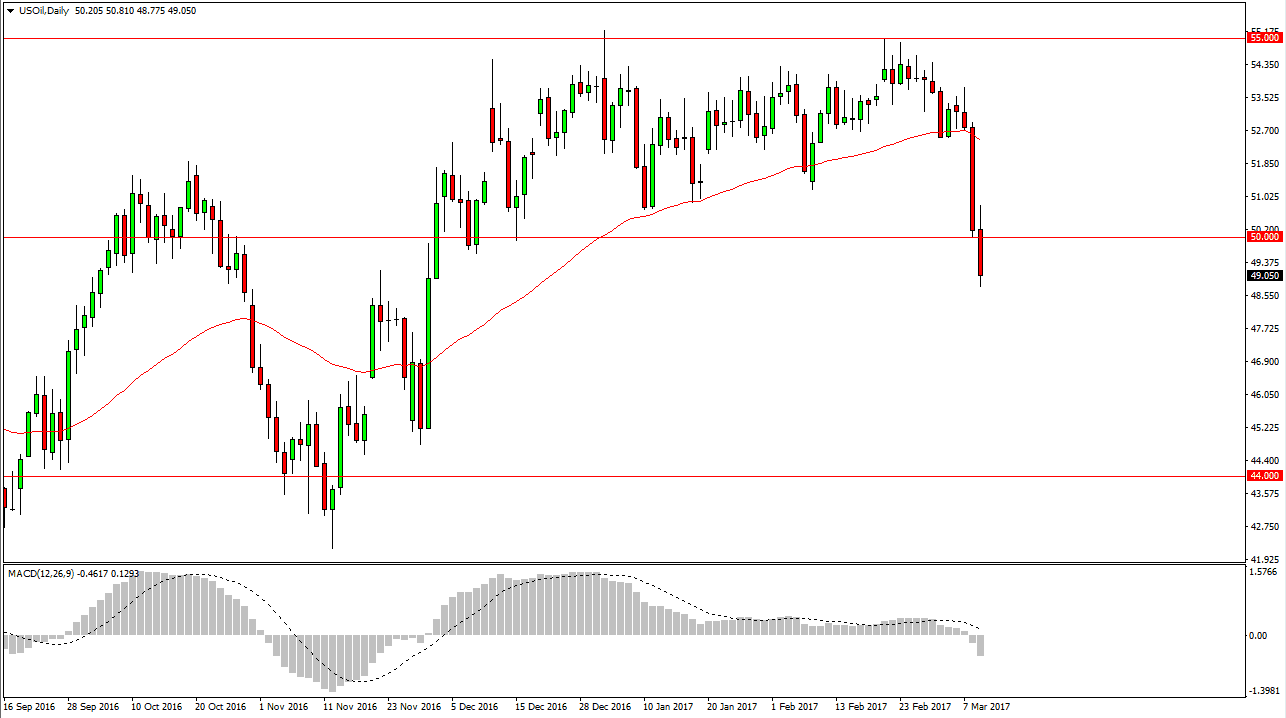

WTI Crude Oil

The oil markets continue to struggle during the Thursday session, as the short-term rally that opened the day turned around and we broke well below the $50 level. This is a psychological win for the sellers, and thus I believe we are going to continue going lower. Anybody who’s been listening to me knows that I’ve been waiting for the breakdown, and this is it. I believe the market will then reach towards the $45 level below, but we will get a bounce from time to time. Those bounces are selling opportunities, and I think that will be the case for some time. Currently, I have no interest in buying oil, and quite frankly I don’t understand why it stayed as high as it did for so long.

Natural Gas

Natural gas markets initially fell during the day on Thursday but turned around to form a bullish candle, as we reach towards the $3 level. This is an area where I think we’re going to see quite a bit of selling pressure, mainly because of the large, round, psychological significance of the number and of course the fact that it was such previously considerable support. And exhaustive candle is what I’m looking for, especially considering that the 50 and 100-day exponential moving averages are sitting just above. Today could be a little bit choppy due to the jobs report out of America, but quite frankly no matter what happens, I have no interest in buying as it is such a strong downtrend and of course there is the oversupply issue that continues to plague the market.

In addition to that, we are approaching spring in the United States, and that means less natural gas demand going forward. Every time the market rallies, I start looking for an opportunity to short.