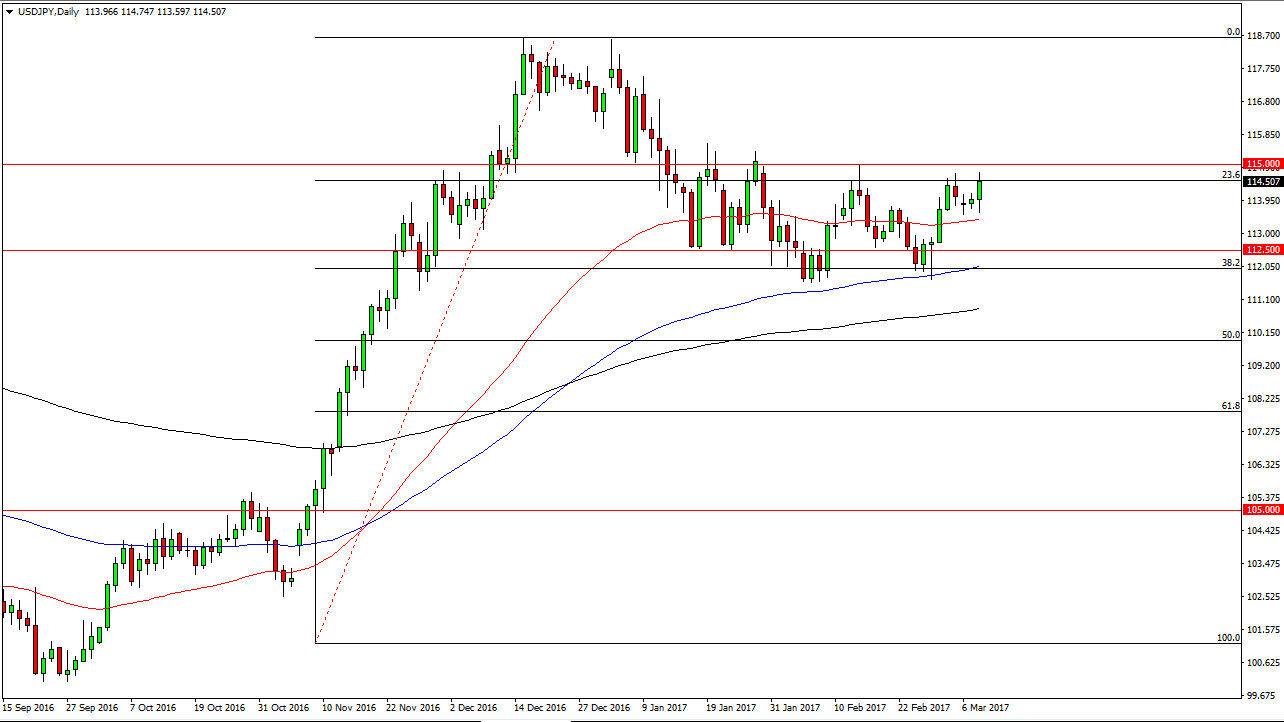

USD/JPY

The USD/JPY pair initially fell during the day on Wednesday, but found enough support at the 50-day exponential moving average to continue bouncing. I find it interesting that we had formed a higher low, which is the very essence of an attempt at an uptrend. If we can break above the 115 handle, the market should then go much higher, at least to the 118.50 level. The 50-day exponential moving average is an obvious indicator, but I also find it interesting that this happened on a day when the ADP job numbers came out much stronger than anticipated. I recognize that it is going to be a fight to get above the 115 handle, but as soon as we do, I think the floodgates will open and we will go much higher.

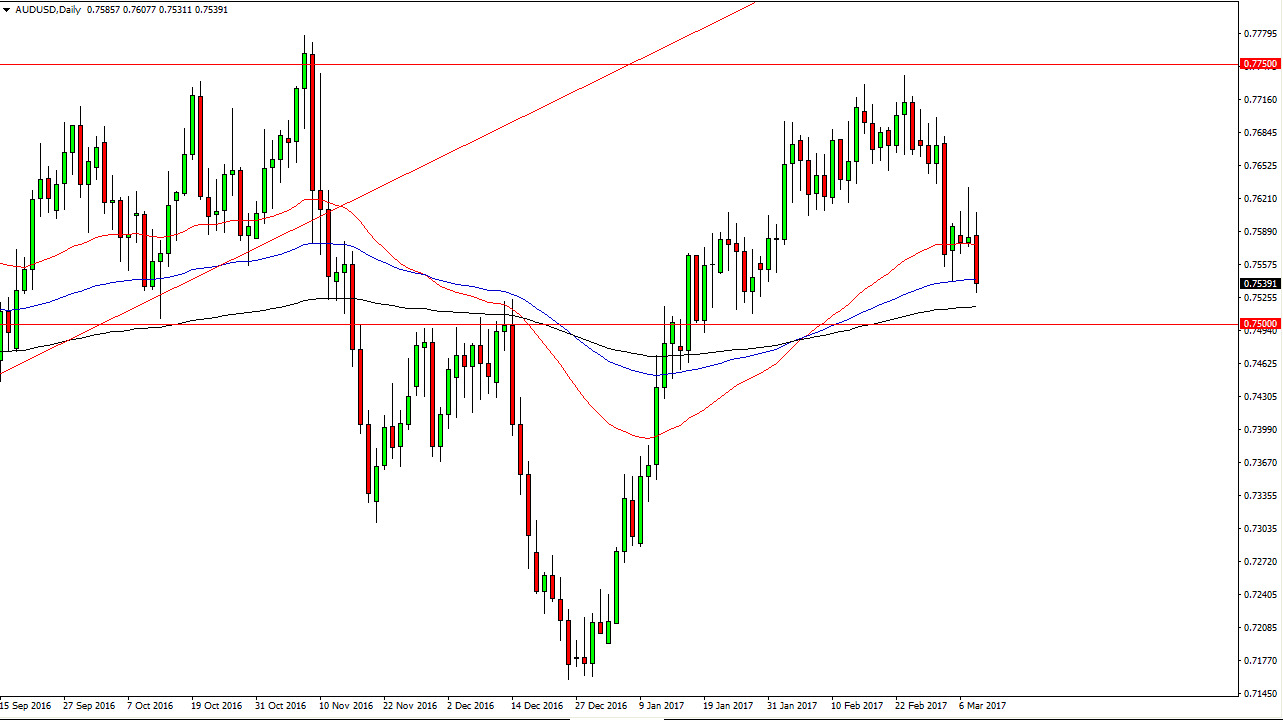

AUD/USD

The Australian dollar initially rallied on Wednesday, but fell below the bottom of the shooting star the formed on Tuesday. This is a very negative sign, but I do think that the 0.75 level underneath will be supportive. It will be interesting to see what happens, so I think that you must wait on the sidelines to see what the daily close is. A supportive candle at the 0.75 level is a buying opportunity, just as a bounce could be. However, with all the volatility and negativity that we’ve seen over the last several sessions, I think it might be a little less nerve-racking to wait until we get the daily signal.

The Australian dollar is highly influenced by gold, which seems to be trying to find support below at the $1200 level. If it bounces, the Aussie should bounce as well. If we do breakdown below the 0.75 handle, I think that there is a lot of noise all the way to at least the 0.74 level. A breakdown below there would be extraordinarily negative in this market.