been so resistive in the past should now be support. I have no interest in shorting this market, and I believe that pullbacks will continue to offer value the traders will be looking for. I have a longer-term target of 1.3450 above, and believe that we will eventually get there. I don’t know that it’s going to be a quick move, but I certainly think that it will become a “buy on the dips” type of situation.

The British pound should continue to benefit from short covering, so that of course keeps the market going higher. After the impulsive candle that we have made for the Tuesday session, I believe that it shows enough impulsivity to believe that the market continues to go higher over the longer term. I have no interest in shorting out.