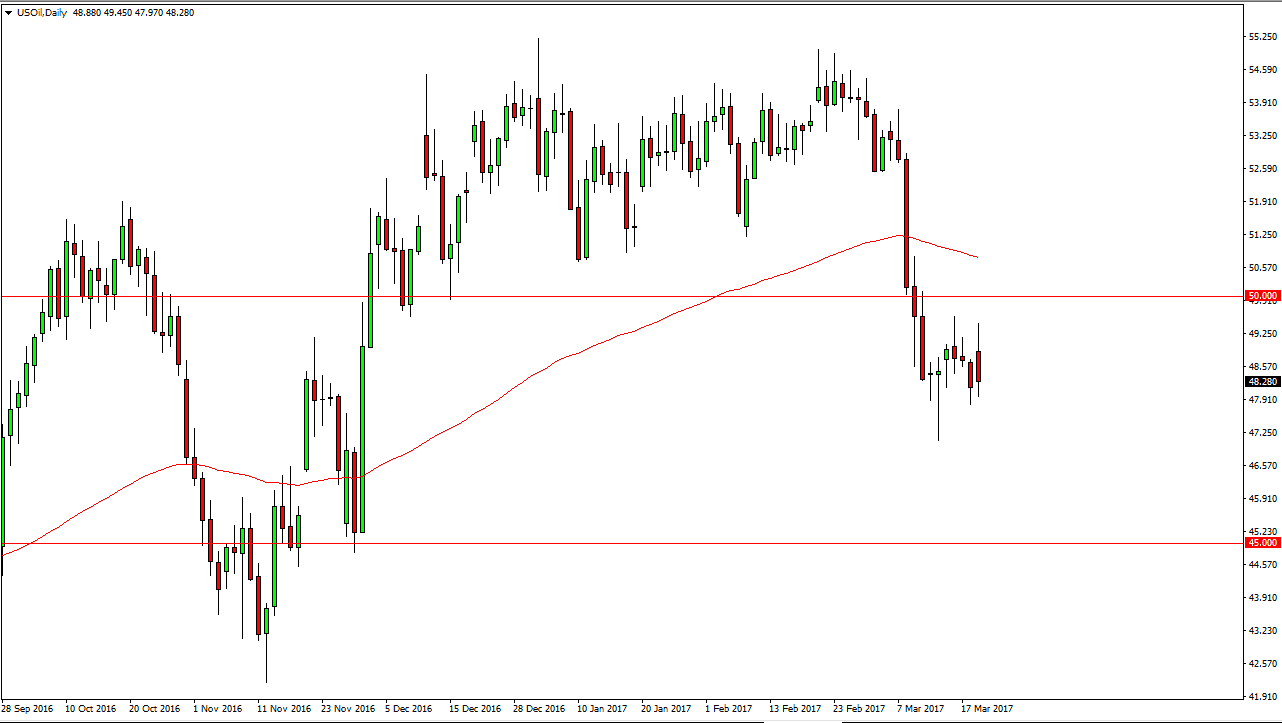

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Tuesday, but the area just below the $50 level offered too much in the way of resistance for the markets to continue going higher. If we did break above there, that would be a bullish sign but I believe that the Crude Oil Inventories announcement coming out today will continue to be highly influential on this market, as we have seen so much in the way of oversupply recently. I believe that we will reach towards the $45 level underneath, which should be supportive. I believe rallies are selling opportunities and I have no interest in buying.

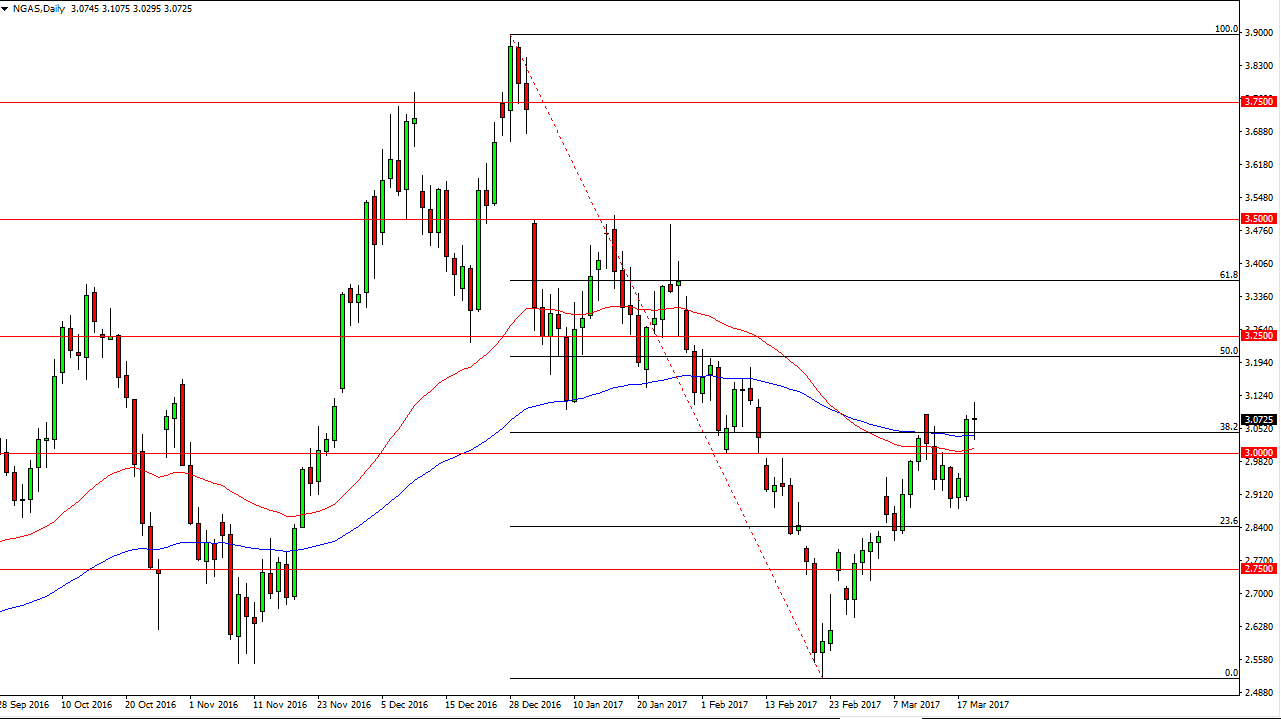

Natural Gas

The natural gas markets trying to break out during the day on Tuesday but struggled enough to end up forming a neutral candle. If we can break down below the $3 level, I am more than willing to start selling. I think at that point the market would reach towards the $2.90 level, and then eventually the $2.75 level. If we broke above the top of the candle alternately, I think at that point the market would probably go looking for the $3.20 level above which was the 50% Fibonacci retracement level. Nonetheless, I believe that the overbought condition continues to be one of the biggest influences in this market, so I have no interest in buying the even if we do breakout to the upside. Given enough time, I believe that we will reach towards the lows yet again, which is closer to the $2.50 level. Given enough time, I think we can break down below there as well. However, there is quite a bit of volatility between here and there. Even if we do rally from here, I just don’t have a scenario in which I’m comfortable buying this market because of the longer-term fundamental bearishness.