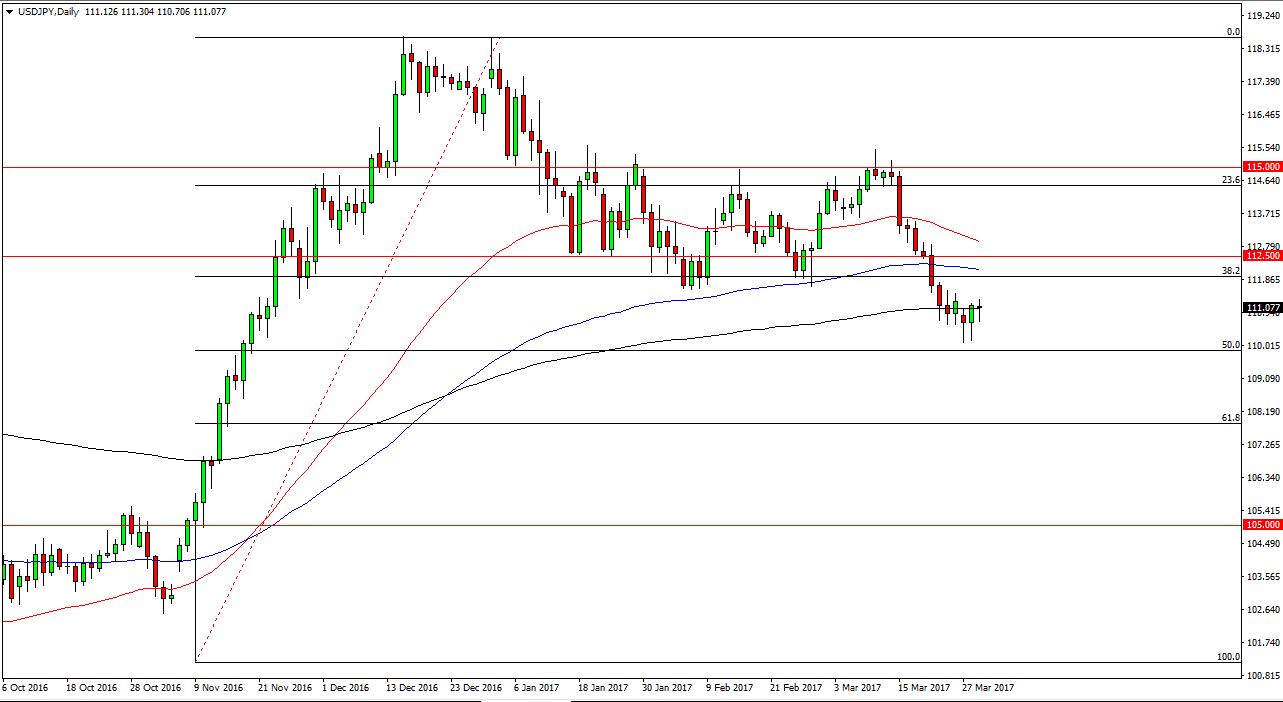

USD/JPY

The USD/JPY pair initially fell on Wednesday, but found enough bullish pressure to turn things around and form a hammer. The hammer of course is a very bullish sign and the fact that the 200-exponential moving average continues to offer support is encouraging for me. I believe that the market will more than likely try to grind its way towards the 112 level, and then eventually the 112.50 handle after that. The 110-level underneath continues to offer support, and I believe that pullbacks will be buying opportunities going forward. However, if we break down below the 110 level, then we will more than likely reach towards the 108 level which is a 61.8% Fibonacci retracement level.

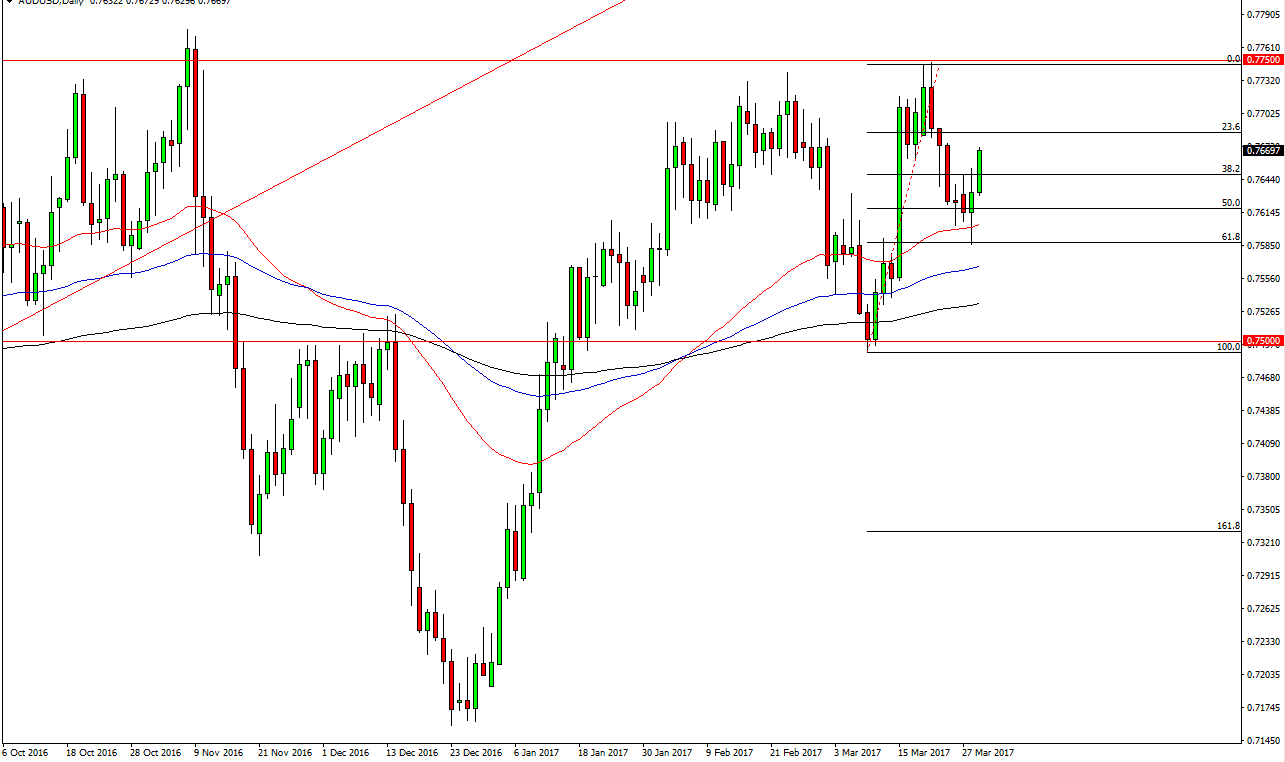

AUD/USD

The Australian dollar broke higher during the day, clearing the top of the candle from the previous trading session. That being the case, the market looks as if it is trying to reach towards the 0.7750 handle. I believe given enough time the buyers will continue to return to this market every time we pull back, and if the gold markets give us a little bit of help, we could very well find ourselves breaking out. Gold markets are trying, but they have a significant amount of resistance just above. I believe this is going to be a slow and tough grind higher, but given enough time the buyers should come out on top.

Pullback should be supported, especially near the 50% Fibonacci retracement level, and of course the 50-day exponential moving average as well. Ultimately, I think we break above the 0.7750 level and reach towards the 0.80 handle above there. Ultimately, I have no interest in shorting the Australian dollar and I believe it’s only a matter of time before the buyers return looking for value in a market that is primed to explode higher over the longer term.