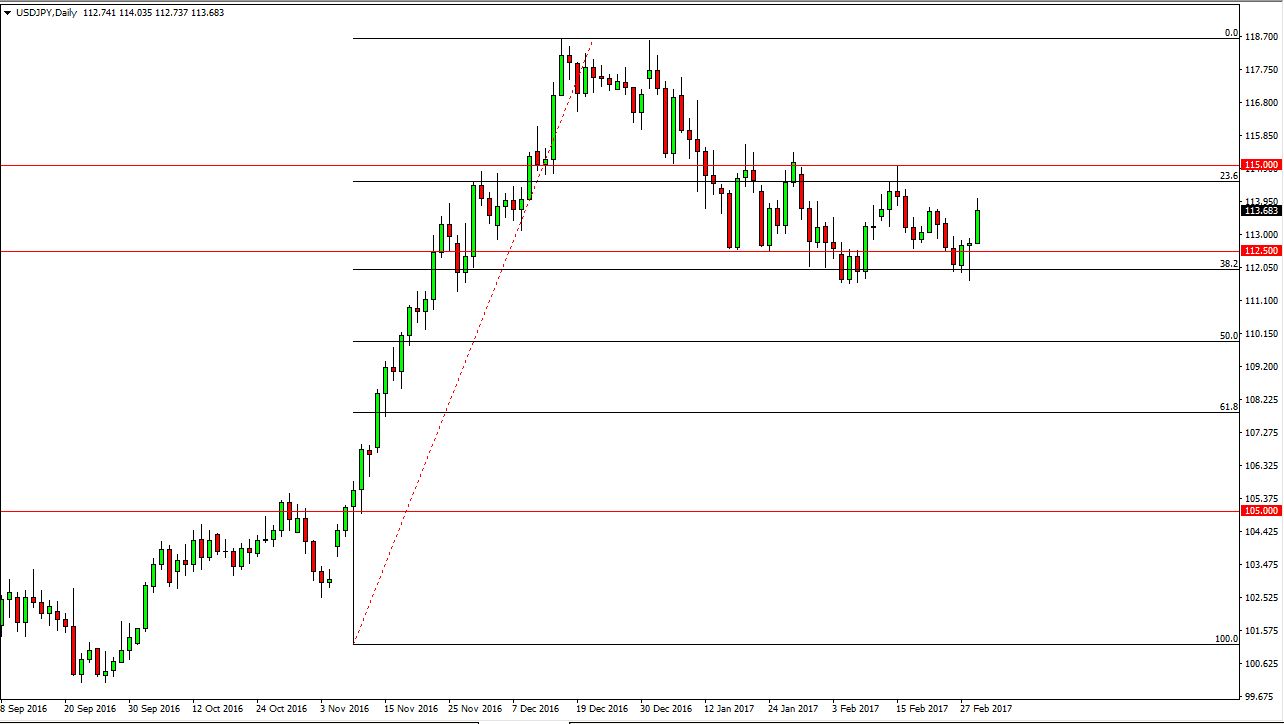

USD/JPY

The USD/JPY pair broke higher during the session on Wednesday, clearing the top of the hammer from the Tuesday session which of course is a strong buying signal. I think that the market is going to try to reach towards the 115 handle again, and test that resistance barrier to try and continue to the upside. I firmly believe that given enough time this market will test the highs again, but we may have a lot of volatility between now and that move. Pullbacks should have plenty of support down at the 112 level, which is extensively the 38.2% Fibonacci retracement level. With the Federal Reserve’s suggestions that interest rate hikes are coming sooner rather than later, it makes sense that this market continues to go higher. Pullbacks continue to offer value.

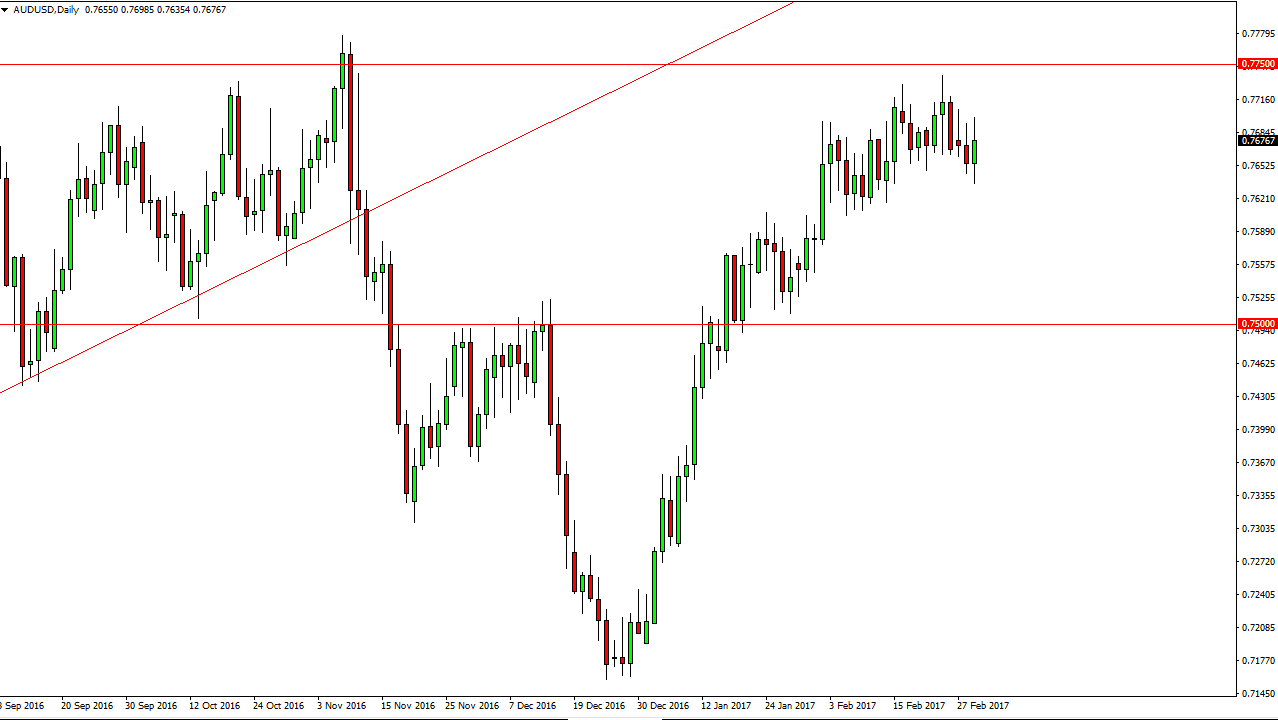

AUD/USD

The AUD/USD pair bounced around during the session on Wednesday, testing the 0.7650 level underneath for support. The market looks as if it is trying to continue the consolidation that we have been in lately, as it is a momentum building exercise to finally break above the 0.7750 level. Once we do, the market should then reach towards the 0.8000, which is a massive move just waiting to happen.

Pay attention to the gold markets, they do look like they’re ready to bounce and continue to go higher. That typically sends this market higher as well, as Australia’s the world’s largest exporter of gold. Because of this, the correlation is very strong, but I believe that this has a lot to do with the “risk on” attitude that we suddenly find the markets and.

If we pull back, there should be plenty of support all the way down to the 0.75 level underneath, which should essentially be the “floor” in this market yet again. Because of this, I believe that buying is the only thing that you can do.