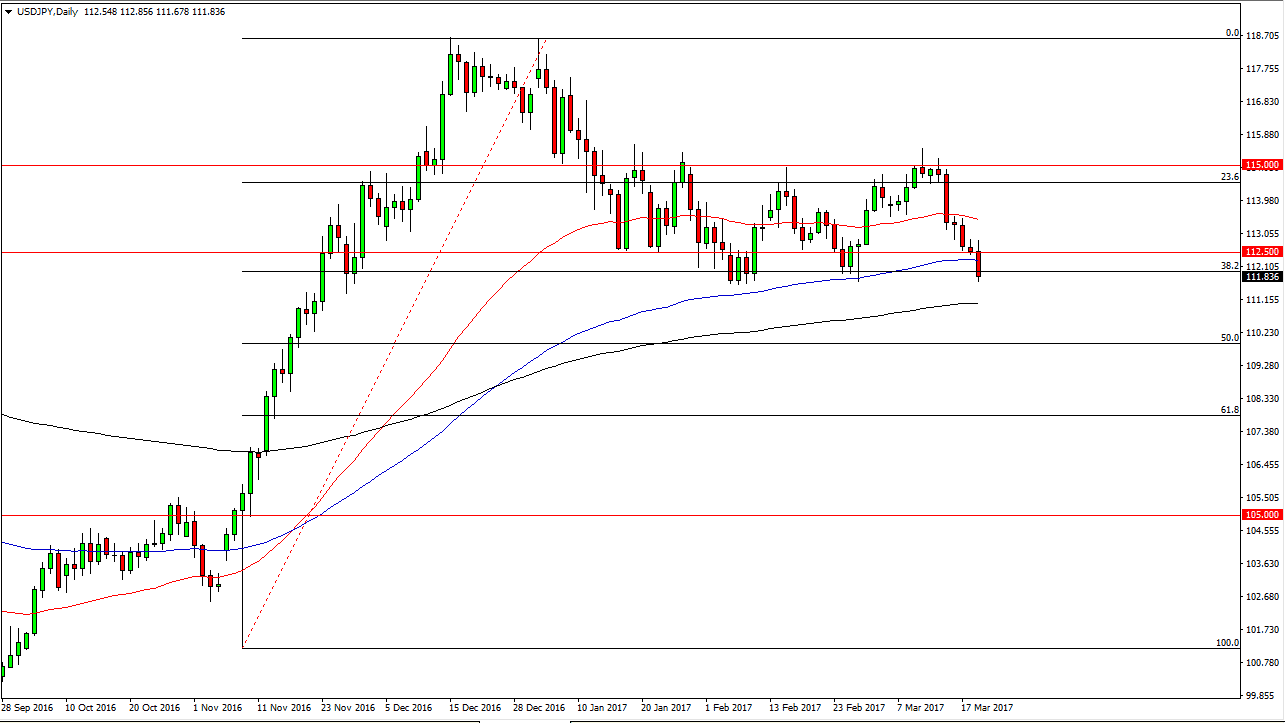

USD/JPY

The USD/JPY initially tried to rally, but turned around to fall significantly. In fact, at the end of the trading session we are testing significant support. If we can break down below the bottom of the candle, I feel that the market will probably reach towards the 200-day exponential moving average near the 111 handle. A breakdown below there should send this market looking for the 50% Fibonacci retracement level, near the 110 handle. I think that some type of bounce should be coming, but the short-term traders may continue to push this market to the downside.

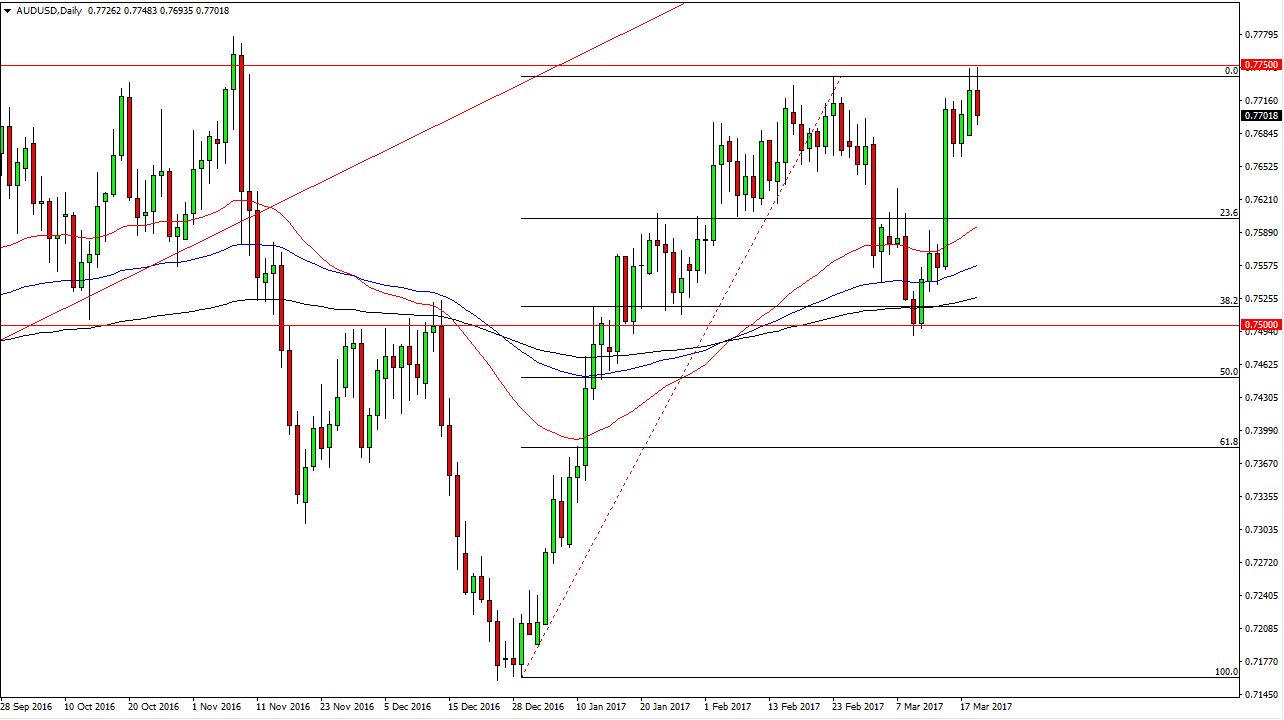

AUD/USD

The Australian dollar try to break out during the day on Tuesday, reaching towards the 0.7750 level. That’s an area that has caused significant resistance a couple of times, so having said that it makes sense that the market fell from there. If we find support below, and I think we will, it’s only a matter of time before the momentum finally breaks above the 0.7750 handle. Once we do, the market should then go to the 0.80 handle, which has been extraordinarily important over the longer-term charts, and I believe it’s only a matter of time before we would have to test that area. Markets tend to be attracted to these areas, and this will be any different. I believe that a pullback should have plenty of support near the 0.7650 levels, and perhaps even lower than there. I think that the absolute bottom of the market is probably somewhere near the 0.75 handle. Ultimately, this is a market that will be highly influenced by gold, which looks as if it is trying to go higher over the longer term, but there should be a significant amount of volatility over the longer term, and with that you must be able to deal with quite a bit of choppiness.