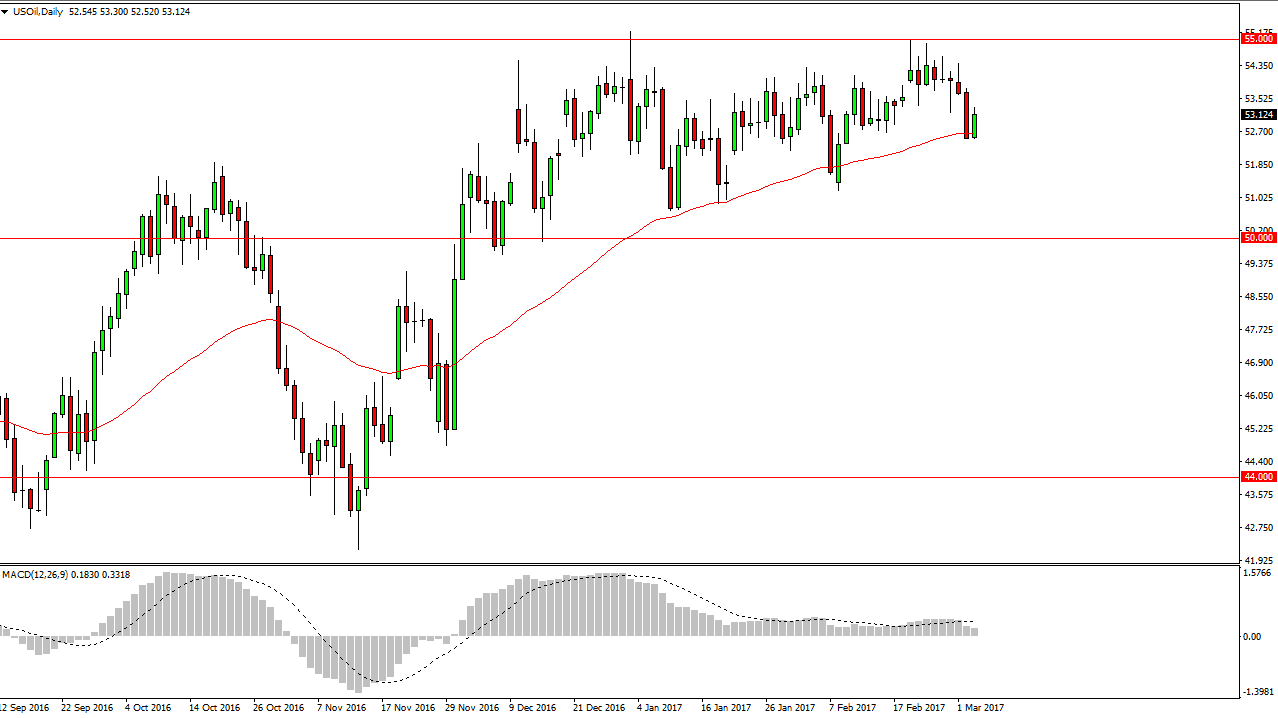

WTI Crude Oil

The WTI Crude Oil market bounced a bit during the day on Friday, as the 50-day exponential moving average has offered enough support to give the market afloat. Given enough time, I think that the market will break above the top of the range and reach towards the $54.50 level again. The $55 level above should continue to be resistive, so as we approach that area I think the sellers will come back into the market. Alternately, if we can break down below the bottom of the range for the Thursday session, I believe that the market will reach towards the $51 level. The $50 level should be supportive as well, but if we break down below there the market will completely fall apart.

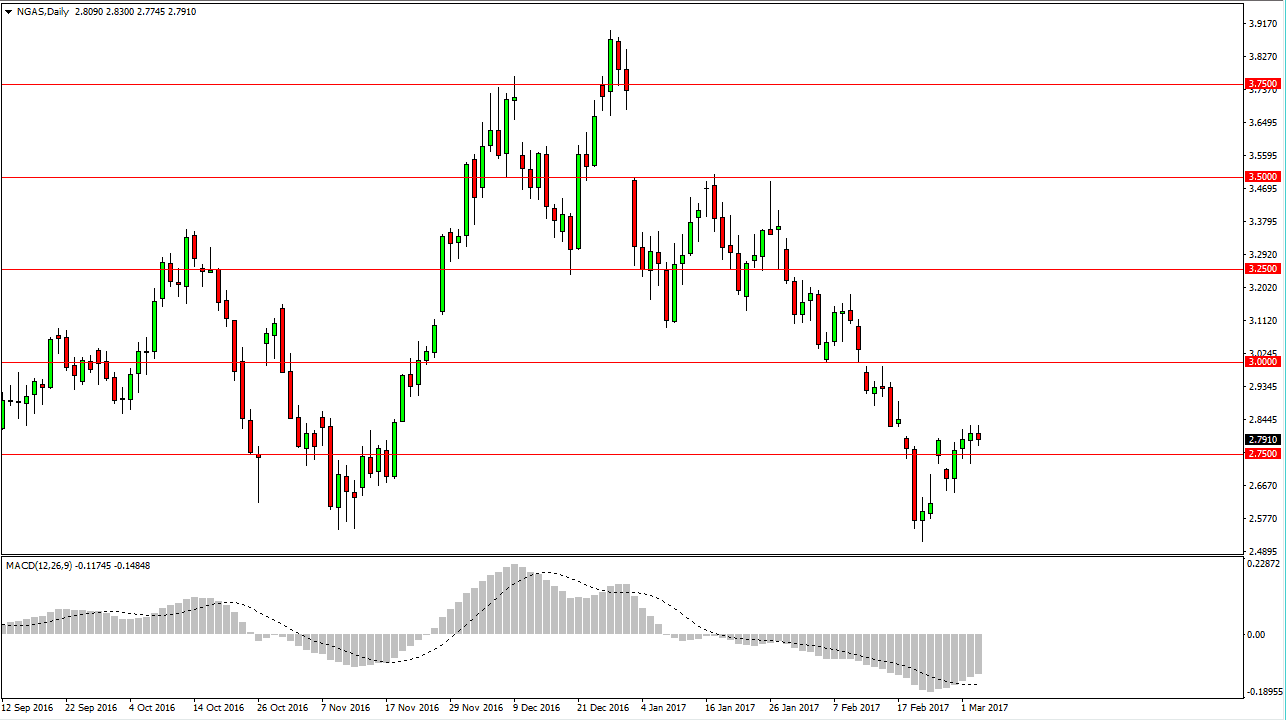

Natural Gas

The natural gas markets went back and forth on Friday, as the $2.75 level should continue to offer support. If we can break down below there, the market will then drop towards the $2.50 level, which is the bottom. On the other hand, if we rally from here I believe that the sellers will return somewhere just below the $3 level which of course is a large significant barrier. The longer-term downtrend should continue, the warmer temperatures in the United States seem to be a major driver of this market, and I believe that we will test the lows again. Once we break down below the $2.50 level the market should then reach towards the $2.25 level underneath. I have no interest in buying natural gas, it is a commodity that has all the fundamentals working against it. Not only do we have a serious lack of demand, we have a massive oversupply currently.

Short-term rally should offer short-term selling opportunities, I don’t have a scenario in which I am willing to buy this commodity.