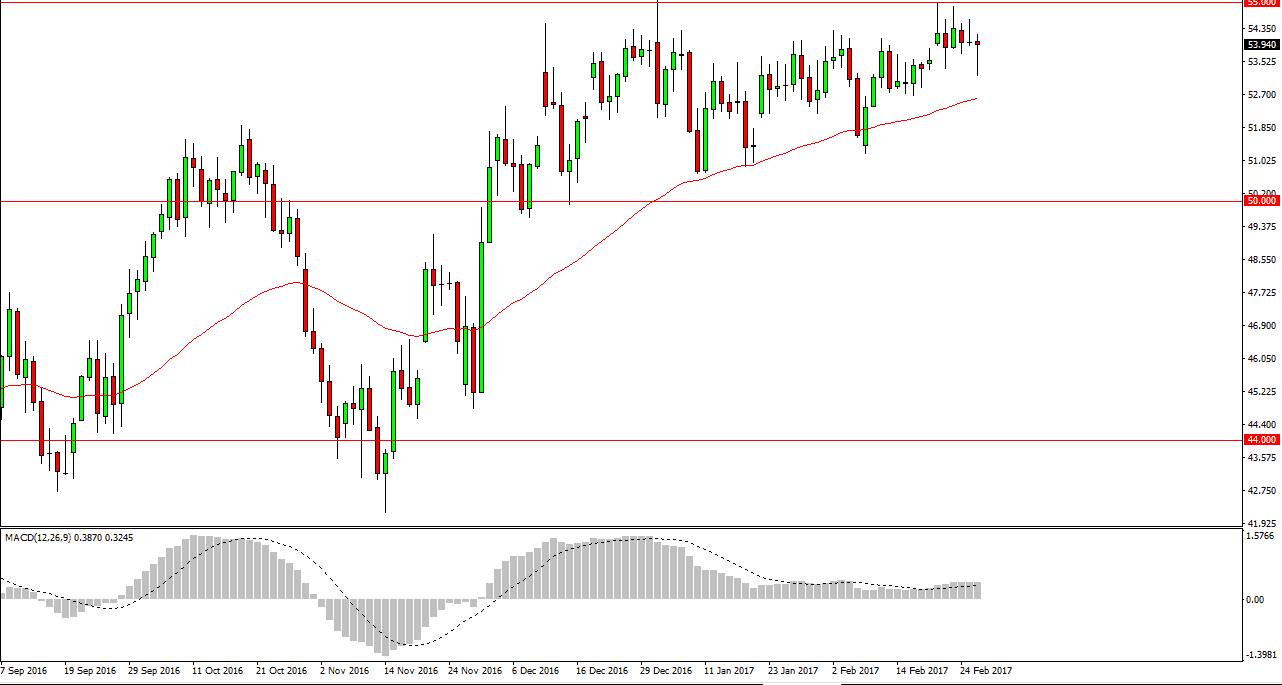

WTI Crude Oil

The WTI Crude Oil market had a very volatile session on Tuesday, initially falling below the $53.50 level. However, we found enough support to turn things around and form a nice-looking hammer. There’s a lot of noise above, and resistance near the $55 handle. Anytime we reach near that area, the market should find bearish pressure and I believe that short-term sellers can get involved. Because of this, it’s only a matter of time before the markets have sellers jump into the market and push back towards the $53.50 yet again. However, if we do break above the $55 level, the market should then reach towards the $60 handle. Either way, I think the one thing you can count on is a significant amount of choppiness.

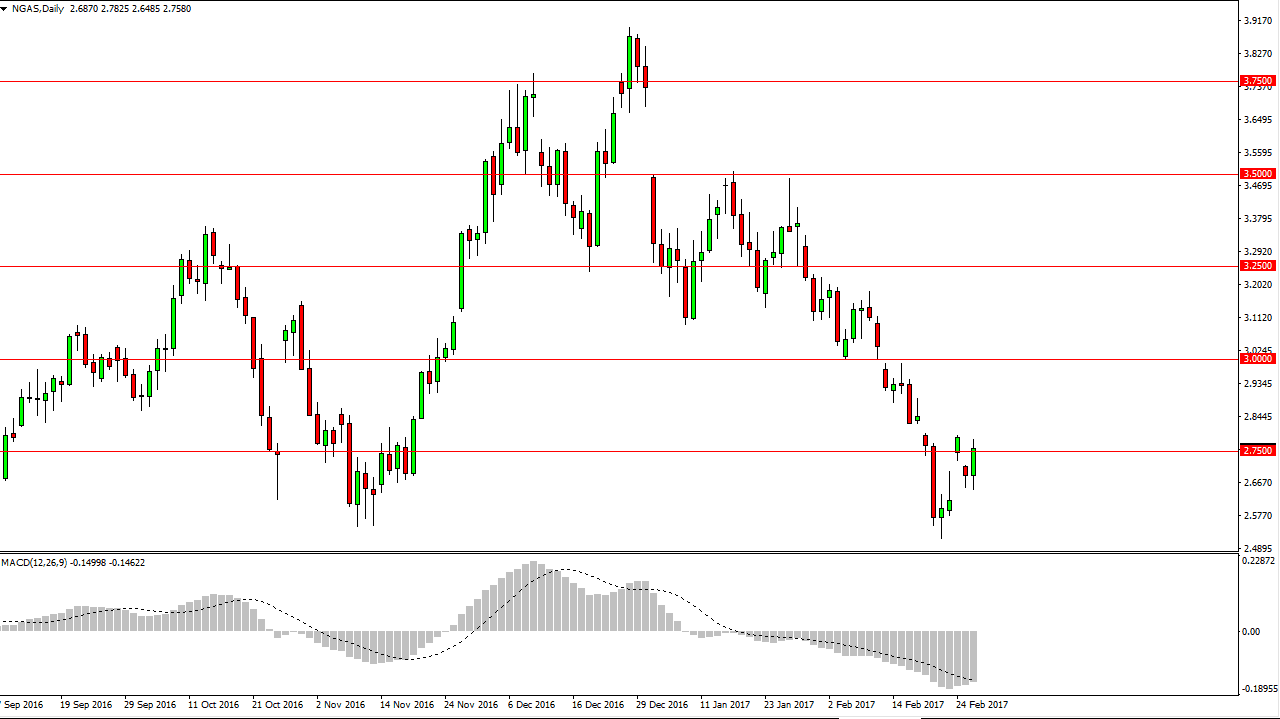

Natural Gas

Natural gas markets initially dipped lower during the day on Tuesday but then slammed into the $2.75 level. There’s a lot of resistance in that area, and that should offer selling opportunities. Either way, there’s no way to buy the natural gas markets as temperatures in the United States, the world’s largest consumer of natural gas, are higher than usual and it’s only a matter of time before the sellers get involved because quite frankly there’s not enough demand.

Even if we break higher, it’s likely that the $3.00 level above is the absolute ceiling in this market. Nonetheless, I don’t even think we get that high. I cannot make an argument for buying the natural gas markets no matter what I do. The $2.50 level below will be targeted, but we may need to bounce a little bit to offer enough of a chance to start shorting yet again. Once we break below the $2.50 level, the market should be free to go down to the $2.25 level.