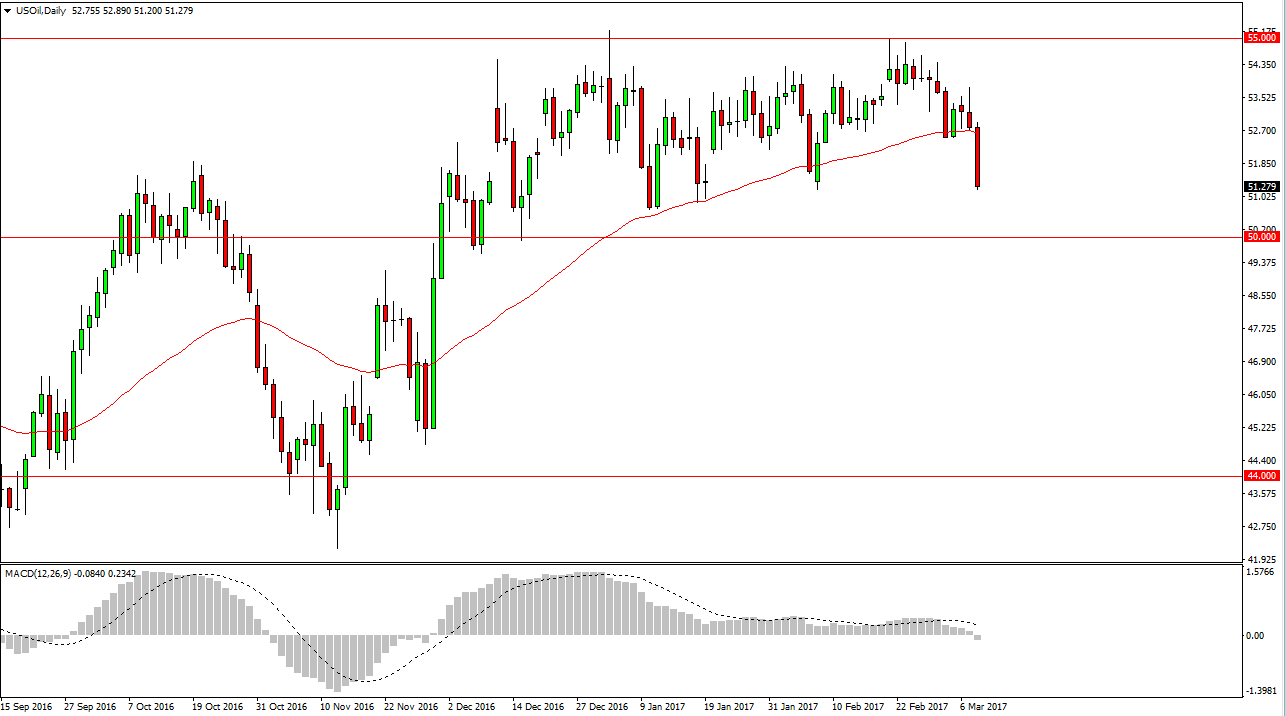

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Wednesday, as we have sliced below the 50-day exponential moving average. Furthermore, it looks as if we are going to reach towards the $50 level, and the build of over 8 million barrels announced at the Crude Oil Inventories announcement suggests that the market may finally be coming to terms with the fact that the oversupply is a very real issue, and that OPEC production cuts are not going to fix the issue. I believe that when we rally, exhaustive candle’s will. On short-term charts that you can start selling again. Once we break below the $50 level, the market should pick up momentum to the downside.

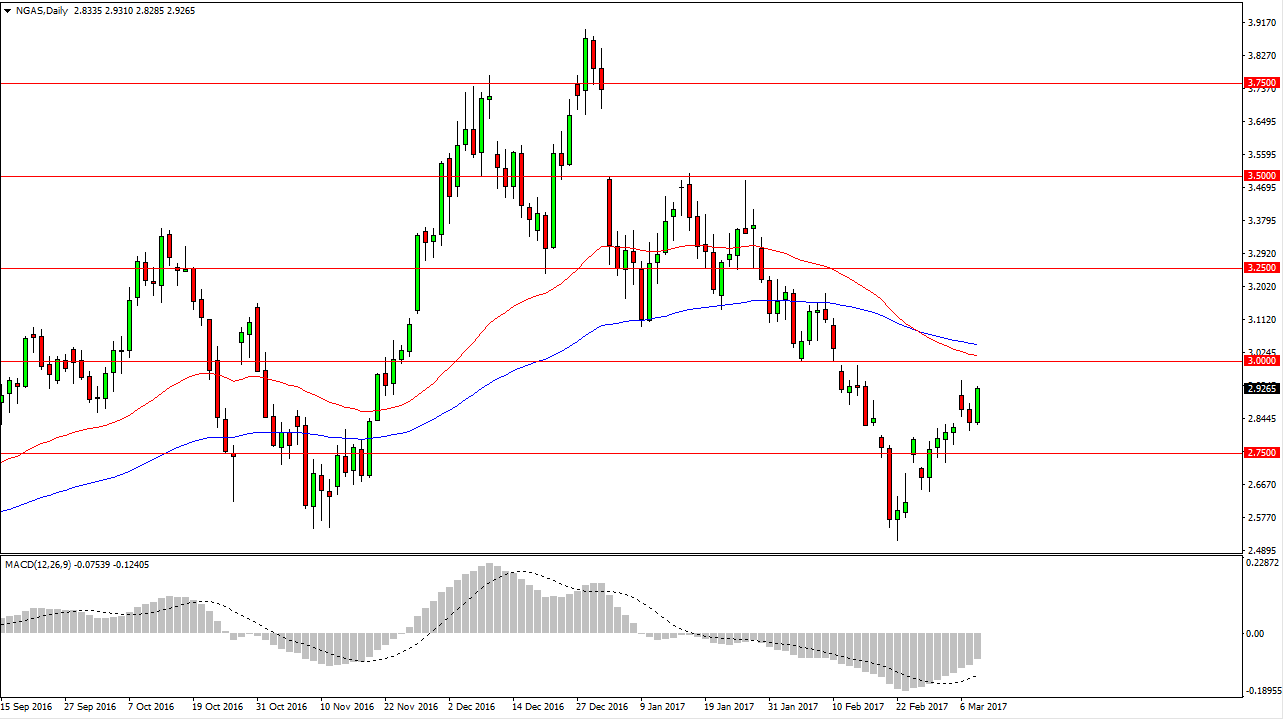

Natural Gas

Natural gas markets quite often move in the opposite direction of crude oil markets, so it’s not a huge surprise that we bounced a bit. However, I believe that the $3.00 level above continues to offer resistance, so I’m waiting to see whether we form and exhaustive candle in that region to start taking advantage of. If we do, I have no interest in finding a, and will start selling. The 50 and the 100-day exponential moving averages are just above the $3.00 level, and that adds even more bearish pressure. Given enough time, I believe that this market reaches towards the $2.50 level, but it might take some time to get there. Rallies continue to be selling opportunities, and I have no interest in going long.

Eventually, we should breakdown below the 2.50 level, and that should send this market much lower, perhaps down to the $2.25 level. I think that the market will then continue to even go lower. I have no interest in buying this market, I believe that natural gas oversupply continues to be an issue, but this may have been a bit of a reaction to the oil market more than anything else.