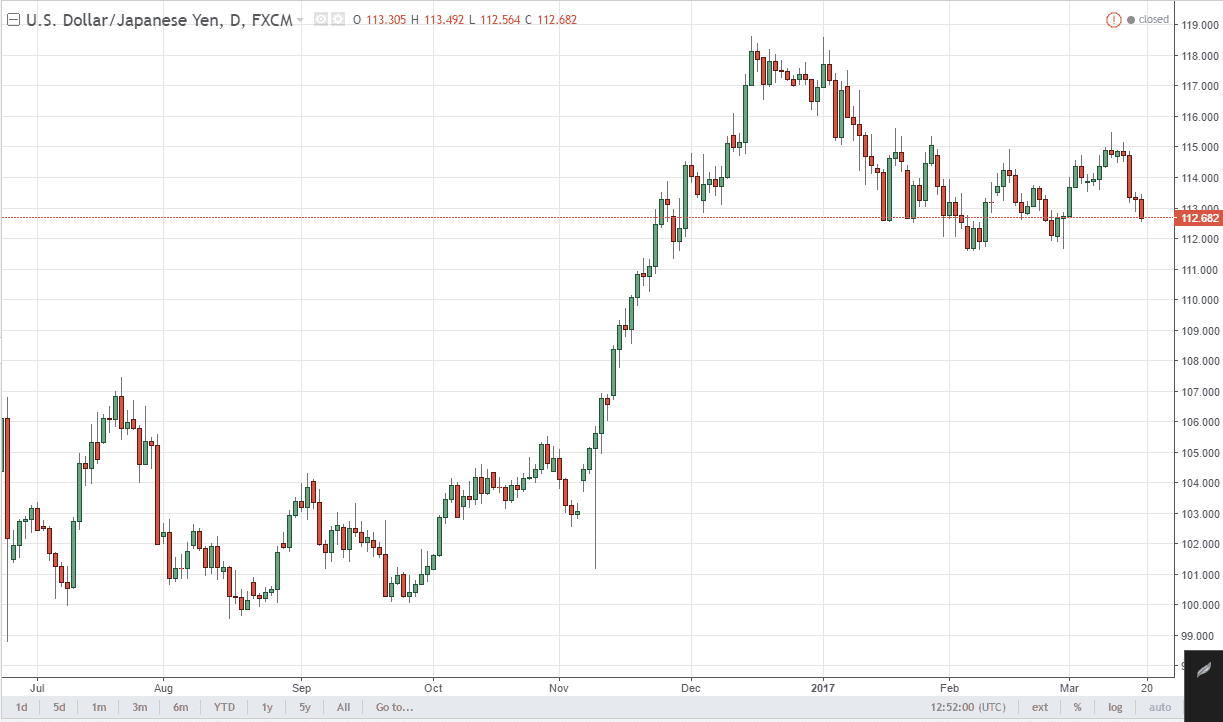

USD/JPY

The US dollar fell against the Japanese yen during the Friday session, breaking the back of a hammer from Thursday. We also broke below the 113 handle, which has some psychological significance, but at the end of the day I still believe that there is much more support at 112. Because of this, I’m looking at this pullback as a potential buying opportunity and if we get some type of supportive candle or a bounce from that level I am more than willing to start going long yet again. A breakdown below the 112 level would be rather significant, so we must wait to see what happens next. I will use a daily candle for my trading signal.

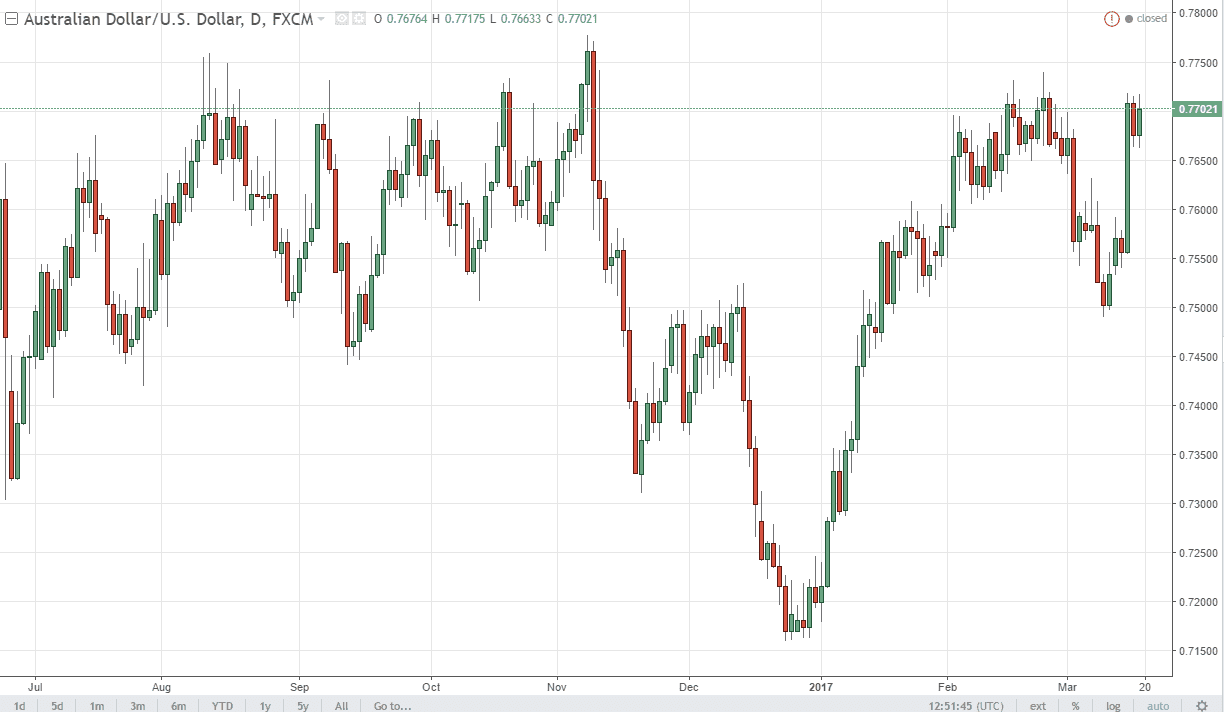

AUD/USD

The Australian dollar rose slightly against the US dollar on Friday as we continue to test the 0.77 region. If we can break above the 0.7750 handle, I feel that this market will then have the momentum necessary to reach towards the 0.80 handle. Gold of course has a major part to play in this market, as it is so influential so pay attention that market as well. I believe pullbacks will continue to offer value the traders want to take advantage of, was support being seen at the 0.7650 level, and of course the 0.76 handle. Supportive candles after short-term pullbacks could be value plays as I believe the Australian dollar is ready to go much higher.

If we do break towards the 0.80 level, expect a significant fight in that area, it is an area that has seen quite a bit of interest over the last several decades. If we can break above there, the Australian dollars free to go much higher, but don’t think it’s going to be an easy move to make, it’s going to be very difficult once we get to that level.