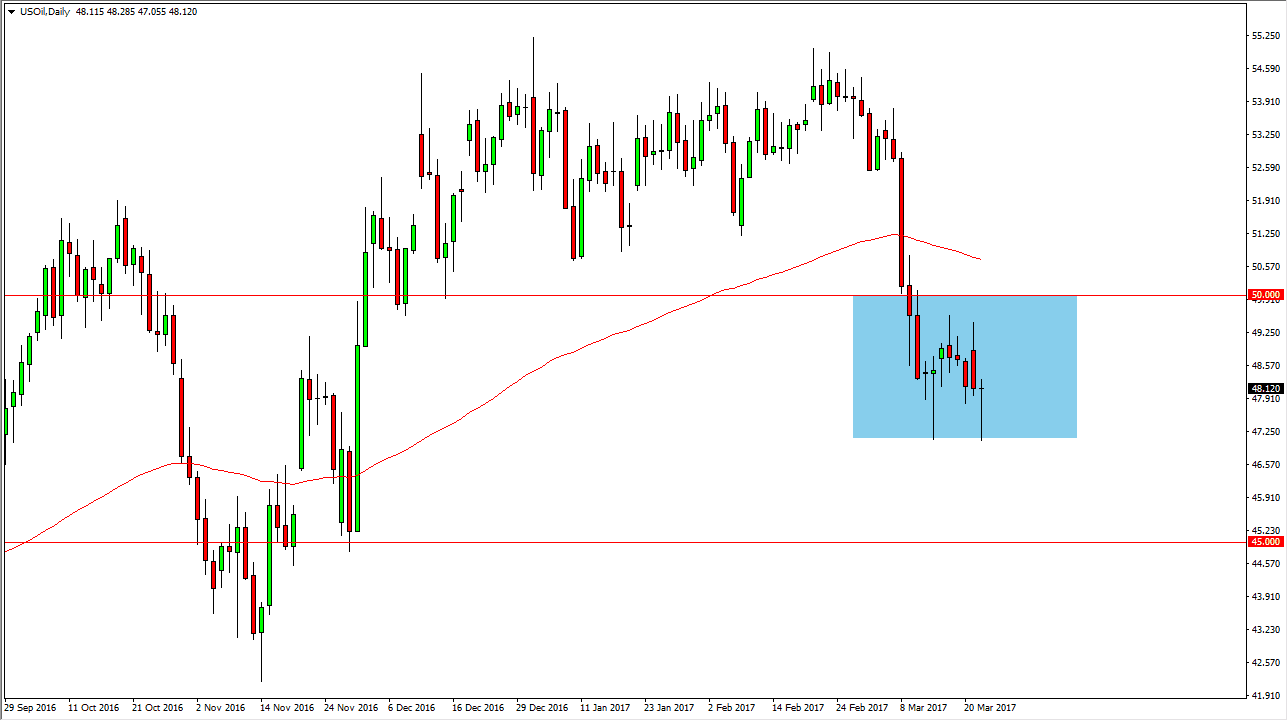

WTI Crude Oil

The WTI Crude Oil market fell significantly during the session on Wednesday but found enough support near the $47.25 level to turn around and form a hammer. Because of this, I think that we are simply going to continue to consolidate as we have been doing over the last couple of weeks. The $50 level above it should be resistance, and an exhaustive candle near that area would have me selling. Alternately, if we can break down below the bottom of the hammer for the session on Wednesday, the market should then drop to the $45 level I’m still bearish on crude oil as oversupply continues to be an issue.

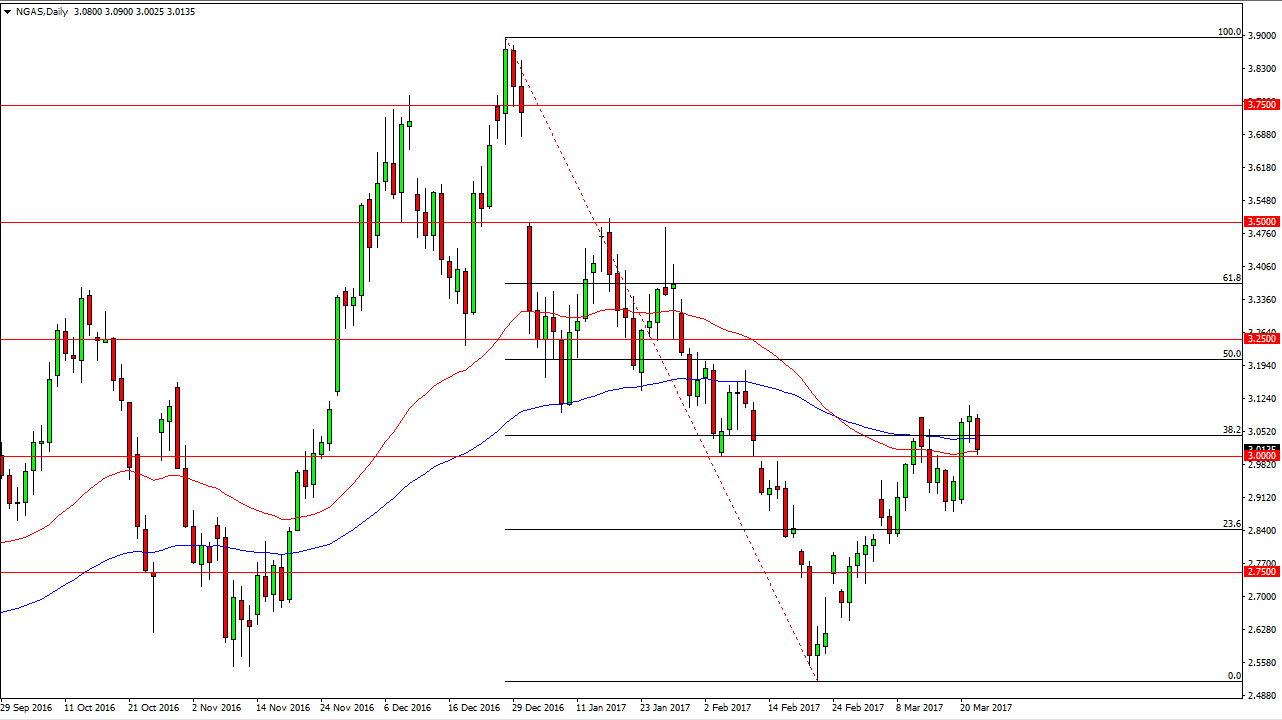

Natural Gas

Natural gas markets fell on Wednesday, testing the $3 level and the 50-day exponential moving average. Because of this, it’s likely that the bearish pressure will pick up, and if we can break down below the big figure, I think that the market will reach towards the $2.90 level and then down to the $2.75 handle. The markets certainly have an oversupply issue currently, and it seems that the markets are starting to think about this again. If we can break down, we could go as low all the way down to the $2.50 level underneath which was the most recent support on the longer-term charts. Warmer temperatures are coming and that makes the Americans by last natural gas. Because of this, that will have a significant drag on markets, not to mention the fact that there is a massive amount of supply out there and quite frankly storage is becoming an issue again.

Rallies should continue to be selling opportunity just waiting to happen, on signs of exhaustion. I think that the bearish pressure will eventually reassert itself, so I’m just waiting for a nice selling opportunity.