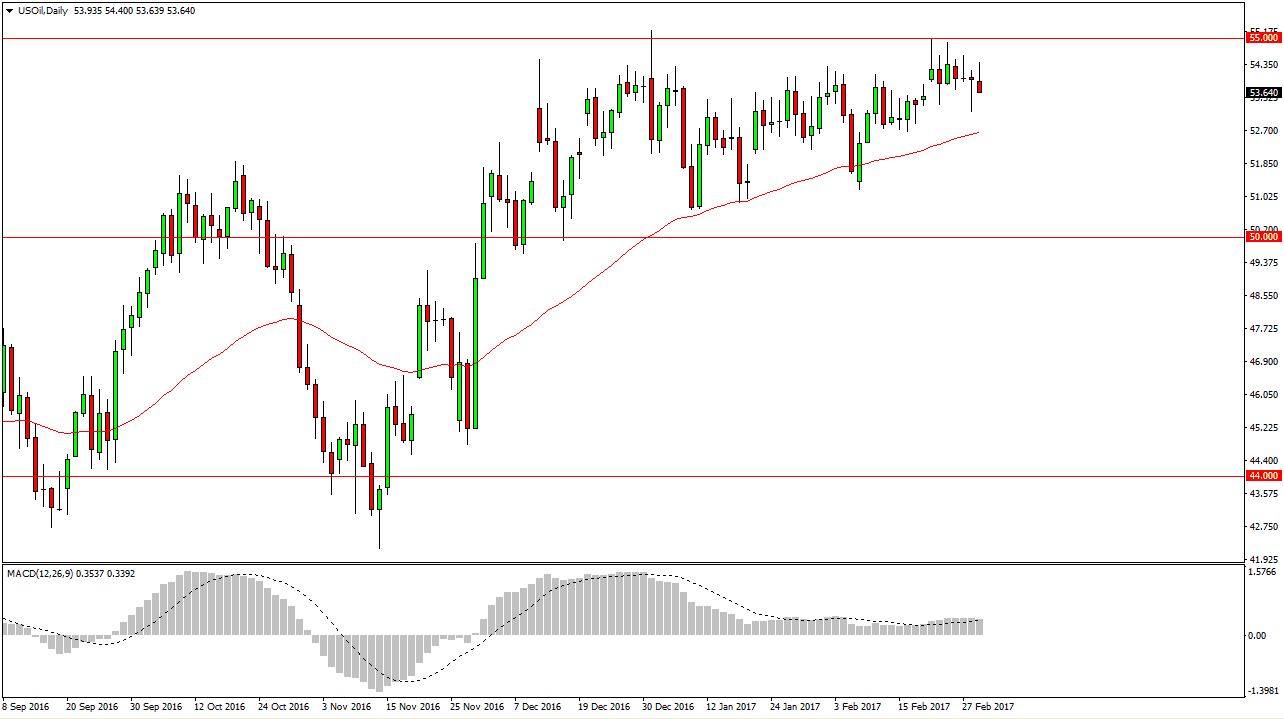

WTI Crude Oil

The WTI Crude Oil market initially rallied on Wednesday, but continued to find resistance near the $54.50 level. Extending all the way to the $55 handle, there seems to be a massive amount of resistance in that area. Today has the inventory numbers coming out of the United States, and that of course will cause quite a bit of volatility. I believe that the market will probably pull back slightly from here, and then react accordingly to the announcement. However, if we manage to break above the $55 level that might be the easiest signal to take, as it would suggest that oil markets are broken out to the upside and will continue to go to the $60 level longer term. Unfortunately, I don’t think it’s going to be quite that easy. Continued back and forth trading makes this a scalpers market at best.

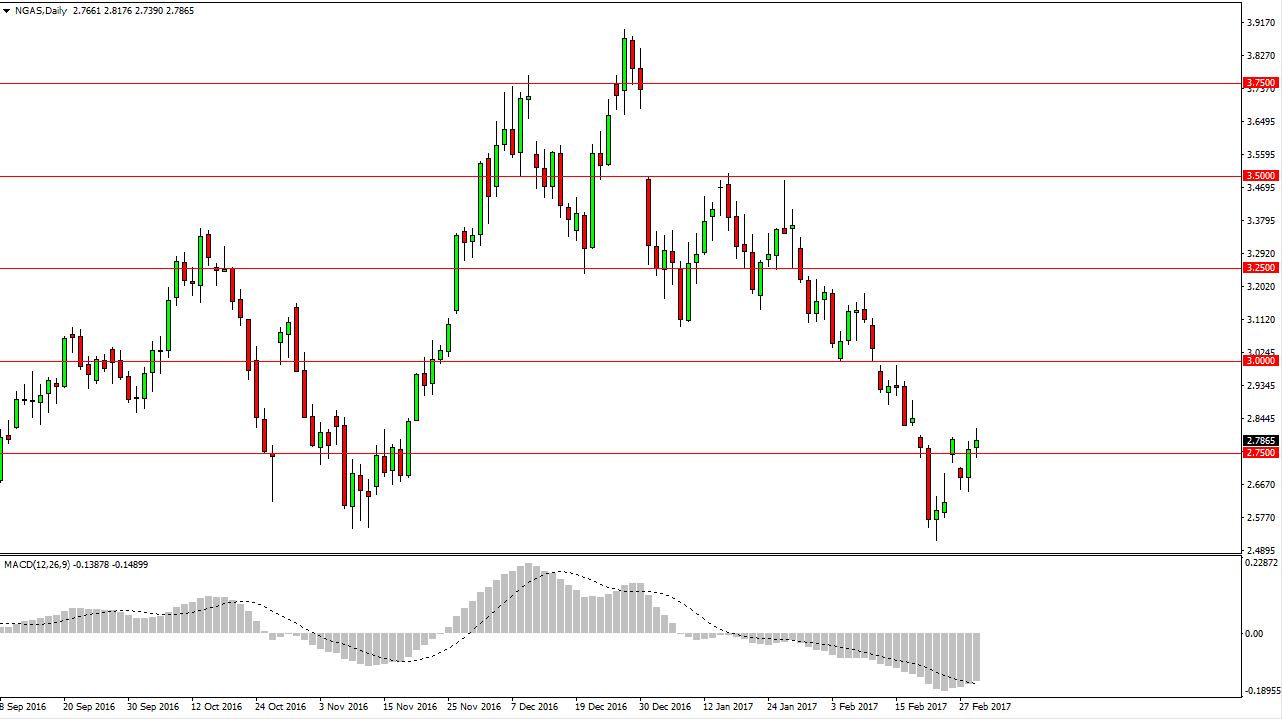

Natural Gas

The natural gas markets had a slightly positive session on Wednesday, clearing the $2.75 level. While it isn’t necessarily a shooting star, it does suggest that were running out of steam to the upside, which of course would be expected. Ultimately, if we can break above the gap just above, the market will probably try to reach towards the $3 handle, which should be massively resistive, as it is a large, round, psychologically significant number, and of course has previously been supportive.

Natural gas markets will continue to be oversupplied, and with that being the case I don’t have any interest in buying this market as it is so oversupplied and of course demand is falling with the warmer than anticipated temperatures in the United States. With this, it’s likely that every time we rally the sellers will come back into this market. I believe that we will eventually reach down to the $2.50 level underneath, which had been so supportive recently.