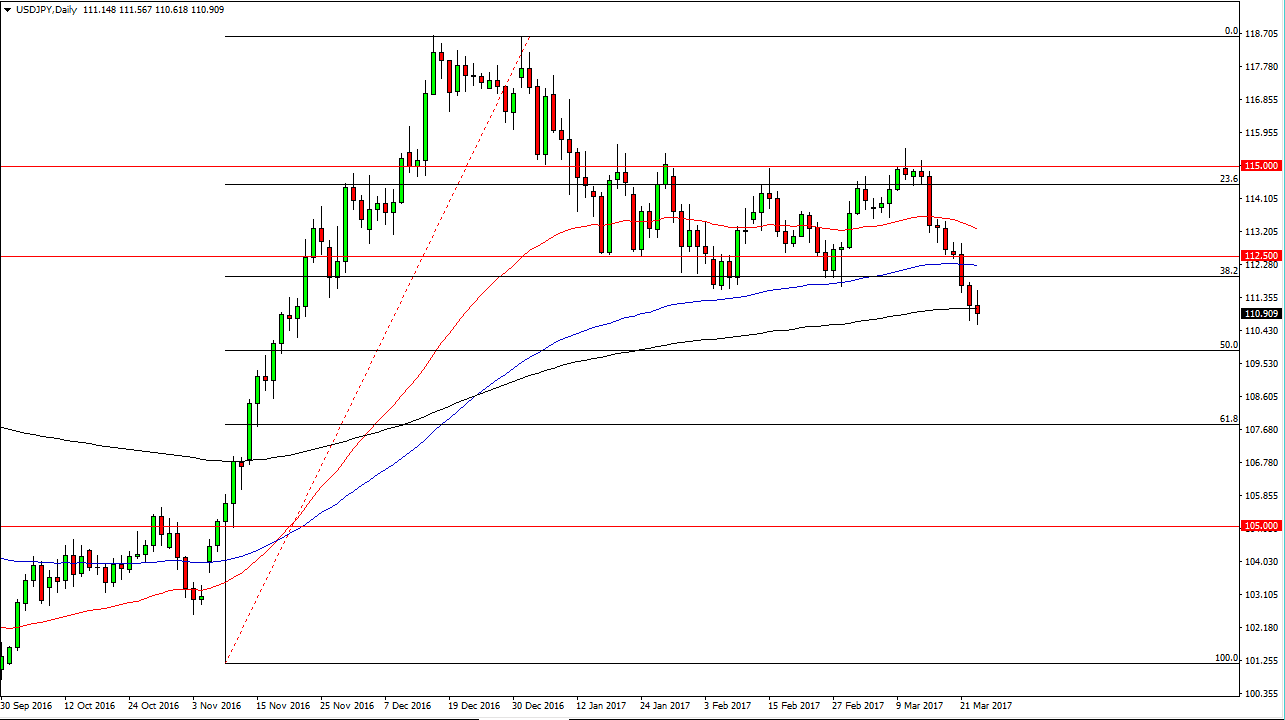

USD/JPY

The USD/JPY pair went back and forth during the session on Thursday, testing the 200-day exponential moving average. This is an area that looks very supportive, at least from a longer-term perspective based upon the fact that so many large bunny players pay attention to that moving average. If we do breakdown below the bottom of the candle for the session, I believe that the market then reaches towards the 110 level. The 50% Fibonacci retracement level is right around there as well, so it would make quite a bit of sense if we found buyers in that area. If we can break above the top of the candle, that would be bullish and we should then reach towards the 112 handle, perhaps even the 112.50 level above there.

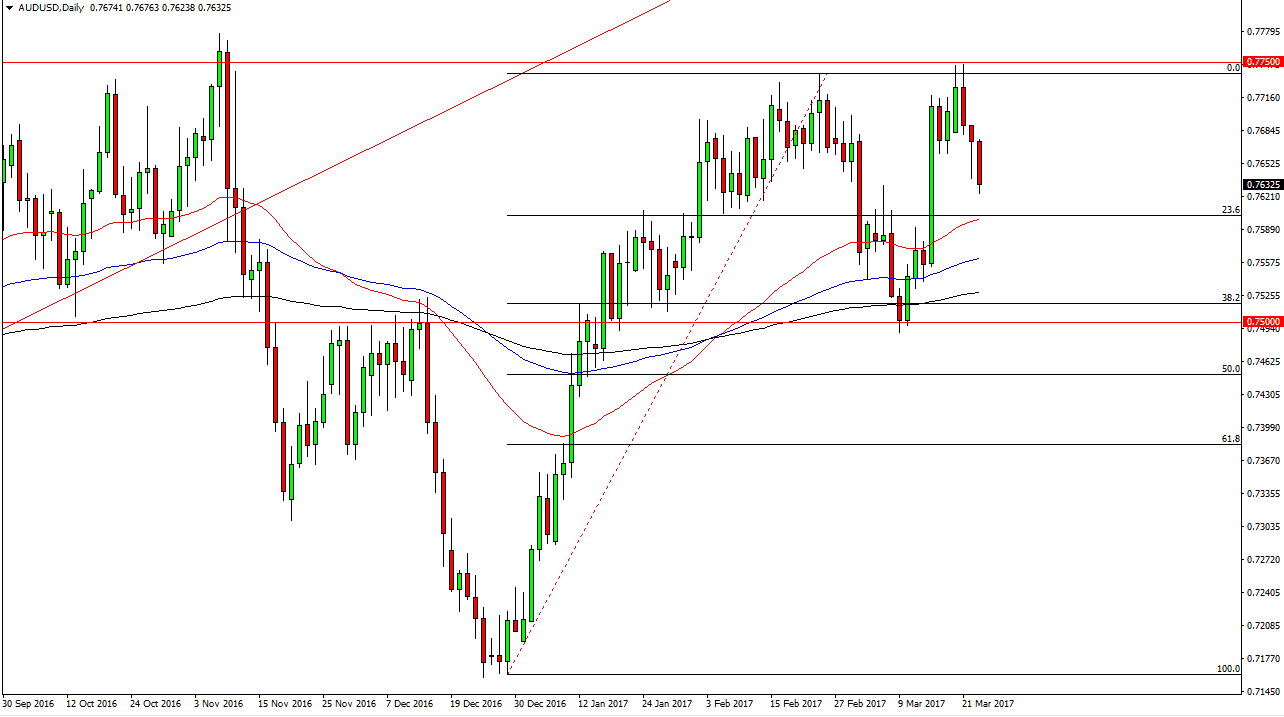

AUD/USD

The Australian dollar fell during the day on Thursday, breaking below the bottom of the hammer from the Wednesday session. The 0.76 level underneath should be supportive, so I think that it’s only a matter of time before the buyers return. Pay attention the gold, it tried to break out during the day on Thursday, but ran into a significant amount of resistance. Longer-term, I believe that it’s only a matter of time before we break out in both markets, but it may take a significant amount of patience to take advantage of that move. Because of this, I believe that the buyers are waiting just below, and the fact that the major moving averages have crossed and are spread out quite nicely suggests to me that we are going to eventually see a continued and sustained moved to the upside.

The 0.7750 level above continues to offer significant resistance, and I believe that break above there would be a big sign of bullish pressure. The 0.80 level is the longer-term target, and I believe will be the scene of significant fighting.