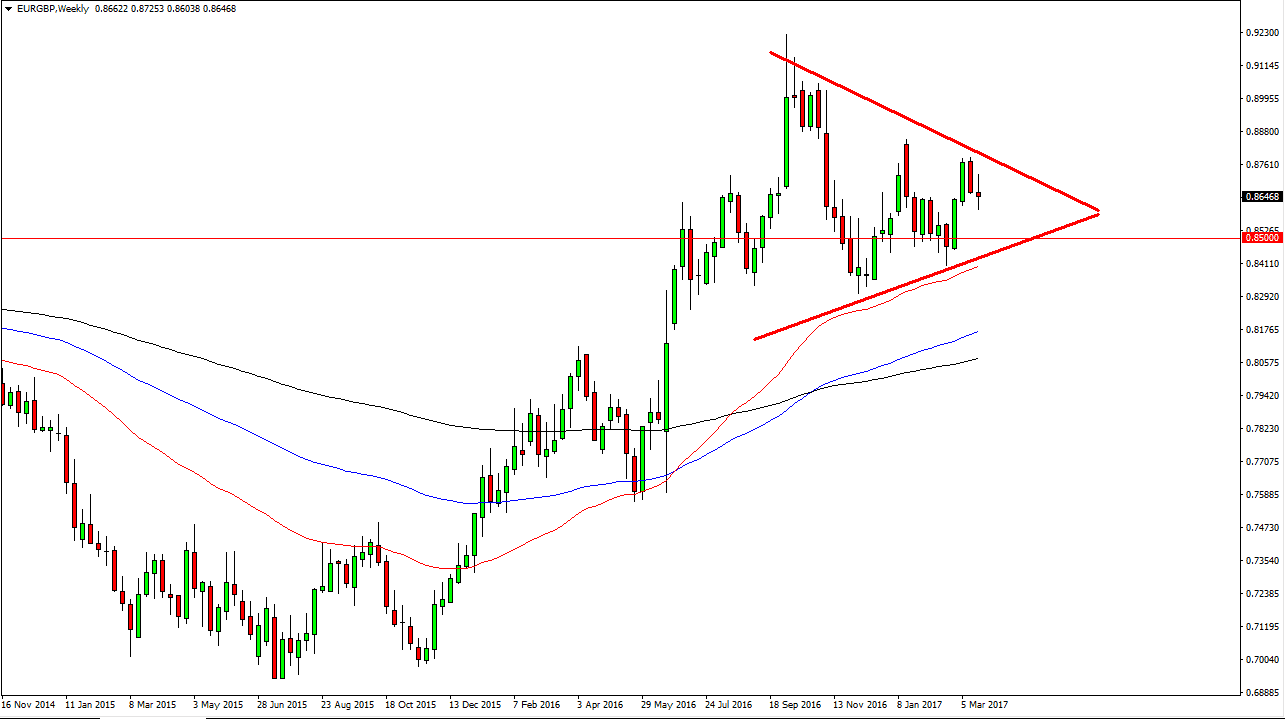

EUR/GBP

The EUR/GBP pair will continue to be very interesting to me, because of the Article 50 coming. Ultimately, I look at this market as “Ground Zero” of that situation. I also have a massive symmetrical triangle drawn on the chart, and this tells me that traders in general are a bit confused. Because of this, I highly recommend staying away from this pair. However, if the trendlines get broken, I will be following that move in either direction.

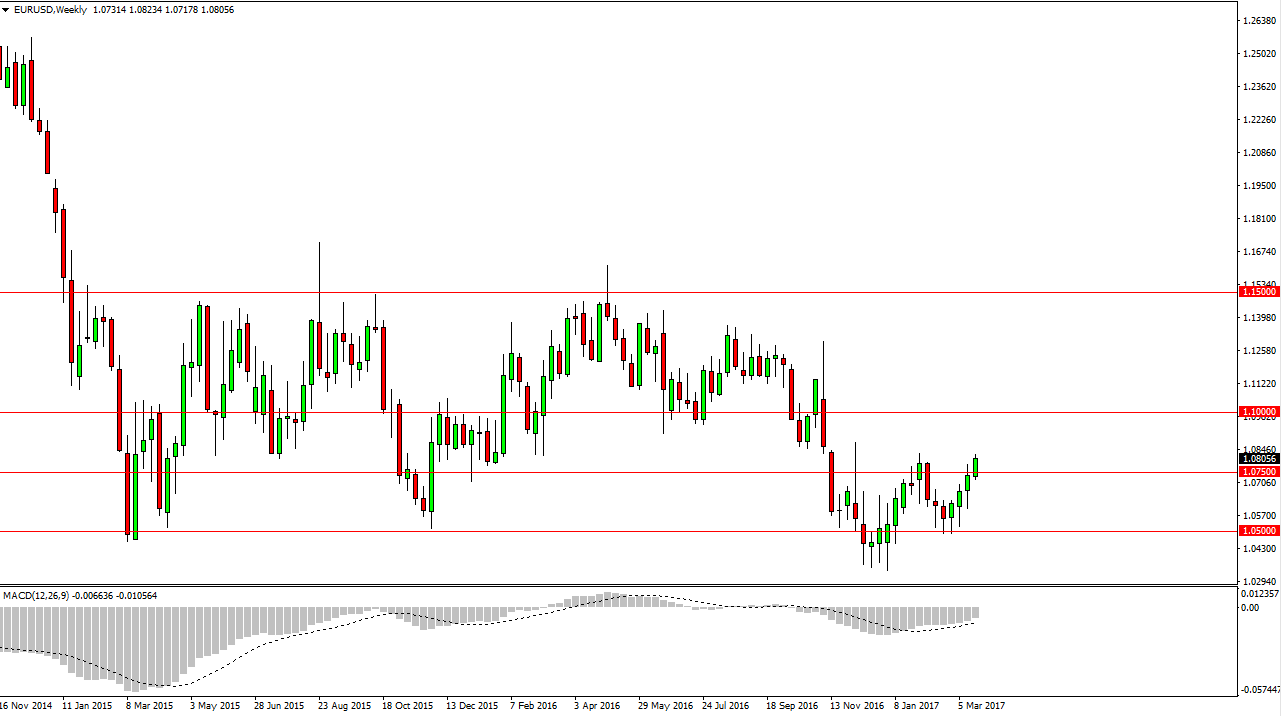

EUR/USD

The EUR/USD pair rallied during the week, and is pressing up against pretty significant resistance. At the 1.0835 handle, if we can break above there the market should continue to go much higher. At that point, I think the market should then go to the 1.10 level. Pullbacks should continue to be buying opportunities, and as a result I have no interest in selling.

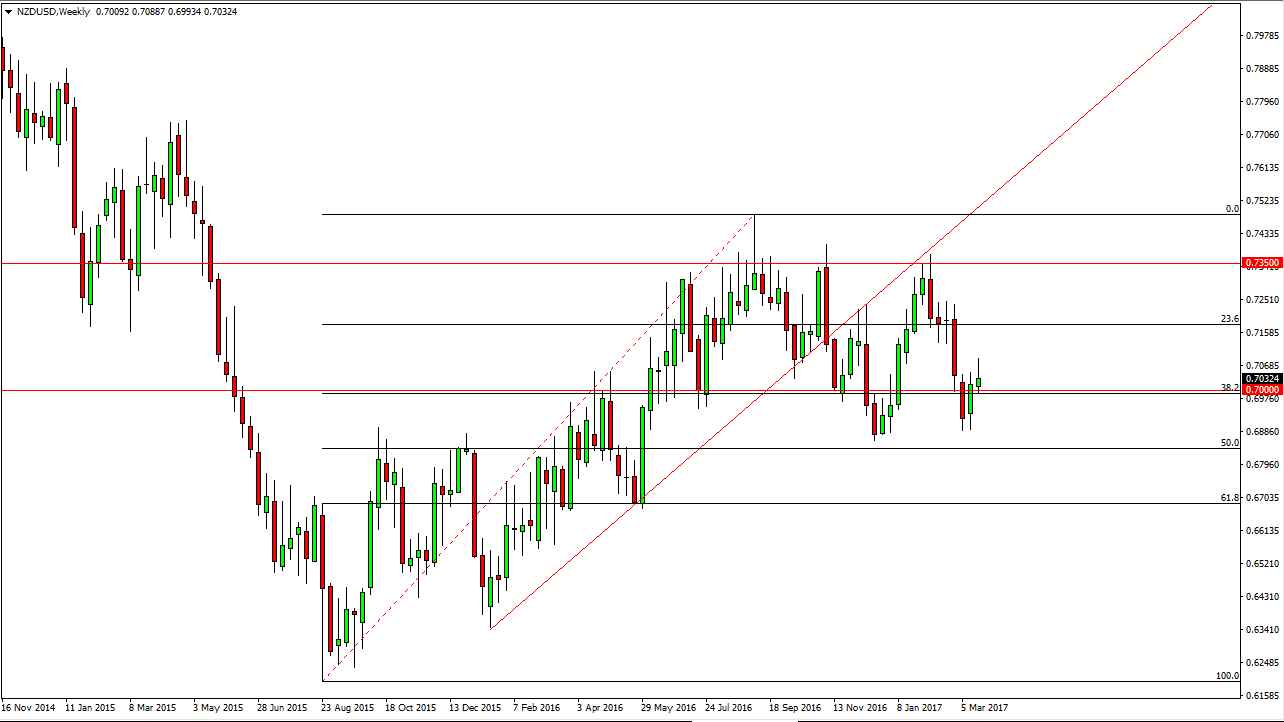

NZD/USD

The New Zealand dollar initially tried to rally during the week, but turned around to form a shooting star. A breakdown below the 0.70 level will have me selling this market and reaching towards the 0.69 handle. Alternately, if we can break above the top of the shooting star, the market should then go to the 0.7150 handle. Either way, expect quite a bit of volatility.

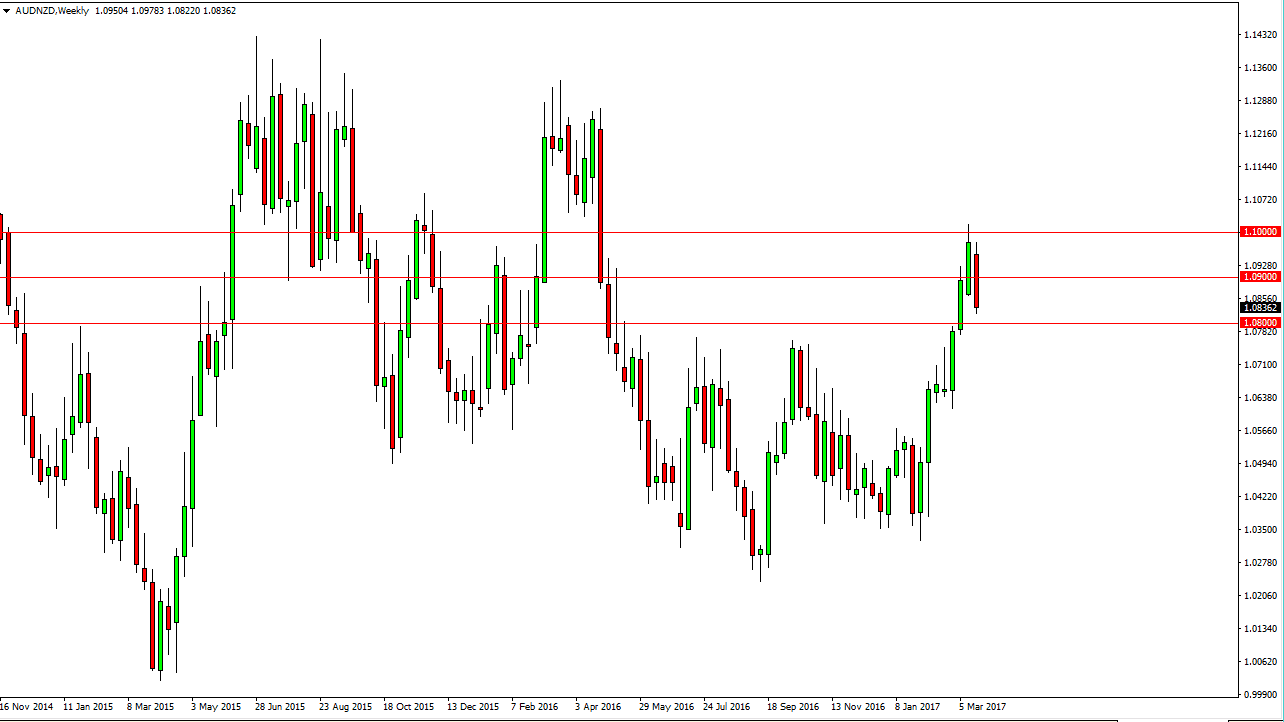

AUD/NZD

The AUD/NZD pair fell during the week, and shows a significant amount of resistance. However, with the New Zealand dollar are looking very soft, I think it’s only a matter of time before the buyers get involved. I think a supportive bounce near the 1.08 handle might be the trigger to start going long, or possibly the 1.0750 handle.